Black & Decker 2010 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2010 Black & Decker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

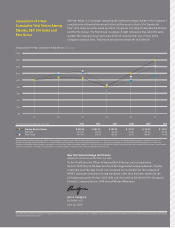

Set forth below is a line graph comparing the yearly percentage change in the Company’s

cumulative total shareholder return for the last five years to that of the Standard &

Index (an index made up of companies including Stanley Black & Decker)

markets the Company serves and many of which compete with one or more of the

Company’s product lines. Total return assumes reinvestment of dividends.

of the Sarbanes-Oxley Act of as Exhibits (i)(a) and (i)(b) to its Annual Report on Form -K filed with the Securities and Exchange

Commission on February , .

Comparison of -Year

Cumulative Total Return Among

Stanley, S&P Index and

Peer Group

New York Stock Exchange Certification

Section A.

certify that as of the date hereof I am not aware of any violation by the Company of

NYSE’s Corporate Governance listing standards, other than has been notified to the

Exchange pursuant to Section A.

Domestic Company Section A Annual Written Armation.

John F. Lundgren

,

Stanley Black & Decker $ . $ . $ . $ . $ . $ .

. . . . . .

. . . . . .

Assumes $,

, the

, , the results of The Black & Decker Corporation are now included in the Company’s consolidated

results. As a matter of consistency, the total returns of the Black & Decker Corporation have been excluded from all prior years.

$180

Comparison of 5-Year Cumulative Total Return (IN MILLIONS)

$120

$140

$160

$100

$80

$60

$40

$20

$0

05 06 07 08 09 10