Callaway 2003 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2003 Callaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

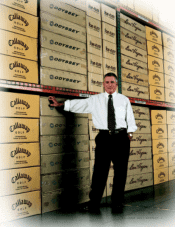

Ronald A. Drapeau | Chairman and CEO | April 1, 2004

multi-layer cores, offer tour-level

performance as confirmed by their

#1 endorser, U.S. Open winner Jim

Furyk. The Hogan brand also plans

to introduce several new club

products, including the FTX-Forged

Transition irons and CFT Hybrid irons and

an expanded line of Ben Hogan Bettinardi

putters, including the “Baby Ben” putter that

was so successful on tour in 2003. The Top-

Flite brand will also be more prominent in

the club category, with new recreational

clubs. Additionally, in 2004 you will recognize

our change of strategy for Top-Flite by

reverting back to tour professionals being

branded as Top-Flite rather than using sub-

brands such as Strata. We believe over time

this exposure will add significant marketing

value back to this staple brand in golf.

Strategically, we have several oppor-

tunities. Most obvious is the opportunity

to integrate the foreign operations of

Top-Flite and Callaway Golf. These are

not just savings as the result of synergies.

There are real opportunities to benefit

both organizations through the sharing

of

best practices, ideas, people, customer

contacts,

and just plain raw excitement

about coming to work in a new environment.

In addition, we still have our strong balance

sheet, and there may yet be some acquisition

opportunities available to us that are foreclosed

to our more financially strapped competitors. Six Sigma work

on our core processes, as discussed above, will continue to generate

savings while improving our products and our services.

Now you can see why I am sounding optimistic – for the first

time, I think, since I became CEO. The world economies seem to

be improving. I believe the golf industry will be considerably

healthier. We have a great line of products. And we are posi-

tioned with the best team in the industry to take advantage of

these dynamics. It will not be easy, and nothing is guaranteed.

Yet, I am confident that our future will be better than our

most recent past.

One thing is clear: we have the desire, and the ability and the

resources to do this. We have led the premium woods business by

a wide margin before, we need to repeat it. When we set a goal

for ourselves such as fixing the losses in the golf ball business, we

do it. It is up to us to perform at our highest levels and if we do, I

think we will see some very good results in 2004.

We appreciate the decision you have made to invest in us.

We will focus on sound financial fundamentals that deliver strong

earnings and cash flow while looking for the opportunities to

grow

using our financial strength and capitalizing on strategic

opportu

nities. And we will do it with the same passion that golfers

bring to the game.

Thank you for your continued support. I look forward to seeing

many of you at our Annual Meeting of Shareholders on May 25, 2004.

pleasingly different

CALLAWAY GOLF COMPANY 7