Callaway 2003 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2003 Callaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other than this strategic move, how did we fare in 2003? We

had a lot of other successes in 2003, but before I talk more about

the good news, I want to be sure that I also address the bad. Not

everything went as well as the Top-Flite transaction.

Callaway Golf sales, excluding $40 million in Top-Flite sales,

declined for the third straight year, to $774 million. While some of

this decline was due to external market forces, including weak

economic conditions in key countries as I predicted in last year’s

letter, most was the result of the loss of market share in the metal

woods category. While we maintained our #1 metal woods

position in the U.S., the gap between the #2 company and us got

smaller than it has been in years. This is simply not acceptable.

When I talk about 2004 later in this letter, I will share with you my

plans for growing net sales and strengthening our hold on the #1

position in the U.S. in woods.

Despite these setbacks in sales and woods market share, and

while negotiating and concluding the Top-Flite transaction, we

delivered these positive results for you in 2003:

•Reflecting the strength of our Callaway Golf business, we achieved

net income of $46 million even after absorbing $25 million in

operating and integration losses associated with Top-Flite.

• On a similar basis, earnings per diluted share in 2003 were $0.68,

which included losses of $0.38 associated with the above items

for the Top-Flite acquisition.

• We generated $119 million in cash flow from operations

and finished the year once again with no debt.

• We maintained our #1 U.S. market share positions for irons and

putters at record levels.

•In our pursuit of technological excellence, Callaway Golf

obtained 102 patents from the U.S. Patent and Trademark Office

in 2003 (146 if the newly issued patents acquired through the

Top-Flite transaction are included), making our Company the

first and only golf company to receive over 100 U.S. golf equip-

ment patents in a single year.

Of course, the core of our business is our golf clubs and golf balls.

And we had a number of successes in our core products in 2003.

For example:

•

The new Great Big Bertha II Driver and Fairway Woods

recovered the ground we had lost at this premium price point due

to the shortcomings of the C4 Driver in 2002. We achieved strong

sales of this outstanding product without engaging in discounting

or “close-out” tactics employed by some of our competitors.

•The new Steelhead X-16 Irons helped us hold our #1 position in

irons at 2.5 times the share of the next nearest competitor.

•Odyssey putter introductions, including some new “2-Ball”

models and the DFX line, sustained our #1 position in putters,

including a remarkable market share of nearly 50% in the

United States.

• Golf balls made by Callaway Golf remained #2 in usage on the

PGA Tour and the 6 major world tours combined with penetration

increasing in the back half of the year due to the enthusiastic

acceptance of prototypes of our new HX Tour golf ball.

• Top-Flite introduced three new golf ball models, including the

Strata Tour Ace model that won the U.S. Open, and the mod-

erately priced Infinity line that has sold very well since its

introduction in the second half of 2003.

• The Ben Hogan product line saw the addition of new wedges and

golf balls, and the launch of the Ben Hogan Bettinardi putter line

(a “Baby Ben” prototype putter won twice and had five “top ten”

finishes on the PGA Tour in 2003, including the U.S. Open victory).

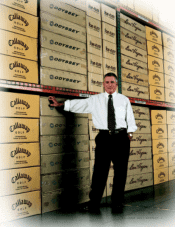

...driven to be a world-class organization

CALLAWAY GOLF COMPANY 3