Berkshire Hathaway 2003 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

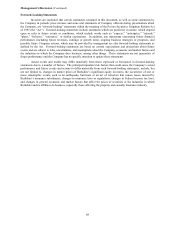

Management’s Discussion (Continued)

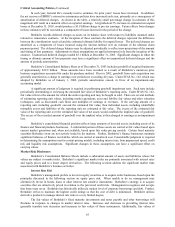

Realized Investment Gains (Continued)

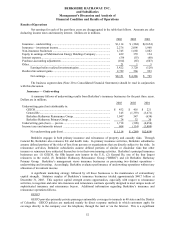

The Consolidated Statements of Earnings include after-tax realized investment gains of $2,729 million in

2003, $566 million in 2002 and $923 million in 2001. These gains were net of after-tax losses of $188 million in

2003, $373 million in 2002 and $161 million in 2001 related to “other-than-temporary” impairments. Management

evaluates investments for impairment as of each balance sheet date. Factors considered in determining whether an

impairment charge is warranted include the length of time the unrealized loss has existed, the financial condition of

the investee, future business prospects and creditworthiness of the investee, and Berkshire’ s ability and intent to

hold the investment until the value recovers. When an impairment charge is recorded, the cost of the investment is

written down to fair value through a charge to earnings. Consequently, impairment charges from essentially all of

Berkshire’ s “other-than-temporarily” impaired investments produced little effect on total shareholders’ equity

because these investments were already carried at fair value with the difference between fair value and cost included

in shareholders’ equity as a component of accumulated other comprehensive income.

After-tax realized gains also included $536 million in 2003 and $193 million in 2002 of realized and

unrealized gains on foreign currency forward contracts entered into during the last two years. After-tax unrealized

gains included in earnings with respect to open contracts totaled $414 million as of December 31, 2003 and $193

million at December 31, 2002. The gains in each year were due primarily to the decline in the value of the U.S.

dollar against certain foreign currencies.

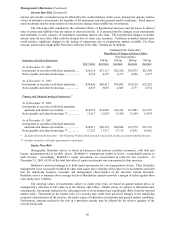

Financial Condition

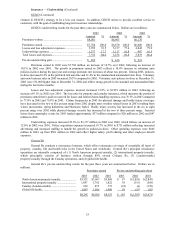

Berkshire’ s balance sheet continues to reflect significant liquidity and a strong capital base. Consolidated

shareholders’ equity at December 31, 2003 totaled $77.6 billion. Consolidated cash and invested assets, excluding

assets of finance and financial products businesses, totaled approximately $95.6 billion at December 31, 2003,

(including $31.3 billion in cash and cash equivalents) and totaled $80.5 billion at December 31, 2002. During 2003,

the market prices of Berkshire’ s holdings in equity and fixed maturity securities increased significantly and cash

flow generated from operations was about $8.2 billion. During 2003, Berkshire deployed about $3.2 billion in

internally generated cash for business acquisitions and during the preceding two years, cash of $7.3 billion was

utilized in business acquisitions, and $1.7 billion was utilized for additional investments in MidAmerican.

Berkshire’ s consolidated notes payable and other borrowings, excluding borrowings of finance businesses,

totaled $4.2 billion at December 31, 2003 and $4.8 billion at December 31, 2002. During 2003, commercial paper

and short-term borrowings of subsidiaries declined $642 million from prepayments arising from strong operating

cash flow at Shaw and utilization of excess cash by General Re. Other borrowings consist primarily of debt of

subsidiaries and investment contracts issued by Berkshire.

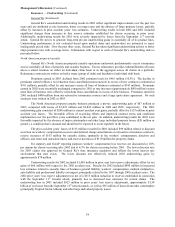

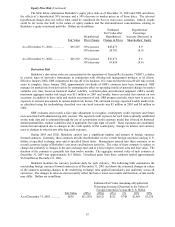

In May 2002, Berkshire issued the SQUARZ securities, which consist of $400 million par amount of senior

notes due in November 2007 together with warrants to purchase 4,464 Class A equivalent shares of Berkshire

common stock, which expire in May 2007. A warrant premium is payable to Berkshire at an annual rate of 3.75%

and interest is payable to note holders at a rate of 3.00%. Each warrant provides the holder the right to purchase

either 0.1116 shares of Class A or 3.348 shares of Class B stock for $10,000. In addition, holders of the senior

notes have the option to require Berkshire to repurchase the senior notes at par annually each May 15 from 2004

through 2006, provided that the holders also surrender a corresponding amount of warrants for cancellation. All

warrants and senior notes were outstanding as of December 31, 2003.

Assets of the finance and financial products businesses totaled $28.3 billion at December 31, 2003 and

$34.1 billion at December 31, 2002. The overall decline reflects a $6 billion decline in assets of BH Finance as a

result of the liquidation of certain fixed income investments, FINOVA loan prepayments totaling $1.65 billion and a

decline in assets of GRS, which is in run-off. The outstanding loan to FINOVA as of December 31, 2003 and

corresponding borrowing from Fleet (each $525 million) were fully repaid in February 2004.

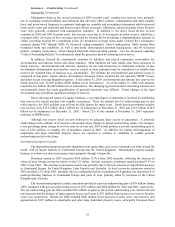

As of December 31, 2003, finance assets included approximately $3.8 billion in assets of Clayton, which

was acquired by Berkshire in August 2003. Clayton is a leading builder of manufactured housing, provides

financing and services loans to customers, and acquires other installment loan portfolios. Prior to its acquisition,

Clayton securitized and sold a significant portion of its installment loans through special purpose entities. In early

2003, Clayton discontinued loan securitizations and sales. Since being acquired by Berkshire, Clayton retained loan

portfolios have increased by about $1.3 billion. Loan portfolios are expected to continue to grow over time.

Notes payable and other borrowings of Berkshire’ s finance and financial products businesses totaled $4.9

billion at December 31, 2003 and $4.5 billion at December 31, 2002. During the last four months of 2003,

Berkshire Hathaway Finance Corporation issued a total of $2.0 billion par amount of medium term notes due from