Black & Decker 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Black & Decker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A

Stanley Black & Decker Annual Report

Annual Report

www.yearinreview.stanleyblackanddecker.com

Stanley Black & Decker

is more than tools.

We’re a solutions company.

A growth company.

A diversified global enterprise.

Delivering solutions people

count on when it really matters.

Table of contents

-

Page 1

Stanley Black & Decker 2010 Annual Report A Stanley Black & Decker is more than tools. We're a solutions company. A growth company. A diversified global enterprise. Delivering solutions people count on when it really matters. 2010 Annual Report www.yearinreview.stanleyblackanddecker.com -

Page 2

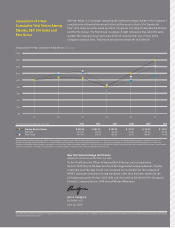

... Top: DeWALT power tools and Stanley FatMax hand tools are the professional's choice. Inside Front Cover Bottom: Bedside charting carts from Stanley Healthcare secure medications and help enhance patient care. Back Cover Top: Customer input guides the design of innovative True Hybrid Solutions from... -

Page 3

Stanley Black & Decker 2010 Annual Report 1 Letter to Shareholders 2010 was an extraordinary year for our Company, highlighted by the closing of the merger of Stanley Works and Black & Decker on March 12. Undoubtedly the most significant transaction in both companies' histories, the formation of ... -

Page 4

... years which, when capitalized, represented an extraordinary 36% of the combined companies' market capitalization. The transaction was also expected to be highly accretive to earnings per share of the new Company with an (1) Excludes merger and acquisition-related charges/payments. CReDIT RATInG... -

Page 5

... markets, CRC-Evans is a scalable, global growth vehicle. We expanded our $915 million Convergent Security Solutions electronic security business with the acquisition of ADT's French operations (2009 revenues Financial highlights (MIllIOnS OF DOllARS, ExCEPT PER-ShARE AMOUnTS) 2010(1) 2009... -

Page 6

... & Decker 2010 Annual Report 4 approximately $175 million), which we rebranded Stanley Solutions de Sécurité, growing our market share of the $1 billion French commercial security monitoring business to approximately 25%. We took an important strategic step forward in evolving our healthcare... -

Page 7

... able to return to the 8 turns level within three to four years, which we believe is feasible. Summary 2010 was a year of successes for Stanley Black & Decker with the closing of the merger, a strong start to the integration, solid financial results and strategic progress across the Company. We are... -

Page 8

... the earnings power of the Company and to properly value the Company, due to current high levels of non-cash expenses related to recent acquisitions. In 2010, EBITDA excludes merger and acquisition-related charges of $538 million primarily associated with the Black & Decker merger. Also, in... -

Page 9

...the Black & Decker Corporation have been excluded from all prior years. new York Stock exchange Certification AnnUAl CEO CERTIFICATIOn (SECTIOn 303A.12(A)) As the Chief Executive Officer of Stanley Black & Decker, and as required by Section 303A.12(a) of the new York Stock Exchange listed Company... -

Page 10

... Team BOARD OF DIReCTORS mAnAGemenT TeAm nolan D. Archibald Executive Chairman of the Board, Stanley Black & Decker John G. Breen lead Independent Director Retired Chairman & Chief Executive Officer, The Sherwin-Williams Company George w. Buckley Chairman, President & Chief Executive Officer, 3M... -

Page 11

... BLACK & DECKER, INC. (Exact Name Of Registrant As Specified In Its Charter) Connecticut 06-0548860 (State Or Other Jurisdiction Of Incorporation Or Organization) 1000 Stanley Drive New Britain, Connecticut (I.R.S. Employer Identification Number) 06053 (Address Of Principal Executive Offices... -

Page 12

(This page intentionally left blank.) -

Page 13

... MARKET RISK ...FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA ...CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE ...CONTROLS AND PROCEDURES ...OTHER INFORMATION ...PART III DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT ...EXECUTIVE COMPENSATION ...SECURITY... -

Page 14

(This page intentionally left blank.) -

Page 15

... the Black & Decker Corporation ("Black & Decker"). Black & Decker, which was incorporated in Maryland in 1910, is a leading global manufacturer and marketer of power tools and accessories, hardware and home improvement products, and technology-based (engineered) fastening systems. Black & Decker... -

Page 16

... of Black & Decker's operations are presented within each of these segments and reflect activity since the Merger date. CDIY The CDIY segment manufactures and markets hand tools, corded and cordless electric power tools and equipment, lawn and garden products, consumer portable power products, home... -

Page 17

...hand-held vacuums, flexible flashlights, paint tools and cleaning solutions. Accessories and attachments for power tools include drill bits, hammer bits, router bits, hacksaws and blades, circular saw blades, jig and reciprocating saw blades, diamond blades, screwdriver bits and quick-change systems... -

Page 18

.../ convergent Security, mechanical security, engineered fastening, infrastructure solutions and healthcare solutions) are made in future years, the proportion of sales to these valued U.S. home center and mass merchant customers is expected to decrease. Raw Materials The Company's products are... -

Page 19

...among the world's most trusted brand names. The Company's tagline, "Make Something Great»" is the centerpiece of the brand strategy for all segments. In the CDIY segment, the Bostitch», Bailey», Powerlock», Tape Rule Case Design», FatMax», Black & Decker», DeWalt», DustBuster», Porter-Cable... -

Page 20

...in 2011, 2012, 2013 and 2014. There have been no significant interruptions or curtailments of the Company's operations in recent years due to labor disputes. The Company believes that its relationship with its employees is good. 1(d) FINANCIAL INFORMATION ABOUT GEOGRAPHIC AREAS Financial information... -

Page 21

... the businesses of Stanley and Black & Decker in a manner that permits the combined company to achieve the cost savings anticipated to result from the Merger; the inability to implement information technology system changes to get the combined businesses on common platforms; lost sales and customers... -

Page 22

... its business portfolio toward favored growth markets through acquisitions and divestitures. The strategy has been advanced over the last several years with the Merger and the acquisition of a number of companies, including Stanley Solutions de Sécurité ("SSDS"), CRC-Evans Pipeline International... -

Page 23

... Notes to the Consolidated Financial Statements in Item 8, the Company has a committed revolving credit agreement, expiring in February 2013, supporting borrowings up to $800 million. Upon closing of the Merger, the Company entered into a $700 million revolving credit agreement that became effective... -

Page 24

..., component parts, freight, energy, labor and sourced finished goods in a timely and cost-effective manner. The Company's products are manufactured using both ferrous and non-ferrous metals including, but not limited to steel, zinc, copper, brass, aluminum and nickel, and resin also represents... -

Page 25

... and other financial institutions negatively impacting the Company's treasury operations. The Company is exposed to market risk from changes in foreign currency exchange rates which could negatively impact profitability. The Company manufactures and sell its products in many countries throughout the... -

Page 26

...'s business. The Company has certain significant customers, particularly home centers and major retailers, although no one customer represented more than 10% of consolidated net sales in 2010. However, on a pro-forma basis (as if Black & Decker were part of the Company's results for the entire year... -

Page 27

.... Unauthorized use of the Company's trademark rights may not only erode sales of the Company's products, but may also cause significant damage to its brand name and reputation, interfere with its ability to effectively represent the Company to its customers, contractors, suppliers, and/or licensees... -

Page 28

... lose market share and profits. The performance of the Company may suffer from business disruptions associated with information technology, system implementations, or catastrophic losses affecting distribution centers and other infrastructure. The Company relies heavily on computer systems to manage... -

Page 29

... adjustment which would decrease the net assets of the Company and result in higher expense in future years. The fair value of these assets at January 1, 2011 was $1.751 billion. The Company is exposed to credit risk on its accounts receivable. The Company's outstanding trade receivables are not... -

Page 30

... greater availability in the sources of the new technology drive down its cost, could adversely affect the Company's results of operations. Market acceptance of the new products introduced in recent years and scheduled for introduction in 2011 may not meet sales expectations due to various factors... -

Page 31

...: Corporate Offices Owned by the Company Leased by the Company None CDIY Owned by the Company New Britain, Connecticut, United States of America Leased by the Company New Britain, Connecticut, United States of America Shelbyville, Kentucky, United States of America Towson, Maryland, United States... -

Page 32

... of America New Britain, Connecticut, United States of America Sterling, Illinois, United States of America Smiths Falls, Canada Villeneuve le Roi, France ITEM 3. LEGAL PROCEEDINGS None In the normal course of business, the Company is involved in various lawsuits and claims, including product... -

Page 33

... can be found under Item 12 of this Annual Report on Form 10-K. The following table provides information about the Company's purchases of equity securities that are registered by the Company pursuant to Section 12 of the Exchange Act for the three months ended January 1, 2011: Total Number Of Shares... -

Page 34

... ...Stanley Black & Decker, Inc.'s Shareowners' Equity(g) ...Ratios: Current ratio ...Total debt to total capital ...Income tax rate - continuing operations ...Return on average equity - continuing operations...Common stock data: Dividends per share ...Equity per share at year-end ...Market price... -

Page 35

... the fiscal years ended 2007 and 2006. Stanley Black & Decker, Inc's Shareowners' Equity was reduced by $14 million in fiscal 2007 for the adoption of Financial Accounting Standards Board ("FASB") Interpretation No. 48, "Accounting for Uncertainty in Income Taxes - an Interpretation of Statement of... -

Page 36

... and markets hand tools, corded and cordless electric power tools and equipment, lawn and garden products, consumer portable power products, home products, accessories and attachments for power tools, plumbing products, consumer mechanics tools, storage systems, and pneumatic tools and fasteners... -

Page 37

... Black & Decker segments: Power Tools and Accessories, Hardware & Home Improvement ("HHI") and Fastening and Assembly Systems, were integrated into the Company's CDIY, Security and Industrial segments, respectively, with the exception of the Pfister plumbing products business which was formerly part... -

Page 38

... in 2012 and 2013. The anticipated revenue synergies will come from: geographic expansion into Latin America and other emerging markets, leveraging pre-existing infrastructure (30%); channel and cross-selling of existing products, such as the sale of power tools through the Company's industrial and... -

Page 39

... for international commercial hardware expansion. GMT had approximately $40 million in 2009 sales. The Company acquired InfoLogix, Inc. in January 2011 for $61 million, net of cash acquired. Infologix is a leading provider of enterprise mobility solutions for the healthcare and commercial industries... -

Page 40

... the full year of 2009) at the end of 2009 to 5.7 at the end of 2010. In 2011 and beyond, the Company plans to further leverage SFS to generate ongoing improvements in working capital turns, cycle times, complexity reduction and customer service levels. Certain Items Impacting Earnings Merger and... -

Page 41

... currency exchange rates relative to the U.S. dollar may have a significant impact, either positive or negative, on future earnings. Refer to the Market Risk section of this Management's Discussion and Analysis ("MD&A") for further discussion. In 2009 the Company realized a $0.34 per diluted share... -

Page 42

... is provided to aid understanding of the Black & Decker business trends compared to the prior year since the Merger occurred March 12, 2010, and accordingly the Company's 2009 reported results solely reflect legacy Stanley. Net Sales: Net sales from continuing operations were $8.410 billion in... -

Page 43

Gross Profit: The Company reported gross profit from continuing operations of $2.949 billion, or 35% of net sales, in 2010, compared to $1.508 billion, or 40% of net sales, in 2009. The addition of Black & Decker and acquired companies results was a main driver to the overall increase in gross ... -

Page 44

... The Company's reportable segments are aggregations of businesses that have similar products, services and end markets, among other factors. The Company utilizes segment profit (which is defined as net sales minus cost of sales, and SG&A aside from corporate overhead expense), and segment profit as... -

Page 45

...successful global launch of the 12-volt compact lithium ion power tools marketed under the DeWalt, Porter Cable and Black & Decker brands, other new product introductions in home products, and strength in emerging markets. Segment profit increased $322 million and reflects $128 million of merger and... -

Page 46

...in mechanical access than in convergent security solutions. Mechanical access sales volume decline was associated with continued slow commercial construction markets and a large U.S. retailer's inventory reduction that affected the hardware business. On a pro forma basis, the Black & Decker hardware... -

Page 47

sales. Sales unit volume gains were 21% primarily attributable to customer supply chain restocking, which subsided in the third quarter, market share gains, and strong end user demand fueled by higher global production levels and new product introductions. The Americas and Europe each posted robust ... -

Page 48

... plan for severed Black & Decker executives which is classified in Accrued Pension and Post-Retirement Benefits on the Consolidated Balance Sheet. Pre-2010 Actions: During 2009 and 2008 the Company initiated cost reduction actions in various businesses in response to sales volume declines associated... -

Page 49

...Working capital turns improved to 5.7 times at January 1, 2011 as compared to 5.2 times for 2009 (pro forma with Black & Decker) due to improvements in days outstanding accounts receivable, inventory and accounts payable, reflecting the process-driven improvements from the Stanley Fulfillment System... -

Page 50

... Company will continue to make capital investments that are necessary to drive productivity and cost structure improvements as well as achieve merger and acquisition-related cost synergies while ensuring that such investments deliver an appropriate risk-adjusted return on capital employed. In 2010... -

Page 51

... the merger the Company increased its committed credit facilities to $1.5 billion from $800 million. The credit facilities are diversified amongst twenty five financial institutions. The credit facilities are designated as a liquidity back-stop for the Company's commercial paper program. The 5 year... -

Page 52

...in 2010, $61 million in 2009 and $19 million in 2008. The Company received $320 million of cash proceeds in May, 2010 from the forward stock purchase contracts element of the Equity Units. The remaining amounts in each year mainly relate to employee and retiree stock option exercises. Credit Ratings... -

Page 53

... in global markets. The Company is exposed to market risk from changes in foreign currency exchange rates, interest rates, stock prices, and commodity prices. Exposure to foreign currency risk results because the Company, through its global businesses, enters into transactions and makes investments... -

Page 54

...to change to a European supplier. Management estimates the combined translational and transactional impact of a 10% overall movement in exchange rates is approximately $81 million, or $0.47 per diluted share. With respect to transactional foreign currency market risk, the Company sources significant... -

Page 55

... if the market value of the Company's common stock declines. CUSTOMER-RELATED RISKS - The Company has significant customers, particularly home centers and major retailers, though individually there are none that exceed 10% of consolidated sales. The loss or material reduction of business from any... -

Page 56

...fair value at the date of acquisition. Goodwill represents costs in excess of fair values assigned to the underlying net assets of acquired businesses. The Company reported $5.942 billion of goodwill and $1.652 billion of indefinite-lived trade names at January 1, 2011. In accordance with ASC 350-20... -

Page 57

... discount rate for both the United States and international pension plans was 5.25% and 5.75% at January 1, 2011 and January 3, 2010, respectively. As discussed further in Note L, Employee Benefit Plans, of the Notes to Consolidated Financial Statements, the Company develops the expected return on... -

Page 58

... 1, 2011. The Merger resulted in a significant increase in defined benefit plan obligations and related expense. The primary Black & Decker U.S pension and post employment benefit plans were curtailed in late 2010, as well as the only material Black & Decker international plan, and the Company... -

Page 59

.... See Note Q, Income Taxes, of the Notes to the Consolidated Financial Statements for further discussion. RISK INSURANCE - To manage its insurance costs efficiently, the Company self insures for certain U.S. business exposures and generally has low deductible plans internationally. For domestic... -

Page 60

... the anticipated results of the Merger; (ii) the Company's success in driving brand expansion, achieving increased access to global markets through established distribution channels and cross selling opportunities; (iii) the ability of the Company to generate organic net sales increase of 5-6%, from... -

Page 61

... in consumer channels; inventory management pressures on the Company's customers; the impact the tightened credit markets may have on the Company or its customers or suppliers; the extent to which the Company has to write off accounts receivable or assets or experiences supply chain disruptions... -

Page 62

...Officer and its Senior Vice President and Chief Financial Officer have concluded that, as of January 1, 2011, the Company's disclosure controls and procedures are effective. There has been no change in the Company's internal control over financial reporting that occurred during the fiscal year ended... -

Page 63

... - Global Consumer Tools Marketing (2001); Vice President Consumer Sales America (1999). Executive Chairman since March 2010. President and Chief Executive Officer and Chairman of the Board of The Black & Decker Corporation (1990-2010). Vice President, Corporate Tax since January 2002. Senior Vice... -

Page 64

..., Construction & DIY EMEA. President-Europe, Middle East, and Africa of the Power Tools and Accessories, The Black & Decker Corporation (2010); Vice President-Consumer Products (Europe, Middle East and Africa), The Black & Decker Corporation (2008); Managing Director Scotts UK and Iceland for Scotts... -

Page 65

... Directors and Officers", and "Executive Compensation", of the Company's definitive proxy statement, which will be filed pursuant to Regulation 14A under the Exchange Act within 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K. EQUITY COMPENSATION PLAN INFORMATION... -

Page 66

... the information set forth under the section entitled "Board of Directors - Related Party Transactions" of the Company's definitive proxy statement, which will be filed pursuant to Regulation 14A under the Exchange Act within 120 days after the end of the fiscal year covered by this Annual Report on... -

Page 67

... of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. STANLEY BLACK & DECKER, INC. By: /s/ John F. Lundgren John F. Lundgren, President and Chief Executive Officer Date: February 18, 2011 Pursuant to... -

Page 68

... S. Kraus * Anthony Luiso * Marianne M. Parrs * Robert L. Ryan * Lawrence A. Zimmerman Director February 18, 2011 Director February 18, 2011 Director February 18, 2011 Director February 18, 2011 Director February 18, 2011 *By: /s/ Bruce H. Beatt Bruce H. Beatt (As Attorney-in-Fact) 55 -

Page 69

... of Independent Registered Public Accounting Firm - Financial Statement Opinion (page 59). Report of Independent Registered Public Accounting Firm - Internal Control (page 60). Consolidated Statements of Operations - fiscal years ended January 1, 2011, January 2, 2010, and January 3, 2009 (page 61... -

Page 70

... II - Valuation and Qualifying Accounts Stanley Black & Decker, Inc. and Subsidiaries Fiscal years ended January 1, 2011, January 2, 2010, and January 3, 2009 (Millions of Dollars) ADDITIONS Charged Charged to Costs and To Other Expenses Accounts(b)(c) Description Beginning Balance (a) Deductions... -

Page 71

... the United States of America. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Management has assessed the effectiveness of Stanley Black & Decker Inc.'s internal control over financial reporting as of January 1, 2011. In making... -

Page 72

...(the "Company") as of January 1, 2011 and January 2, 2010, and the related consolidated statements of operations, changes in shareowners' equity, and cash flows for each of the three fiscal years in the period ended January 1, 2011. Our audits also included the financial statement schedule listed in... -

Page 73

...Board (United States), the consolidated balance sheets of the Company as of January 1, 2011 and January 2, 2010, and the related consolidated statements of operations, changes in shareowners' equity, and cash flows for each of the three fiscal years in the period ended January 1, 2011 and our report... -

Page 74

... Statements of Operations Fiscal years ended January 1, 2011, January 2, 2010 and January 3, 2009 (In Millions of Dollars, except per share amounts) 2010 2009 2008 Net Sales ...Costs and Expenses Cost of sales ...Selling, general and administrative ...Provision for doubtful accounts...Other-net... -

Page 75

... in treasury (9,744,142 shares in 2010 and 11,864,786 shares in 2009) ...Stanley Black & Decker, Inc. Shareowners' Equity ...Non-controlling interests ...Total Shareowners' Equity ...Total Liabilities and Shareowners' Equity ...See Notes to Consolidated Financial Statements. 62 ... - 440.7 2,301... -

Page 76

Consolidated Statements of Cash Flows Fiscal years ended January 1, 2011, January 2, 2010 and January 3, 2009 (Millions of Dollars) 2010 Operating Activities: Net earnings ...Less: net earnings attributable to non-controlling interests ...Net earnings attributable to Stanley Black & Decker, Inc ... -

Page 77

... Statements of Changes in Shareowners' Equity Fiscal years ended January 1, 2011, January 2, 2010 and January 3, 2009 (Millions of Dollars, Except Per Share Amounts) Accumulated Other Additional Paid In Retained Comprehensive Capital Earnings Income (Loss) NonTreasury Controlling Shareowners' Stock... -

Page 78

.... The Company's fiscal year ends on the Saturday nearest to December 31. There were 52, 52 and 53 weeks in the fiscal years 2010, 2009 and 2008, respectively. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires... -

Page 79

... and amortization related to the production of inventory and delivery of services are recorded in cost of sales. Depreciation and amortization related to distribution center activities, selling and support functions are reported in selling, general and administrative expenses. The Company assesses... -

Page 80

... preparing the product for sale. These costs include expenses to acquire and manufacture products to the point that they are allocable to be sold to customers and costs to perform services pertaining to service revenues (e.g. installation of security systems, automatic doors, and security monitoring... -

Page 81

...to 2009, certain costs directly related to acquisitions including legal, audit and other fees, were recorded to goodwill. SALES TAXES - Sales and value added taxes collected from customers and remitted to governmental authorities are excluded from Net sales reported in the Consolidated Statements of... -

Page 82

... rather than goodwill. SFAS 141(R) was applied to the Company's business combinations completed in fiscal 2010 and 2009. In December 2009, the FASB issued Accounting Standards Update ("ASU") No. 2009-16, "Accounting for Transfers of Financial Assets". This ASU eliminates the concept of a "qualifying... -

Page 83

... ASU is effective for fiscal years and interim periods beginning after December 15, 2010. The Company has evaluated the ASU and does not believe it will have a material impact on the consolidated financial statements. In December 2010, the FASB issued ASU 2010-29, "Business Combinations (Topic 805... -

Page 84

... sold in 2010 were less than $0.2 million for the year ended January 1, 2011. Cash inflows related to the deferred purchase price receivable totaled $174.4 million for the year ended January 1, 2011. All cash flows under the program are reported as a component of changes in accounts receivable... -

Page 85

... combined Company was changed to "Stanley Black & Decker, Inc". Black & Decker is a global manufacturer and marketer of power tools and accessories, hardware and home improvement products, and technology-based fastening systems. The Merger creates a larger and more globally diversified company with... -

Page 86

... closing (a) ...Other vested equity awards (a) ...Cash paid to settle fractional shares ...Total fair value of consideration transferred ... 61.571 $73.77 $4,542.2 91.7 12.2 10.1 0.3 $4,656.5 (a) As part of the Merger the Company exchanged the pre-merger equity awards of Black & Decker for Stanley... -

Page 87

... transferred over the net assets recognized and represents the expected revenue and cost synergies of the combined business, assembled workforce, and the going concern nature of Black & Decker. It is estimated that $167.7 million of goodwill, relating to Black & Decker's pre-merger historical tax... -

Page 88

... price required. In March 2010, the Company completed the acquisition of Stanley Solutions de Sécurité ("SSDS") (formerly known as ADT France) for $8.0 million, net of cash acquired. SSDS is a leading provider of security services, primarily for commercial businesses located in France. SSDS... -

Page 89

... The following table presents information for the Black & Decker Merger and other 2010 acquisitions that is included in the Company's consolidated statement of operations from the merger and acquisition dates through January 1, 2011 (in millions): Year Ended 2010 Net sales ...Loss attributable to... -

Page 90

... security monitoring services, primarily for small and mid-sized businesses located in France and Belgium. The Company also made eleven small acquisitions relating to its mechanical access systems, convergent security solutions, including healthcare storage systems, and fastening businesses during... -

Page 91

... - 13 years; technology - 8 years; and other intangible assets - 1 year. F. GOODWILL AND OTHER INTANGIBLE ASSETS GOODWILL - The changes in the carrying amount of goodwill by segment are as follows: (Millions of Dollars) CDIY Industrial Security Total Balance January 2, 2010 ...Addition from Merger... -

Page 92

... at January 1, 2011 and January 2, 2010 were as follows: (Millions of Dollars) 2010 2009 Payroll and related taxes ...Income and other taxes...Customer rebates and sales returns ...Insurance and benefits ...Accrued restructuring costs...Derivative financial instruments ...Warranty costs ...Deferred... -

Page 93

... additional commercial paper borrowings. The Company executed a full and unconditional guarantee of the existing debt of The Black & Decker Corporation and Black & Decker Holdings, LLC (this guarantee is applicable to all of the Black & Decker outstanding notes payable), and Black & Decker executed... -

Page 94

... the transaction. The Company used the net proceeds from the offering primarily to reduce borrowings under its existing commercial paper program. The $260.8 million of debt reported at January 1, 2011 reflects the fair value adjustment related to a fixed-to-floating interest rate swap entered into... -

Page 95

... cumulative cash dividends at the rate of 4.75% per annum of the $100 liquidation preference per share of the Convertible Preferred Stock. Dividends on the Convertible Preferred Stock will be payable, when, as and if declared by the Company's board of directors, quarterly in arrears on February... -

Page 96

... the Company's filing any periodic or annual report under Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, in respect of any fiscal quarter with financial statements for such fiscal quarter where the Company's leverage ratio (as described in the prospectus supplement relating... -

Page 97

...debt securities to The Stanley Works Capital Trust I (the "Trust"), with a 40-year term and a fixed initial coupon rate of 5.902% for the first five years. The Trust, which was not consolidated in accordance with ASC 470-20, obtained the funds it loaned to the Company through the capital market sale... -

Page 98

... offerings and the related financial instruments described below were used to pay down the short-term bridge facility and commercial paper borrowings. The 2010 Term Notes matured March 15, 2010. Equity Units: On March 20, 2007, the Company issued 330,000 Equity Units, each with a stated value of... -

Page 99

... to accelerate conversion, and "make whole" adjustments to the conversion rate may apply, in the event of a cash merger or "fundamental change". Subject to the foregoing, if the market value of the Company's common shares is below the conversion price at conversion, (set at a rate equating to $64.34... -

Page 100

... as of January 1, 2011. I. DERIVATIVE FINANCIAL INSTRUMENTS The Company is exposed to market risk from changes in foreign currency exchange rates, interest rates, stock prices and commodity prices. As part of the Company's risk management program, a variety of financial instruments such as interest... -

Page 101

... Hedges below resulted in net cash paid of $64.0 million. The Company also received $30.1 million in March 2010 from the termination of $325.0 million notional of fixed to variable interest rate swaps that became undesignated at the merger date and as a result the cash inflow was reported... -

Page 102

...) Recognized in Income (Ineffective Portion*) Year-to-date 2009 (In millions) Gain (Loss) Recorded in OCI Interest Rate Contracts ...Foreign Exchange Contracts ...Foreign Exchange Contracts ... $ 7.2 $(0.5) $(7.7) Interest expense Cost of sales Other-net $(4.6) $ 4.7 $(3.5) $- - - * Includes... -

Page 103

...million as of January 1, 2011 and January 2, 2010, respectively. A summary of the fair value adjustments relating to these swaps is as follows (in millions): Income Statement Classification Year-to-Date 2010 Gain/(Loss) on Gain /(Loss) on Swaps Borrowings Year-to-Date 2009 Gain/(Loss) on Gain /(Loss... -

Page 104

... Not Designated as Hedging Instruments under ASC 815 Income Statement Classification Year-to-Date 2010 Amount of Gain (Loss) Recorded in Income on Derivative Year-to-Date 2009 Amount of Gain (Loss) Recorded in Income on Derivative Foreign Exchange Contracts ... Other, net Cost of Sales $38... -

Page 105

... and diluted earnings per share for the fiscal years ended January 1, 2011, January 2, 2010 and January 3, 2009. Basic Earnings per Share Computation 2010 2009 2008 Numerator (in millions): Net earnings attributable to Stanley Black & Decker, Inc...$198.2 Less: Net earnings allocated to unvested... -

Page 106

...and Financing Arrangements. COMMON STOCK SHARE ACTIVITY - Common stock share activity for 2010, 2009 and 2008 was as follows: 2010 2009 2008 Outstanding, beginning of year ...Shares issued as part of the merger ...Shares issued from Equity Units Offering Issued from treasury ...Returned to treasury... -

Page 107

..., restricted stock units, and other stock-based awards. The plans are generally administered by the Compensation and Organization Committee of the Board of Directors, consisting of non-employee directors. Stock Options: Stock options are granted at the fair market value of the Company's stock on the... -

Page 108

... enables eligible employees in the United States and Canada to subscribe at any time to purchase shares of common stock on a monthly basis at the lower of 85% of the fair market value of the shares on the grant date ($37.53 per share for fiscal year 2010 purchases) or 85% of the fair market value of... -

Page 109

... stock units and awards as part of the Merger. Accordingly, the Company expensed $4.3 million in stock-based compensation for the twelve months ended January 1, 2011, respectively, related to these awards. A summary of non-vested restricted stock unit activity as of January 1, 2011, and changes... -

Page 110

... grant. There is a third market-based element, representing 25% of the total grant, which measures the Company's common stock return relative to peers over the performance period. The ultimate delivery of shares will occur in 2012 and 2013 for the 2009 and 2010 grants, respectively. Total payouts... -

Page 111

... exercised and net-share settled in March 2010 using an average share price of $58.76 and a fair value of $1,673,265. K. ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS) Accumulated other comprehensive income (loss) at the end of each fiscal year was as follows: (Millions of Dollars) 2010 2009 2008... -

Page 112

... ESOP shares. The Company's net ESOP activity resulted in expense of $3.4 million in 2010, income of $8.0 million in 2009 and expense of $10.6 million in 2008. ESOP expense is affected by the market value of the Company's common stock on the monthly dates when shares are released. The market value... -

Page 113

...1.9 Net periodic pension expense (income)... Changes in plan assets and benefit obligations recognized in other comprehensive income in 2010 are as follows: (Millions of Dollars) 2010 Current year actuarial loss ...Amortization of actuarial loss ...Current year prior service credit ...Amortization... -

Page 114

... Plans 2010 2009 Non-U.S. Plans 2010 2009 Other Benefits 2010 2009 Change in benefit obligation Benefit obligation at end of prior year ...Service cost ...Interest cost ...Settlements/curtailments ...Actuarial loss ...Plan amendments ...Foreign currency exchange rates ...Participant contributions... -

Page 115

... long-term rate of return assumption of 7.0% for both the U.S. and the non-U.S. plans in the determination of fiscal 2011 net periodic benefit expense. PENSION PLAN ASSETS - Plan assets are invested in equity securities, government and corporate bonds and other fixed income securities, money market... -

Page 116

..., the Company's target allocations include 50%-65% in equity securities, 35%-50% in fixed income securities and up to 10% in other securities. Maturities of investments are not necessarily related to the timing of expected future benefit payments, but adequate liquidity to make immediate and... -

Page 117

... value of these financial instruments for which Level 1 evidence does not exist, the Company considers various factors including the following: exchange or market price quotations of similar instruments, time value and volatility factors, the Company's own credit rating and the credit rating of the... -

Page 118

... expense and merger and acquisition-related charges primarily consisting of transaction costs, partially offset by pension curtailments and settlements. Research and development costs, which are classified in SG&A, were $131.4 million, $18.3 million and $25.4 million for fiscal years 2010, 2009 and... -

Page 119

... as it relates to a defined benefit plan for severed Black & Decker executives which is classified in Post-Retirement Benefits on the Consolidated Balance Sheet. Pre-2010 Actions: During 2009 and 2008 the Company initiated cost reduction actions in various businesses in response to sales volume... -

Page 120

... and markets hand tools, corded and cordless electric power tools and equipment, lawn and garden products, consumer portable power products, home products, accessories and attachments for power tools, plumbing products, consumer mechanics tools, storage systems, and pneumatic tools and fasteners... -

Page 121

......Corporate assets ...Consolidated ... Sales to the Home Depot were 14%, 14% and 13% of the CDIY segment net sales in 2010, 2009 and 2008, respectively, and 10% of the Security segment net sales in 2010. Sales to Lowes were 13% of the CDIY segment net sales and 10% of the Security segment net sales... -

Page 122

...year ended January 1, 2011 includes $81.0 million of charges pertaining primarily to certain merger-related executive compensation and Black & Decker integration costs. GEOGRAPHIC AREAS (Millions of Dollars) 2010 2009 2008 Net Sales United States...Canada ...Other Americas ...France ...Other Europe... -

Page 123

... of Black & Decker during the year. The valuation allowance is primarily attributable to foreign and state net operating loss carry forwards and a U.S. federal capital loss carry forward. The classification of deferred taxes as of January 1, 2011 and January 2, 2010 is as follows: 2010 Deferred... -

Page 124

...) 2010 2009 2008 United States...Foreign ...Earnings from continuing operations before income taxes ... $(182.7) 419.8 $237.1 $115.1 168.2 $283.3 $94.8 198.4 $293.2 Concurrent with the Merger, the Company has made a determination to repatriate $1,636.1 million of legacy Black & Decker foreign... -

Page 125

... the Internal Revenue Service as of January 1, 2011, tax years 2006 and 2007 are under current audit. For Stanley Black & Decker, Inc. tax years 2007 and forward remain subject to Internal Revenue Service examination. The Company also files many state and foreign income tax returns in jurisdictions... -

Page 126

... value guarantee. The fair value of that aircraft is estimated at $39.5 million. The Company provides product and service warranties which vary across its businesses. The types of warranties offered generally range from one year to limited lifetime, while certain products carry no warranty. 113 -

Page 127

... as new information becomes available. Following is a summary of the warranty liability activity for the years ended January 1, 2011, January 2, 2010 and January 3, 2009: (Millions of Dollars) 2010 2009 2008 Beginning balance ...Warranties and guarantees issued ...Liability assumed in the Merger... -

Page 128

... costs associated with the site may vary from the amount accrued by the Company at January 1, 2011. The EPA and the Santa Ana Regional Water Quality Control Board have each initiated administrative proceedings against Black & Decker and certain of its current or former affiliates alleging that... -

Page 129

...for sale in the Consolidated Balance Sheets at January 1, 2011 and January 2, 2010. U. PARENT AND SUBSIDIARY DEBT GUARANTEES The following information is presented in accordance with Rule 3-10 of Regulation S-X. In connection with the Merger, on March 12, 2010, Stanley Black & Decker, Inc. ("Stanley... -

Page 130

... for the years ended January 1, 2011, January 2, 2010 and January 3, 2009. The condensed consolidated financial statements for the year ended January 1, 2011 include the results of Black & Decker from the Merger date. The 2009 comparative condensed consolidating financial statements reflect only... -

Page 131

... Black & Decker, Inc. Condensed Consolidating Statement of Operations (Millions of Dollars) Year Ended January 1, 2011 Parent Stanley Black & Decker, Inc. The Black & Decker Corporation Non-Guarantor Subsidiaries Eliminations Consolidated NET SALES ...COSTS AND EXPENSES Cost of sales ...Selling... -

Page 132

Stanley Black & Decker, Inc. Condensed Consolidating Statement of Operations (Millions of Dollars) Year Ended January 2, 2010 Parent Stanley Black & Decker, Inc. Non-Guarantor Subsidiaries Eliminations Consolidated NET SALES ...COSTS AND EXPENSES Cost of sales ...Selling, general and administrative... -

Page 133

Stanley Black & Decker, Inc. Condensed Consolidating Statement of Operations (Millions of Dollars) Year Ended January 3, 2009 Parent Stanley Black & Decker, Inc. Non-Guarantor Subsidiaries Eliminations Consolidated NET SALES ...COSTS AND EXPENSES Cost of sales ...Selling, general and administrative... -

Page 134

... (Millions of Dollars) January 1, 2011 Parent Stanley Black & Decker, Inc. The Black & Decker Corporation NonGuarantor Subsidiaries Eliminations Consolidated ASSETS Current Assets Cash and cash equivalents...Accounts and notes receivable, net . . Inventories, net ...Other current assets ...Total... -

Page 135

...2010 Parent Stanley Black & Decker, Inc. Non-Guarantor Subsidiaries Eliminations Consolidated ASSETS Current Assets Cash and cash equivalents ...Accounts and notes receivable, net ...Inventories, net ...Other current assets ...Total Current Assets ...Property, Plant and Equipment, net...254.7 100.6 ... -

Page 136

Stanley Black & Decker, Inc. Condensed Consolidating Statements of Cash Flow (Millions of Dollars) Year Ended January 1, 2011 Parent The Black & Stanley Black & Decker Non-Guarantor Decker, Inc. Corporation Subsidiaries Eliminations Consolidated Cash (used in) provided by operating activities ...... -

Page 137

Stanley Black & Decker, Inc. Condensed Consolidating Statements of Cash Flow (Millions of Dollars) Year Ended January 2, 2010 Parent Stanley Black & Decker, Inc. Non-Guarantor Subsidiaries Eliminations Consolidated Cash (used in) provided by operating activities ...Investing Activities Capital ... -

Page 138

... Year Ended January 3, 2009 Parent Stanley Black & Decker, Inc. Non-Guarantor Subsidiaries Eliminations Consolidated Cash (used in) provided by operating activities ...Investing Activities Capital expenditures and capitalized software ...Business acquisitions and asset disposals ...Net investment... -

Page 139

... per common share . . 2009 Net sales ...Gross profit ...Selling, general and administrative expenses ...Net earnings from continuing operations ...Less: Earnings (loss) from non-controlling interest ...Net earnings from continuing operations attributable to Stanley Black & Decker, Inc...Net earnings... -

Page 140

...-tax gain from the repurchase of $103.0 million junior subordinated debt securities. In the fourth quarter of 2009, the Company recognized $19.3 million, or $0.22 per diluted share, in pre-tax transaction and integration planning charges primarily related to the pending Black & Decker merger. 127 -

Page 141

... (incorporated by reference to Exhibit 3(ii) to the Company's Current Report on Form 8-K filed on February 16, 2011). Indenture, dated as of June 26, 1998, by and among Black & Decker Holdings Inc., as Issuer, The Black & Decker Corporation, as Guarantor, and The First National Bank of Chicago, as... -

Page 142

... between The Black & Decker Corporation and The Bank of New York Mellon (formerly, The Bank of New York) as trustee (incorporated by reference to Exhibit 4.3 to the Company's Current Report on Form 8-K filed on March 12, 2010). Indenture, dated November 22, 2005, between The Stanley Works and HSBC... -

Page 143

...The Black & Decker Corporation, and The Bank of New York Mellon (formerly, The Bank of New York), as trustee (incorporated by reference to Exhibit 4.2 to the Company's Current Report on Form 8-K filed on March 12, 2010). Rights Agreement dated as of January 19, 2006, by and between The Stanley Works... -

Page 144

... Company's Current Report on Form 8-K filed on March 12, 2010). Amended and Restated Credit Agreement, dated as of February 27, 2008, by and among The Stanley Works, the lenders named therein, Citibank, N.A., as Administrative Agent, Citigroup Global Markets Inc. and Banc of America Securities LLC... -

Page 145

...Stanley's Management Incentive Plan amended and restated as of December 11, 2007 (incorporated by reference to Exhibit 10(ix) to the Company's Annual Report on Form 10-K for the year ended December 29, 2007).* Stanley Black & Decker Supplemental Retirement Account Plan (as in effect, January 1, 2011... -

Page 146

...Loan and the 1991 Hourly ESOP Loan and their related promissory notes (incorporated by reference to Exhibit 10(ii) to the Company's Quarterly Report on Form 10-Q for the quarter ended July 4, 1998). The Stanley Works Non-Employee Directors' Benefit Trust Agreement dated December 27, 1989 and amended... -

Page 147

... Company's Quarterly Report on Form 10-Q filed on May 13, 2010).* The Stanley Works Restricted Stock Unit Plan for Non-Employee Directors amended and restated as of December 11, 2007 (incorporated by reference to Exhibit 10(xx) to the Company's Annual Report on Form 10-K for the year ended December... -

Page 148

... 12, 2010)*. Form of Restricted Stock Unit Award Agreement relating to The Black & Decker Corporation 2008 Restricted Stock Plan (incorporated by reference to Exhibit 10(xii) to the Company's Quarterly Report on Form 10-Q filed on May 13, 2010)*. The Black & Decker Non-Employee Directors Stock Plan... -

Page 149

... of Ethics for CEO and Senior Financial Officers (incorporated by reference to the Company's website, www.stanleyblackanddecker.com. Subsidiaries of Registrant. Consent of Independent Registered Public Accounting Firm. Power of Attorney. Certification by Chief Executive Officer pursuant to Rule 13a... -

Page 150

(This page intentionally left blank.) -

Page 151

... OF EARNINGS TO FIXED CHARGES For the fiscal years ended January 1, 2011, January 2, 2010, January 3, 2009, December 29, 2007 and December 30, 2006 (Millions of Dollars) 2010 2009 Fiscal Year 2008 2007 2006 Earnings from continuing operations before income taxes and non-controlling interests Add... -

Page 152

... Black & Decker Investments LLC Bostitch Holding LLC CRC-Evans International, Inc. CRC-Evans International Holdings, Inc. CRC-Evans Pipeline International, Inc. CRC-Evans Weighting Systems, Inc. Delta International Machinery Corp. Devilbiss Air Power Company Embedded Technologies, LLC Emglo Products... -

Page 153

... Holdings, Inc. Stanley Israel Investments, Inc. Stanley Logistics, L.L.C. Stanley Security Solutions, Inc. Stanley Supply & Services, Inc. The Farmington River Power Company UNISPEC LLC Vector Products, Inc. Weiser Lock Corporation ZAG USA, Inc. International Subsidiaries Black & Decker... -

Page 154

... Black & Decker (Xiamen) Industrial Co. Ltd. Black & Decker Asia Based Enterprises China GMT Hardware Group Guangzhou Emhart Fastening System Co., Ltd. Qingdao Sungun Power Tool Co., Ltd. Shanghai Emhart Fastening Systems Ltd. Spiralock (Shanghai) Trading Co., Ltd. Stanley (Tianjin) International... -

Page 155

.... The Stanley Works (Langfang) Fastening Systems Co., Ltd. The Stanley Works (Shanghai) Co., Ltd. The Stanley Works (Shanghai) Management Co., Ltd. The Stanley Works (Zhejiang) Industrial Tools Co., Ltd. The Stanley Works (Zhongshan) tool Co., Ltd. Black & Decker de Colombia S.A. Black and Decker de... -

Page 156

... Stanley Black & Decker International Finance 4 Baltimore Financial Services Company Baltimore Insurance Limited Belco Investments Company Black & Decker (Ireland) Chesapeake Falls Holdings Company Gamrie Limited Stanley Security Solutions Ireland Limited The Stanley Works Israel Ltd. Black & Decker... -

Page 157

... Eigendomsrechten Blick Benelux B.V. TCS Group B.V. Teletechnicom Holding B.V. The Stanley Works C.V. Black & Decker (New Zealand) Limited Stanley Tools (NZ) Limited Black & Decker (Norge) A/S Emhart Sjong A/S PIH Services ME LLC Black & Decker de Panama, S.A. Malaysia Mexico Mexico Mexico Mexico... -

Page 158

... S.A. Scan Modul System AG Stanley Black & Decker Holding GmbH Stanley Black & Decker Sales GmbH Stanley Works (Europe) AG Besco Pneumatic Corporation Joinery Industrial Co., Ltd. Stanley Chiro International Ltd. Stanley Fastening Systems Investment (Taiwan) Co. Black & Decker (Thailand) Limited... -

Page 159

... Products U.K. Ltd. Masterfix UK Holdings Limited Mosley-Stone Limited PAC International Limited PIH Ltd. PIH Holdings Ltd. PIH Services Ltd. Pipeline Induction Heat Ltd. Scan Modul System Limited Spiralock of Europe Ltd. Stanley Black & Decker UK Holdings Limited Stanley Security Solutions - Europe... -

Page 160

CORPORATE NAME JURISDICTION OF INCORPORATION/ ORGANIZATION International Subsidiaries (continued) SWK (U.K.) Holding Limited SWK (UK) Limited The Stanley Works Limited Tucker Fasteners Limited United Kingdom United Kingdom United Kingdom United Kingdom -

Page 161

... and related prospectuses of Stanley Black & Decker, Inc. and subsidiaries (the "Company") of our reports dated February 18, 2011 with respect to the consolidated financial statements and schedule of the Company, and the effectiveness of internal control over financial reporting of the Company... -

Page 162

... indicated below, the Annual Report on Form 10-K for the year ended January 1, 2011 of the Corporation filed herewith (the "Form 10-K"), and any and all amendments thereof, and generally to do all such things in our name and on our behalf in our capacities as officers and directors to enable the... -

Page 163

... information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 18, 2011 /s/ John F. Lundgren John F. Lundgren President and Chief Executive Officer -

Page 164

... financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 18, 2011 /s/ Donald Allan Jr. Donald Allan Jr. Senior Vice President and Chief... -

Page 165

... connection with the Annual Report of Stanley Black & Decker, Inc. (the "Company") on Form 10-K for the period ending January 1, 2011 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, John F. Lundgren, President and Chief Executive Officer, certify, pursuant... -

Page 166

... with the Annual Report of Stanley Black & Decker, Inc. (the "Company") on Form 10-K for the period ending January 1, 2011 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Donald Allan Jr., Senior Vice President and Chief Financial Officer, certify, pursuant... -

Page 167

... and other Company information. • Meetings with securities analysts and fund managers. Contact the Stanley Black & Decker investor relations department at our corporate offices by calling Kate Vanek, Director, Investor Relations at (860) 827-3833 or by mail at 1000 Stanley Drive, new Britain, CT... -

Page 168