Berkshire Hathaway 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion (Continued)

Utilities and Energy (“MidAmerican”) (Continued)

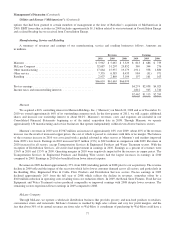

We hold an 89.8% ownership interest in MidAmerican Energy Holdings Company (“MidAmerican”), which operates an

international energy business. MidAmerican’s domestic regulated energy interests are comprised of two regulated utility

companies and two interstate natural gas pipeline companies. In the United Kingdom, MidAmerican operates two electricity

distribution businesses. The rates that our utilities and natural gas pipelines charge customers for energy and other services are

generally subject to regulatory approval. Rates are based in large part on the costs of business operations, including a return on

capital. To the extent we are not allowed to include such costs in the approved rates, operating results will be adversely affected.

In addition, MidAmerican also operates a diversified portfolio of independent power projects and the second-largest residential

real estate brokerage firm in the United States.

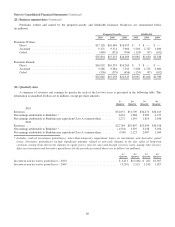

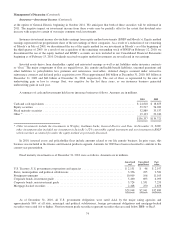

Our U.S. based regulated utilities businesses are conducted through PacifiCorp and MidAmerican Energy Company

(“MEC”). PacifiCorp’s revenues and earnings before corporate interest and taxes (“EBIT”) in 2010 were $4,518 million and

$783 million, respectively, relatively unchanged from 2009. Revenues in 2010 reflected lower average wholesale prices and a

decrease in wholesale sales volume of approximately 8%, offset by higher retail prices approved by regulators and higher

renewable energy credit sales. PacifiCorp’s EBIT reflected decreased prices of purchased electricity and natural gas and lower

natural gas volumes, offset by higher transmission costs from higher contract rates, higher volumes of purchased electricity and

higher coal prices. Revenues of MEC in 2010 increased $113 million (3%) over 2009, primarily due to higher volumes of

regulated and non-regulated electricity sales which are attributable to higher customer usage, impacted by weather conditions

and customer growth. MEC’s EBIT in 2010 was $279 million, a slight decrease compared to 2009, primarily due to higher

energy costs, operating expenses and depreciation and amortization. Energy costs increased due to higher coal prices and greater

thermal generation as a result of higher sales volume. Operating expenses increased due to higher maintenance costs from plant

outages and storm damages.

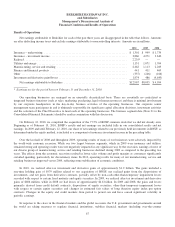

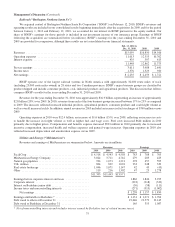

PacifiCorp’s revenues in 2009 of $4,543 million were relatively unchanged from 2008. Revenues in 2009 reflect an overall

decrease in sales volume (both wholesale and retail) of approximately 2% and lower wholesale prices, somewhat offset by

higher retail prices approved by regulators and higher renewable energy credit sales. PacifiCorp’s EBIT in 2009 of $788 million

increased $85 million (12%) over 2008, primarily due to lower volume and prices of energy purchased in response to lower

sales volumes and the use of lower-cost generation facilities put into service in the second half of 2008 and first quarter of 2009.

Revenues of MEC in 2009 declined $1,031 million (22%) from 2008, primarily due to lower regulated natural gas and

electricity sales. Regulated natural gas revenues decreased by $520 million in 2009, primarily due to a lower average per-unit

cost of gas sold, which is passed on to customers and a 5% decline in sales volume. MEC’s regulated electricity revenues

declined $315 million primarily as a result of a 35% decline in average wholesale prices and lower volumes, which were

attributable to reduced demand due to economic conditions as well as mild temperatures in 2009. MEC’s EBIT in 2009 declined

$140 million (33%) compared to 2008, primarily due to the lower regulated electricity revenues and increased depreciation due

to additions of new wind-power generation facilities, partially offset by lower costs of purchased electricity and natural gas.

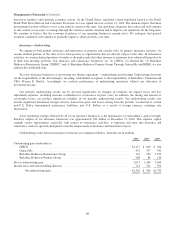

Our natural gas pipeline businesses are conducted through Northern Natural Gas and Kern River. Natural gas pipelines

revenues and EBIT each declined $79 million in 2010 from 2009. The declines were primarily due to lower transportation

volume resulting from less favorable economic conditions and lower natural gas price spreads. Natural gas pipelines revenues

and EBIT in 2009 declined $148 million and $138 million, respectively, from 2008 due primarily to lower volumes due to the

economic climate, lower price spreads and the effects of a favorable rate proceeding included in the results for 2008.

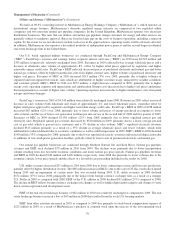

U.K. utility revenues decreased $25 million in 2010 from 2009 due to lower contracting revenue and lower gas production,

partially offset by higher distribution revenue. The $85 million increase in EBIT is due to the sale of CE Gas (Australia) Limited

during 2010 and an impairment of certain assets that was recorded during 2009. U.K. utility revenues in 2009 declined

$172 million (17%) versus 2008, principally due to the impact from foreign currency exchange rates as a result of a stronger

U.S. Dollar in 2009 as compared with 2008. EBIT of the U.K. utilities in 2009 declined $91 million (27%) compared to 2008.

The decline in EBIT reflects foreign currency exchange rate changes as well as higher depreciation expense and charges to write

down certain exploration and development assets.

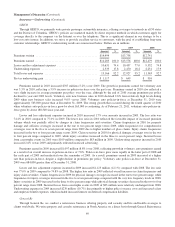

EBIT of the real estate brokerage business of $42 million in 2010 was relatively unchanged as compared to 2009. The real

estate brokerage business incurred a loss of $45 million in 2008 that resulted from the weak U.S. housing markets.

EBIT from other activities increased in 2010 as compared to 2009 due primarily to stock-based compensation expense of

$125 million in 2009, as a result of MidAmerican’s purchase of common stock upon the exercise of the last remaining stock

76