Berkshire Hathaway 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

Notes to Consolidated Financial Statements (Continued)

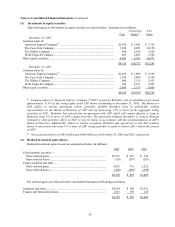

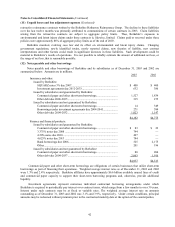

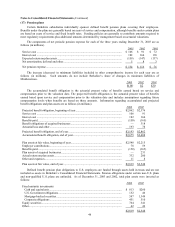

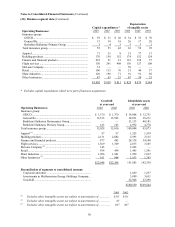

(19) Supplemental cash flow information

A summary of supplemental cash flow information for each of the three years ending December 31, 2003 is

presented in the following table (in millions). 2003 2002 2001

Cash paid during the year for:

Income taxes.................................................................................................................. $3,309 $1,945 $ 905

Interest of finance and financial products businesses.................................................... 372 509 726

Interest of insurance and other businesses..................................................................... 215 207 221

Non-cash investing and financing activities:

Liabilities assumed in connection with acquisitions of businesses................................ 2,167 700 3,507

Common shares issued in connection with acquisitions of businesses.......................... —324 —

Securities sold (purchased) offset by decrease (increase) in repurchase agreements .... 5,936 6,666 (6,731)

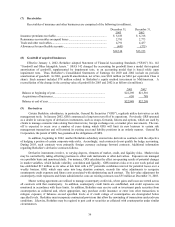

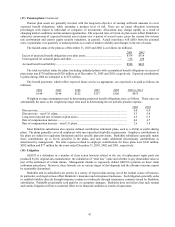

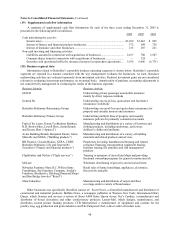

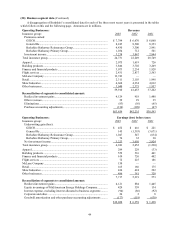

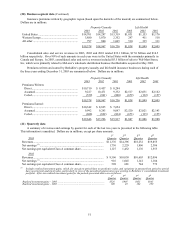

(20) Business segment data

Information related to Berkshire’ s reportable business operating segments is shown below. Berkshire’ s reportable

segments are reported in a manner consistent with the way management evaluates the businesses. As such, insurance

underwriting activities are evaluated separately from investment activities. Realized investment gains are not considered

relevant in evaluating investment performance on an annual basis. Amortization of purchase accounting adjustments is

not considered by management in evaluating the results of the business segments.

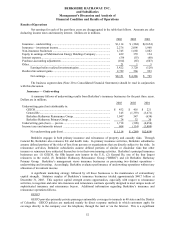

Business Identity Business Activity

GEICO Underwriting private passenger automobile insurance

mainly by direct response methods

General Re Underwriting excess-of-loss, quota-share and facultative

reinsurance worldwide

Berkshire Hathaway Reinsurance Group Underwriting excess-of-loss and quota-share reinsurance for

property and casualty insurers and reinsurers

Berkshire Hathaway Primary Group Underwriting multiple lines of property and casualty

insurance policies for primarily commercial accounts

Fruit of the Loom, Garan, Fechheimer Brothers,

H.H. Brown Shoe, Lowell Shoe, Justin Brands

and Dexter Shoe (“Apparel”)

Manufacturing and distribution of a variety of footwear and

clothing products, including underwear, activewear,

children’ s clothes and uniforms

Acme Building Brands, Benjamin Moore, Johns

Manville and MiTek (“Building products”)

Manufacturing and distribution of a variety of building

materials and related products and services

BH Finance, Clayton Homes, XTRA, CORT,

Berkshire Hathaway Life and General Re

Securities (“Finance and financial products”)

Proprietary investing, manufactured housing and related

consumer financing, transportation equipment leasing,

furniture leasing, life annuities and risk management

products

FlightSafety and NetJets (“Flight services”) Training to operators of aircraft and ships and providing

fractional ownership programs for general aviation aircraft

McLane Wholesale distributing of groceries and non-food items

Nebraska Furniture Mart, R.C. Willey Home

Furnishings, Star Furniture Company, Jordan’ s

Furniture, Borsheim’ s, Helzberg Diamond Shops

and Ben Bridge Jeweler (“Retail”)

Retail sales of home furnishings, appliances, electronics,

fine jewelry and gifts

Shaw Industries Manufacturing and distribution of carpet and floor

coverings under a variety of brand names

Other businesses not specifically identified consist of: Scott Fetzer, a diversified manufacturer and distributor of

commercial and industrial products; Buffalo News, a newspaper publisher in Western New York; International Dairy

Queen, which licenses and services a system of about 6,000 Dairy Queen stores; See’ s Candies, a manufacturer and

distributor of boxed chocolates and other confectionery products; Larson-Juhl, which designs, manufactures, and

distributes custom picture framing products; CTB International, a manufacturer of equipment and systems for the

poultry, hog, egg production and grain industries and The Pampered Chef, a direct seller of kitchen tools.