Carnival Cruises 2009 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2009 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.To Our Shareholders:

During 2009, the global recession significantly impacted the financial performance of travel companies worldwide. We responded

swiftly and successfully, thanks to our talented management teams and global portfolio of well-recognized brands. As a result, we

weathered the most challenging economic environment in the company’s history exceptionally well.

The global recession, however, resulted in reduced travel demand, which had a negative impact on our revenue yields. For our North

American brands, yields fell 13 percent and, for our European brands, a more modest 6 percent (in local currency).

Another challenge during 2009 was the U.S. government’s advisory against travel to Mexico as a result of the flu virus, which

necessitated itinerary changes for 27 of our ships calling in Mexico. These itinerary changes, coupled with the temporary reduction in

demand for travel to Mexico after the travel advisory was lifted, reduced our earnings by approximately $80 million, or $0.10 per share.

We managed to partially offset the pressure on revenue by intensifying our cost-containment efforts. All told, we reduced operating

expenses by $170 million in 2009 from our original guidance. Fuel conservation has been and continues to be a large part of our cost-

containment efforts. Over the past year, we reduced fuel consumption by 5 percent on a unit basis.

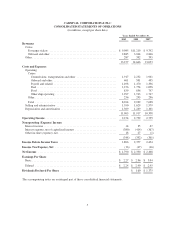

Taking all of these factors together, Carnival Corporation & plc maintained its position as the world’s most profitable leisure travel

company in 2009, posting net income of $1.8 billion, or $2.24 per share. More importantly, our company provided exceptional vacation

experiences and lasting memories to a record 8.5 million guests.

A key component of our success was the ongoing implementation of our global expansion strategy, with particular emphasis on Europe,

Australia and Asia. Five new state-of-the-art ships began service last year, each providing unique cruise experiences while garnering

excellent feedback from guests. Three new vessels were introduced to our fast-growing European brands—the 2,050-passenger

AIDAluna, the 2,260-passenger Costa Luminosa and the 2,978-passenger Costa Pacifica. Two new vessels were introduced to our

popular North American brands—the 3,642-passenger Carnival Dream, the brand’s largest ship, and the 450-passenger Seabourn

Odyssey, the ultra-luxury line’s first new ship in two decades.

Other growth initiatives focused on Australia and Asia. P&O Cruises Australia added a third ship to its fleet with the inauguration of

Pacific Jewel in Sydney Harbor, which was one of the country’s most celebrated cruise events. We also deployed a second ship in Asia,

with the 1,302-passenger Costa Classica joining the 784-passenger Costa Allegra in China.

CONTINUED GLOBAL EXPANSION

Our newbuilding program is the primary growth platform for brands operating in well-established cruise markets throughout Europe

and North America. In December, we announced our first new ship order in two years, a 3,690-passenger Dream-class ship for Carnival

Cruise Lines that is set to debut in 2012. With this announcement, our order book is now complete through 2012, with 13 new ships

driving a 6 percent average annual capacity growth. Six of those vessels will enter service in 2010—four for our European brands: the

2,192-passenger AIDAblu, the 2,260-passsenger Costa Deliziosa, P&O Cruises’ 3,100-passenger Azura and Cunard’s 2,092-passenger

Queen Elizabeth; and two for our North American brands: Holland America’s 2,106-passenger Nieuw Amsterdam and the

450-passenger Seabourn Sojourn.

Through 2012, our average annual capacity growth in North America, the world’s most developed cruise region, is 3 percent. The

majority of our capacity growth over the next three years will come from our European brands, which are expected to grow by 9

percent, compounded annually through 2012. Europe represents a significant growth opportunity. From a market-development

perspective, it compares to where North America was 12 years ago. The continued strong profit performance of our European brands

reinforces our commitment to expansion within the region.

We continue to grow our presence in the emerging markets of Australia and Asia by transferring existing vessels. That reduces our risk of

entry in these markets while optimizing our fleet profile. We have made great progress in these emerging markets and expect to double our

capacity by 2012. We believe the Asia-Pacific region represents a significant long-term growth opportunity for us given its early stage of

development, favorable economic outlook and increasing affluence of consumers in this region who have a strong desire to travel.

In 2012 and beyond, our current intention is to have an average of two to three new cruise ships enter service annually, which is below

our recent capacity growth levels. Over time, we expect industry capacity growth to slow and demand for cruises to accelerate as global

economies recover and emerging markets continue to develop. We believe the resulting favorable supply and demand balance should

positively impact our ability to profitably grow our business.

We continue to believe that there is opportunity for global growth of our capacity over the long term. Only 20 percent of the U.S.

population, 9 to 10 percent of the UK population and 4 to 5 percent of the continental European population have ever taken a cruise. We

2