Carnival Cruises 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of time prior to taking steps against the relevant guarantor. All actions or proceedings arising out of or in

connection with the deeds of guarantee must be exclusively brought in courts in England.

Under the terms of the DLC transaction documents, Carnival Corporation and Carnival plc are permitted to

transfer assets between the companies, make loans to or investments in each other and otherwise enter into

intercompany transactions. The companies have entered into some of these types of transactions and may enter

into additional transactions in the future to take advantage of the flexibility provided by the DLC structure and to

operate both companies as a single unified economic enterprise in the most effective manner. In addition, under

the terms of the Equalization and Governance Agreement and the deeds of guarantee, the cash flow and assets of

one company are required to be used to pay the obligations of the other company, if necessary.

Given the DLC structure as described above, we believe that providing separate financial statements for

each of Carnival Corporation and Carnival plc would not present a true and fair view of the economic realities of

their operations. Accordingly, separate financial statements for both Carnival Corporation and Carnival plc have

not been presented.

Simultaneously with the completion of the DLC transaction, a partial share offer (“PSO”) for 20% of

Carnival plc’s shares was made and accepted, which enabled 20% of Carnival plc shares to be exchanged for

41.7 million Carnival Corporation shares. All of these shares of Carnival plc that are still held by Carnival

Corporation as a result of the PSO, which initially cost $1.05 billion, are being accounted for as treasury stock in

the accompanying Consolidated Balance Sheets.

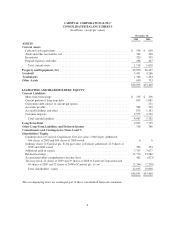

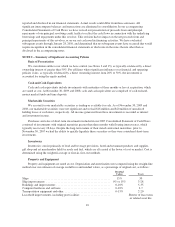

NOTE 4 – Property and Equipment

Property and equipment consisted of the following (in millions):

November 30,

2009 2008

Ships ..................................................................... $35,187 $30,557

Ships under construction ...................................................... 770 707

35,957 31,264

Land, buildings and improvements, including leasehold improvements and port facilities . . . 864 762

Computer hardware and software, transportation equipment and other .................. 913 847

Total property and equipment .................................................. 37,734 32,873

Less accumulated depreciation and amortization ................................... (7,864) (6,416)

$29,870 $26,457

Capitalized interest, primarily on our ships under construction, amounted to $37 million, $52 million and

$44 million in fiscal 2009, 2008 and 2007, respectively. Ships under construction include progress payments for

the construction of new ships, as well as design and engineering fees, capitalized interest, construction oversight

costs and various owner supplied items. At November 30, 2009, four ships with an aggregate net book value of

$1.5 billion were pledged as collateral pursuant to mortgages related to $700 million of debt. Subsequent to

November 30, 2009, the mortgages on two of these ships with an aggregate net book value of $688 million were

released and, accordingly, $309 million of secured debt became unsecured. See Note 5.

Repairs and maintenance expenses, including minor improvement costs and dry-dock expenses, were $749

million, $661 million and $583 million in fiscal 2009, 2008 and 2007, respectively, and are substantially all

included in other ship operating expenses in the accompanying Consolidated Statements of Operations.

14