Boeing 2011 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2011 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

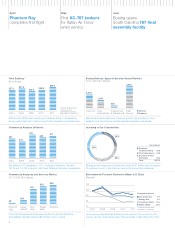

— Reported net income of $4 billion, or $5.33 per

share, a 21 percent rise from $3.3 billion, or

$4.46 per share, in 2010.

— Delivered record revenues of $68.7 billion, a

7 percent increase compared to $64.3 billion

in 2010.

— A d d e d $103 billion in new orders, expanding

our backlog to a record $355 billion—more than

five times 2011 revenues.

— Generated strong operating cash flow of $4 billion

and cash and marketable securities of $11.3 billion,

maintaining continued healthy liquidity.

— Delivered 477 commercial airplanes, including the

first 787 Dreamliners and 747-8 Freighters, the

7,000th 737 and the 1,000th 767, and completed

FAA certification on the 747-8 Intercontinental.

— W o n 805 net commercial airplane orders, includ-

ing a record 200 orders for the 777, and 150 firm

orders for the new 737 MAX; backlog grew to

3,771 airplanes valued at a record $296 billion.

— Delivered 115 production military aircraft and four

satellites, maintaining Boeing Defense, Space &

Security revenues at 2010 levels, with a backlog

of $60 billion.

— C a p t u r e d key new and follow-on Defense, Space

& Security business, including the U.S. Air Force

KC-46 tanker program; the first production con-

tract for the U.S. Navy’s P-8A Poseidon; a U.S.

agreement with Saudi Arabia for the largest-

ever foreign sale of F-15s; a contract from the

U.S. Missile Defense Agency for Ground-based

Midcourse Defense; the C-17 Integrated Sustain-

ment Program for the U.S. Air Force; and contracts

to begin design and development of the core

rocket stages and avionics system for NASA’s

new manned Space Launch System.

— O p e n e d our new 787 final assembly facility and

delivery center in South Carolina; raised production

rates to meet rising demand for all commercial

airplane models; and signed an early, four-year

contract extension with our machinists union in

Puget Sound, Portland and Wichita.

— A c h i e v e d key Defense, Space & Security pro-

gram milestones, including flight testing of the

first Chinooks for the United Kingdom and

Netherlands, first combat deployment of the

EA-18G Growler by the U.S. Navy, first flight of

the Phantom Ray unmanned airborne system,

first flight of the P-8I maritime surveillance aircraft

for India and the final space shuttle mission.

— Advanced our environmental stewardship by help-

ing lead industry efforts to approve sustainable

biofuels for commercial and military flights; relied

on hydroelectric and renewable energy sources

for nearly half of our total electrical consump-

tion; and were recognized as an ENERGY STAR

Partner of the Year by the U.S. Environmental

Protection Agency.

2011 2010 2009 2008 2007

Revenues 68,735 64,306 68,281 60,909 66,387

Net earnings 4,018 3,307 1,312 2,672 4,074

Earnings per share* 5.33 4.46 1.87 3.65 5.26

Operating margins 8.5% 7.7% 3.1% 6.5% 8.8%

Contractual backlog 339,657 303,955 296,500 323,860 296,964

Total backlog† 355,432 320,826 315,558 351,926 327,137

2011 Financial Highlights

U.S. dollars in millions except per share data

*Represents diluted earnings per share from continuing operations.

†Total backlog includes contractual and unobligated backlog. See page 22 of the 10-K.

Operational Summary

73417bo_txt 1 3/5/12 8:04 PM