Best Buy 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Best Buy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.15

We may seek to expand or reposition our business in existing markets in order to attain a greater overall market share. Because

our stores typically draw customers from their local areas, a new store may draw customers away from our nearby existing

stores and may cause customer traffic and comparable store sales performance to decline at those existing stores.

We also open stores in new markets from time to time. The risks associated with entering a new market include difficulties in

attracting customers where there is a lack of customer familiarity with our brands, our lack of familiarity with local customer

preferences, seasonal differences in the market and our ability to obtain the necessary governmental approvals. In addition,

entry into new markets may bring us into competition with new competitors or with existing competitors with a large,

established market presence.

Our current growth strategy includes refocusing our investments on areas that we believe have the potential to meet our rate of

return expectations. We expect to continue the expansion of our small-format Best Buy Mobile stand-alone stores in the U.S.

and our Five Star branded stores in China. We cannot ensure that our new stores, regardless of brand, size, format or market,

will be profitably deployed. As a result, our future profitability may be materially adversely affected.

Additionally, in order to optimize the returns we realize from our property portfolio, we may vacate leased properties or modify

the terms of such leases prior to the termination of the lease. If we are unable to effectively negotiate such changes with the

landlords and/or find suitable subtenants, we may incur excessive lease costs associated with these actions.

The failure to control our costs could have a material adverse impact on our profitability.

Certain elements of our cost structure are largely fixed in nature. Consumer spending remains uncertain, which makes it more

challenging for us to maintain or increase our operating income. As a result, we must continue to control our expense structure.

Failure to manage our labor and benefit rates, advertising and marketing expenses, operating leases, other store expenses or

indirect spending could delay or prevent us from achieving profitability goals or otherwise have a material adverse impact on

our results of operations.

Our liquidity may be materially adversely affected by constraints in the capital markets.

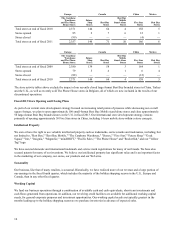

We must have sufficient sources of liquidity to fund our working capital requirements, service our outstanding indebtedness

and finance investment opportunities. Without sufficient liquidity, we could be forced to curtail our operations or we may not

be able to pursue promising business opportunities. The principal sources of our liquidity are funds generated from operating

activities, available cash and cash equivalents, and borrowings under credit facilities and other debt financings.

If our sources of liquidity do not satisfy our requirements, we may have to seek additional financing. The future availability of

financing will depend on a variety of factors, such as economic and market conditions, the availability of credit and our credit

ratings, as well as the possibility that lenders could develop a negative perception of us or the retail industry generally. If

required, we may not be able to obtain additional financing, on favorable terms, or at all.

Changes in our credit ratings may limit our access to capital markets and materially increase our borrowing costs.

In fiscal 2012, Moody's Investors Service, Inc. and Standard & Poor's Ratings Services maintained their corporate and debt

ratings at investment grade level with a stable outlook. Fitch Ratings Ltd. maintained its rating of our corporate and debt

securities at investment grade level but lowered it from BBB+ to BBB-, while raising its outlook to stable. Subsequent to the

end of fiscal 2012, Fitch Ratings Ltd. reaffirmed its corporate and debt rating, but revised its outlook to negative.

Future downgrades to our long-term credit ratings and outlook could negatively impact our access to the capital markets and

the perception of us by lenders and other third parties. Our credit ratings are based upon information furnished by us or

obtained by a rating agency from its own sources and are subject to revision, suspension or withdrawal by one or more rating

agencies at any time. Rating agencies may review the ratings assigned to us due to developments that are beyond our control,

including as a result of new standards requiring the agencies to re-assess rating practices and methodologies.

Any downgrade to our debt securities may result in higher interest costs for certain of our credit facilities and other debt

financings, and could result in higher interest costs on future financings. Further, in the event of such a downgrade, we may not

be able to obtain additional financing, if necessary, on favorable terms, or at all.