Berkshire Hathaway 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Don’t let that reality spook you. Throughout my lifetime, politicians and pundits have constantly

moaned about terrifying problems facing America. Yet our citizens now live an astonishing six times better than

when I was born. The prophets of doom have overlooked the all-important factor that is certain: Human potential

is far from exhausted, and the American system for unleashing that potential – a system that has worked wonders

for over two centuries despite frequent interruptions for recessions and even a Civil War – remains alive and

effective.

We are not natively smarter than we were when our country was founded nor do we work harder. But

look around you and see a world beyond the dreams of any colonial citizen. Now, as in 1776, 1861, 1932 and

1941, America’s best days lie ahead.

Performance

Charlie and I believe that those entrusted with handling the funds of others should establish

performance goals at the onset of their stewardship. Lacking such standards, managements are tempted to shoot

the arrow of performance and then paint the bull’s-eye around wherever it lands.

In Berkshire’s case, we long ago told you that our job is to increase per-share intrinsic value at a rate

greater than the increase (including dividends) of the S&P 500. In some years we succeed; in others we fail. But,

if we are unable over time to reach that goal, we have done nothing for our investors, who by themselves could

have realized an equal or better result by owning an index fund.

The challenge, of course, is the calculation of intrinsic value. Present that task to Charlie and me

separately, and you will get two different answers. Precision just isn’t possible.

To eliminate subjectivity, we therefore use an understated proxy for intrinsic-value – book value –

when measuring our performance. To be sure, some of our businesses are worth far more than their carrying

value on our books. (Later in this report, we’ll present a case study.) But since that premium seldom swings

wildly from year to year, book value can serve as a reasonable device for tracking how we are doing.

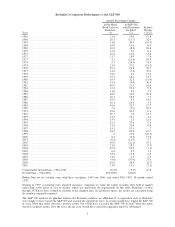

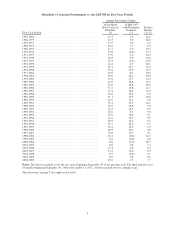

The table on page 2 shows our 46-year record against the S&P, a performance quite good in the earlier

years and now only satisfactory. The bountiful years, we want to emphasize, will never return. The huge sums of

capital we currently manage eliminate any chance of exceptional performance. We will strive, however, for

better-than-average results and feel it fair for you to hold us to that standard.

Yearly figures, it should be noted, are neither to be ignored nor viewed as all-important. The pace of

the earth’s movement around the sun is not synchronized with the time required for either investment ideas or

operating decisions to bear fruit. At GEICO, for example, we enthusiastically spent $900 million last year on

advertising to obtain policyholders who deliver us no immediate profits. If we could spend twice that amount

productively, we would happily do so though short-term results would be further penalized. Many large

investments at our railroad and utility operations are also made with an eye to payoffs well down the road.

To provide you a longer-term perspective on performance, we present on the facing page the yearly

figures from page 2 recast into a series of five-year periods. Overall, there are 42 of these periods, and they tell

an interesting story. On a comparative basis, our best years ended in the early 1980s. The market’s golden period,

however, came in the 17 following years, with Berkshire achieving stellar absolute returns even as our relative

advantage narrowed.

After 1999, the market stalled (or have you already noticed that?). Consequently, the satisfactory

performance relative to the S&P that Berkshire has achieved since then has delivered only moderate absolute

results.

Looking forward, we hope to average several points better than the S&P – though that result is, of

course, far from a sure thing. If we succeed in that aim, we will almost certainly produce better relative results in

bad years for the stock market and suffer poorer results in strong markets.

4