Carnival Cruises 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Carnival Cruises annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report

CARNIVAL

C O R P O R A T I O N & P L C

The Power of Our Global Brands

Table of contents

-

Page 1

C A R N I VA L COR POR ATION฀&฀PLC The Power of Our Global Brands 2004 Annual Report -

Page 2

... brands includes Carnival Cruise Lines, Princess Cruises, Holland America Line, Windstar Cruises and Seabourn Cruise Line in North America; P&O Cruises, Cunard Line, Ocean Village and Swan Hellenic in the United Kingdom; AIDA Cruises in Germany; Costa Cruises in Europe; and P&O Cruises in Australia... -

Page 3

... North America. Most cruises range from 7 to 15 days in length, with some up to 30 days. Destinations include Alaska, the Caribbean, Europe, the Panama Canal, the Mexican Riviera, the South Paciï¬c, South America, Hawaii, Asia, and Canada/New England. (www.princesscruises.com) Holland America Line... -

Page 4

... per share. This differs from the pro forma amounts shown in Note 3 to the consolidated financial statements as U.S. GAAP requires pro forma net income to be reduced by the amount of the merger related costs. (b) As of the end of the year, except for the number of ships and passenger capacity... -

Page 5

... market. While the euro-dollar exchange rate made it extremely expensive to order new ships for a North American cruise brand this past year, our financial strength enabled us to structure an economical five-ship order which included very attractively priced U.S. dollar ships for our North American... -

Page 6

...five ships on order for our well-recognized brands Carnival Cruise Lines, Princess Cruises and Holland America Line. To further stimulate demand for these companies, each of these brands embarked on new marketing campaigns to reflect their distinct market positioning, including Carnival Cruise Lines... -

Page 7

...with proof of ownership of Carnival Corporation or Carnival plc shares (i.e., photocopy of shareholder proxy card, shares certificate or a current brokerage or nominee statement) and the initial deposit to your travel agent or to the cruise line you have selected. NORTH AMERICAN BR ANDS C A R N I VA... -

Page 8

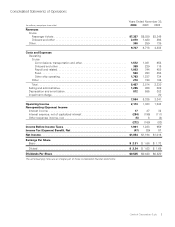

...(in millions, except per share data) Revenues Cruise Passenger tickets ...Onboard and other ...Other ...Costs and Expenses Operating Cruise Commissions, transportation and other . Onboard and other ...Payroll and related...Food ...Other ship operating ...Other ...Total ...Selling and administrative... -

Page 9

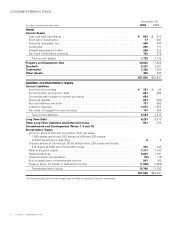

...stock; 42 shares of Carnival plc at cost ... ... 6 353 7,311 8,623 (16) 541 (1,058) 15,760 $27,636 6 349 7,163 7,191 (18) 160 (1,058) 13,793 $24,491 Total shareholders' equity ... The accompanying notes are an integral part of these consolidated financial statements. 6 Carnival Corporation & plc -

Page 10

...102 307 Net cash (used in) provided by financing activities ...Effect of exchange rate changes on cash and cash equivalents ...Net increase (decrease) in cash and cash equivalents...Cash and cash equivalents at beginning of year ...Cash and cash equivalents at end of year ...The accompanying notes... -

Page 11

... 30, 2002 ...Comprehensive income Net income ...Foreign currency translation adjustment ...Unrealized losses on marketable securities, net ...Changes related to cash flow derivative hedges, net ...Total comprehensive income ...Cash dividends declared...Acquisition of Carnival plc ...Issuance of... -

Page 12

... Cruise Ships 20 14 11 12 4 4 2 2 1 1 3 3 77 Passenger Capacity(a) 44,866 28,332 18,272 16,930 7,724 5,378 4,410 2,686 1,578 678 624 604 132,082 Primary Market North America North America Europe North America United Kingdom Germany North America and United Kingdom Australia and New Zealand United... -

Page 13

... different foreign currency translation rates at each balance sheet date, except as noted below. During 2004, we increased the fair values of the P&O Princess publicly traded debt, and correspondingly, goodwill, by $61 million to take into account the extension of Carnival Corporation's guarantee... -

Page 14

... Expense Recognition Guest cruise deposits represent unearned revenues and are initially recorded as customer deposit liabilities when received. Customer deposits are subsequently recognized as cruise revenues, together with revenues from onboard and other activities and all associated direct costs... -

Page 15

.... At November 30, 2004 and 2003, the amount of advertising costs included in prepaid expenses was not material. per share computations if Carnival Corporation's common stock price had reached certain conversion trigger prices. As required by EITF No. 04-08, we have retroactively restated our 2003... -

Page 16

... and large number of accounts within our customer base. We have experienced only minimal credit losses on our trade receivables. We do not normally require collateral or other security to support normal credit sales. However, we do normally require collateral and/or guarantees to support notes... -

Page 17

... is required to make a payment to the other company to equalize the possible net distribution to shareholders, subject to certain exceptions. At the closing of the DLC transaction, Carnival Corporation and Carnival plc also executed deeds of guarantee. Under the terms of Carnival Corporation's deed... -

Page 18

... by Carnival plc's shareholders who wish to continue to hold shares in a UK-listed company. Carnival plc was the third largest cruise company in the world and operated many well-known global brands with leading positions in the U.S., UK, Germany and Australia. The combination of Carnival Corporation... -

Page 19

... net insurance proceeds. (d) The 2002 pro forma net income included a $51 million nonrecurring income tax benefit related to an Italian incentive tax law, which allowed Costa to receive an income tax benefit for contractual expenditures during 2002 incurred on the construction of a new ship. (e) The... -

Page 20

...% of the interest cost on our long-term debt was fixed (60% at November 30, 2003) and 32% was variable (40% at November 30, 2003), including the effect of our interest rate swaps. The deeds of guarantee between Carnival Corporation and Carnival plc, or alternatively standalone guarantees in lieu of... -

Page 21

... which the closing price of the Carnival Corporation common stock is greater than a specified trigger price for a defined duration of time in the preceding fiscal quarter. The trigger price commenced at a low of $31.94 per share for the first quarter of fiscal 2002 and increases at an annual rate of... -

Page 22

... Includes $600 million of Carnival Corporation's 2% Notes in 2005, $561 million of its Zero-Coupon Notes in 2006, and $575 million of its 1.75% Notes in 2008, based in each case on the date of the noteholders' first put option. Debt issuance costs are generally amortized to interest expense using... -

Page 23

... Service Date(a) Passenger Capacity Estimated Total Cost(b) Euros Sterling USD Brand and Ship USD Commitments Carnival Cruise Lines Carnival Valor(c) ...Carnival Liberty ...Carnival Freedom ...Total Carnival Cruise Lines...Princess Crown Princess...Newbuild ...Total Princess ...Holland America Line... -

Page 24

... these actions. In February 2001, Holland America Line-USA, Inc. ("HAL-USA"), our wholly-owned subsidiary, received a grand jury subpoena requesting that it produce documents and records relating to the air emissions from Holland America Line ships in Alaska. HAL-USA responded to the subpoena... -

Page 25

.... Carnival Corporation would only be required to make any payments under these contingent obligations in the remote event of nonperformance by these financial institutions, all of which have longterm credit ratings of AAA or AA. In addition, Carnival Corporation obtained a direct guarantee from... -

Page 26

... based on passenger counts, ship tonnage or some other measure. These taxes, other than those directly charged to and/or collected from passengers by us, are recorded as operating expenses in the accompanying statements of operations. Note 10-Shareholders' Equity Carnival Corporation's articles of... -

Page 27

... to the impact of changes in the Carnival Corporation common stock value on the value of our convertible notes on those dates. The fair values of our unsecured fixed rate public notes, convertible notes, sterling bonds and unsecured 5.57% euro notes were based on their public market prices. The fair... -

Page 28

... segment revenues primarily included revenues for the cruise portion of a tour, when a cruise is sold along with a land tour package by Holland America Tours or Princess Tours, and shore excursion and port hospitality services provided to cruise passengers by these tour companies. These intersegment... -

Page 29

... the number of shares for which options are to be granted and the amounts that may be exercised within a specified term. The Carnival Corporation and Carnival plc option exercise price is generally set by the Committee at 100% of the fair market value of the common stock/ ordinary shares on the date... -

Page 30

... Princess options which terminated in 2004 prior to their original termination dates. (e) Included 3.3 million and 3.6 million of Carnival plc options at a weighted-average exercise price of $38.42 and $20.89 per share, based on the November 30, 2004 and 2003 U.S. dollar to sterling exchange rate... -

Page 31

... employee plans are closed to new membership and are funded at or above the level required by U.S. or UK regulations. The remaining defined benefit plans are primarily unfunded. In determining our plans' benefit obligations at November 30, 2004, we used assumed weighted-average discount rates... -

Page 32

.... In addition, cash paid for income taxes was $8 million in fiscal 2004 and $20 million in fiscal 2003. Finally, we received a $60 million note on the sale of Holland America Line's Nieuw Amsterdam in fiscal 2002, which represented a noncash investing activity. Note 14-Earnings Per Share Our basic... -

Page 33

... maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a-15(f). Under the supervision and with the participation of our management, including our Chief Executive Officer, Chief Operating Officer and Chief Financial and Accounting Officer, we... -

Page 34

... Certified Public Accounting Firm To the Boards of Directors and Shareholders of Carnival Corporation and Carnival plc: We have completed an integrated audit of Carnival Corporation & plc's November 30, 2004 consolidated financial statements and of its internal control over financial reporting as... -

Page 35

... Annual Report. Forward-looking statements include those statements which may impact the forecasting of our earnings per share, net revenue yields, booking levels, pricing, occupancy, operating, financing and/or tax costs, costs per available lower berth day ("ALBD"), estimates of ship depreciable... -

Page 36

... eight new ships for our North American and European brands, which are expected to be delivered between 2007 and 2009. These new ships are expected to continue to help us maintain our leadership position within the cruise industry. The year-overyear percentage increases in Carnival Corporation & plc... -

Page 37

... variable costs, which are travel agent commissions, cost of air transportation and certain other variable direct costs associated with onboard revenues. Substantially all of our remaining cruise costs are largely fixed once our ship capacity levels have been determined. Net cruise costs per... -

Page 38

... 83% of our total assets. We make several critical accounting estimates dealing with our ship accounting. First, we compute our ships' depreciation expense, which represents 11.6% of our cruise operating expenses in fiscal 2004, which requires us to estimate the average useful life of each of our... -

Page 39

... non-alcoholic beverages, entertainment and many onboard activities, and • the sale of goods and/or services primarily on board our ships, which include bar and some beverage sales, casino gaming, shore excursions, gift shop and spa sales, photo and art sales and pre- and post cruise land packages... -

Page 40

...420 259 6,718 $ 5,128 1,356 284 6,768 $ 3,346 898 139 4,383 Costs and Expenses Operating Cruise Commissions, transportation and other Onboard and other ...Payroll and related ...Food ...Other ship operating ...Other ...Total...Selling and administrative ...Depreciation and amortization Impairment... -

Page 41

...from higher cruise ticket prices, a 1.9% increase in occupancy, higher onboard revenues and the weaker U.S. dollar relative to the euro and sterling. Net revenue yields as measured on a constant dollar basis, where we recompute 2004 net revenue yields at the foreign currency exchange rates in effect... -

Page 42

...or 43%, in 2004 to $6.48 billion from $4.52 billion in reported 2003 primarily for the same reasons as net cruise costs and a higher proportion of P&O Princess brands' customers who purchased air from us. Other non-cruise operating expense increased $24 million, or 8.5%, to $308 million in 2004 from... -

Page 43

... Corporation fleet and ship improvement expenditures. Income Taxes The income tax expense of $29 million in reported 2003 was primarily due to the consolidation of Carnival plc's U.S. based Princess Tours and Costa's Italian taxable income. Liquidity and Capital Resources Sources and Uses of Cash... -

Page 44

... deferred income taxes, have been excluded from the table as they do not require cash settlement in the future or the timing of the cash outflow cannot be reasonably estimated. (d) Foreign currency payments are based on the November 30, 2004 exchange rates. During 2004, the Board of Directors... -

Page 45

... euro, the U.S. dollar cost to order new cruise ships at current exchange rates has increased significantly. If the U.S. dollar remains at current levels or declines further, this may affect our ability to order future new cruise ships for U.S. dollar functional currency brands. Finally, we consider... -

Page 46

... an unrealized loss of $137 million, which is recorded in AOCI and offsets a portion of the gains recorded in AOCI upon translating these foreign subsidiaries' net assets into U.S. dollars. Based upon a 10% hypothetical increase or decrease in the November 30, 2004 foreign currency exchange rate, we... -

Page 47

...Revenues ...Operating income ...Net income(c) ...Earnings per share(c) Basic ...Diluted(e) ...Dividends declared per share ...Cash from operations ...Capital expenditures ...Other Operating Data(a)(b) Available lower berth days(f) ...Passengers carried ...Occupancy percentages(g) ...2003 Years Ended... -

Page 48

... of two passengers per cabin even though some cabins can accommodate three or more passengers. The percentages in excess of 100% indicate that more than two passengers occupied some cabins. (h) Percentage of total debt to the sum of total debt and shareholders' equity. Carnival Corporation & plc 45 -

Page 49

... as Carnival Corporation's per share dividends and are declared in U.S. dollars. Carnival plc UK ordinary shareholders can elect to receive these dividends either in U.S. dollars or sterling, based upon a current U.S. dollar to sterling exchange rate announced prior to the dividend payment date. 46... -

Page 50

...) Our revenue from the sale of passenger tickets is seasonal, with our third quarter being the strongest. Historically, demand for cruises has been greatest during our third fiscal quarter, which includes the Northern Hemisphere summer months. The consolidation of P&O Princess brands has caused our... -

Page 51

... financial statements. UK Terms Acquisition accounting ...Associate/Joint venture ...Called up share capital ...Creditors ...Debtors ...Finance lease ...Financial year...Gearing ...Interest payable ...Interest receivable ...Profit ...Profit and loss account ...Profit and loss account reserves Profit... -

Page 52

... D. Ames President and Chief Executive Officer Carnival Cruise Lines Senior Vice President Management Advisory Services Arnold W. Donald Pamela C. Conover Ian J. Gaunt Chairman of the Board Merisant Company Senior Vice President Shared Services Senior Vice President International Pier Luigi... -

Page 53

C A R N I VA L Carnival Place 3655 N.W. 87th Avenue Miami, Florida 33178-2428 U.S.A. www.carnivalcorp.com Carnival House 5 Gainsford Street London SE1 2NE UK www.carnivalplc.com COR POR ATION฀&฀PLC