Black & Decker 2010 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2010 Black & Decker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

expanding across the globe, as exemplified by the recent introduction of DeWalt hand tools in certain

channels, (30%); and joint new product development, which entails leveraging development expertise from

both legacy companies to pursue new product opportunities (10%). The CDIY segment is expected to realize

approximately two-thirds of the revenue synergies, and the remainder will be split evenly in the Industrial and

Security segments. In 2011, the Company intends to increase capital expenditures to 2.5% — 2.8% of revenues

partially as a result of infrastructure improvements to foster attainment of the revenue synergies. In 2012 and

beyond, the capital expenditure ratio is expected to return to more historical levels (2.0% — 2.5% of revenues)

in 2012.

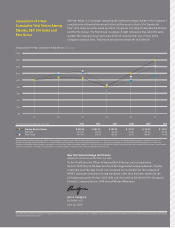

Net sales from continuing operations have increased from $3.7 billion in 2009 to a record $8.4 billion in 2010,

primarily as a result of the Merger, double digit organic growth in the legacy Stanley Industrial segment, as

well as the effects of several smaller acquisitions. The Company sold the CST/berger business in 2008 along

with several other small divestitures in 2008. Results have been recast for these discontinued operations. Refer

to Note E, Merger and Acquisitions, and Note T, Discontinued Operations, of the Notes to the Consolidated

Financial Statements in Item 8 for a discussion of acquisitions and divestitures over the past three years.

At January 1, 2011, the Company employed approximately 36,700 people worldwide. The Company’s principal

executive office is located at 1000 Stanley Drive, New Britain, Connecticut 06053 and its telephone number is

(860) 225-5111.

(ii) Restructuring Activities. Information regarding the Company’s restructuring activities is incorporated

herein by reference to the material captioned “Restructuring Activities” in Item 7 and Note O, Restructuring

and Asset Impairments, of the Notes to the Consolidated Financial Statements in Item 8.

1(b) FINANCIAL INFORMATION ABOUT SEGMENTS

Financial information regarding the Company’s business segments is incorporated herein by reference to the

material captioned “Business Segment Results” in Item 7 and Note P, Business Segments and Geographic

Areas, of the Notes to the Consolidated Financial Statements in Item 8.

1(c) NARRATIVE DESCRIPTION OF BUSINESS

The Company’s operations are classified into three reportable business segments: Construction & Do-It-Yourself

(“CDIY”), Security, and Industrial. All segments have significant international operations in developed countries,

but do not have large investments that would be subject to expropriation risk in developing countries. Fluctuations

in foreign currency exchange rates affect the U.S. dollar translation of international operations in each segment.

After consummation of the Merger, the Black & Decker businesses were assessed and integrated into the

Company’s existing reportable segments. The legacy Black & Decker segments: Power Tools and Accessories,

Hardware & Home Improvement (“HHI”) and Fastening and Assembly Systems, were integrated into the

Company’s CDIY, Security and Industrial segments, respectively, with the exception of the Pfister plumbing

products business which was formerly part of HHI but is included in the CDIY segment. The results of Black &

Decker’s operations are presented within each of these segments and reflect activity since the Merger date.

CDIY

The CDIY segment manufactures and markets hand tools, corded and cordless electric power tools and

equipment, lawn and garden products, consumer portable power products, home products, accessories and

attachments for power tools, plumbing products, consumer mechanics tools, storage systems, and pneumatic

tools and fasteners. These products are sold to professional end users, distributors, and consumers, and are

primarily distributed through retailers (including home centers, mass merchants, hardware stores, and retail

lumber yards). Hand tools include measuring and leveling tools, planes, hammers, demolition tools, knives and

blades, screwdrivers, saws, chisels and consumer tackers. Corded and cordless electric power tools and

equipment include drills, impact wrenches and drivers, wet/dry vacuums, lights, radios/chargers, grinders,

various saws, polishers, plate joiners, jointers, lathes, dust management systems, routers, planers, tile saws,

sanders, air tools, building instruments, air compressors, laser products, and Workmate»products. Lawn and

garden products include hedge trimmers, string trimmers, lawn mowers, edgers, pruners, shears, shrubbers,

blowers/vacuums, chain saws, and related accessories. Consumer portable power products include inverters,

3