Berkshire Hathaway 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

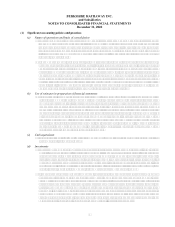

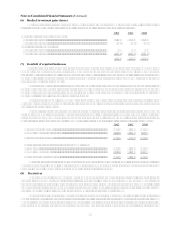

(1) Significant accounting policies and practices (Continued)

(p) Accounting pronouncements to become effective subsequent to December 31, 2002 (Continued)

In January 2003, the FASB issued FIN No. 46, Consolidation of Variable Interest Entities, which

addresses the consolidation of certain entities (variable interest entity) when control exists through

other than voting interests. FIN 46 requires that a variable interest entity be consolidated by the holder

of the majority of the risks and rewards associated with the activities of the variable interest entity. FIN

46 is effective immediately for variable interest entities created after January 31, 2003. For variable

interest entities created prior to February 1, 2003, FIN 46 is effective for the first interim period

beginning after June 15, 2003, and may be applied retroactively or prospectively. Berkshire has not

completed its assessment of FIN 46. However, based on a preliminary review, Berkshire believes that

its investment in Value Capital L.P., currently accounted for under the equity method, will be subject to

consolidation in accordance with the guidelines established by FIN 46 (see Note 9).

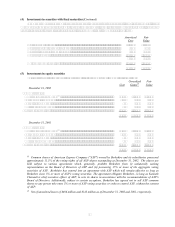

(2) Significant business acquisitions

Berkshires long-held acquisition strategy is to purchase businesses with consistent earning power, good returns on

equity, able and honest management and at sensible prices. Businesses with these characteristics typically have market

values that exceed net asset value, thus producing goodwill for accounting purposes.

During 2002, Berkshire completed five business acquisitions for cash consideration of approximately $2.3 billion

in the aggregate. Information concerning these acquisitions follows.

Albecca Inc. (Albecca)

On February 8, 2002, Berkshire acquired all of the outstanding shares of Albecca. Albecca designs, manufactures

and distributes a complete line of high-quality custom picture framing products primarily under the Larson-Juhl name.

Fruit of the Loom (FOL)

On April 30, 2002, Berkshire acquired the basic apparel business of Fruit of the Loom, LTD. FOL is a leading

vertically integrated basic apparel company manufacturing and marketing underwear, activewear, casualwear and

childrenswear. FOL operates on a worldwide basis and sells its products principally in North America under the Fruit

of the Loom and BVD brand names.

Garan, Incorporated (Garan)

On September 4, 2002, Berkshire acquired all of the outstanding common stock of Garan. Garan is a leading

manufacturer of childrens, womens, and mens apparel bearing the private labels of its customers as well as several of

its own trademarks, including GARANIMALS.

CTB International (CTB)

On October 31, 2002, Berkshire acquired all of the outstanding shares of CTB, a manufacturer of equipment and

systems for the poultry, hog, egg production and grain industries.

The Pampered Chef, LTD (The Pampered Chef)

On October 31, 2002, Berkshire acquired The Pampered Chef, LTD. The Pampered Chef is the largest branded

kitchenware company and the largest direct seller of housewares in the U.S.

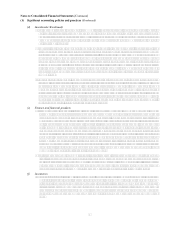

In addition, Berkshire completed four business acquisitions during 2001. Information concerning these

acquisitions follows.

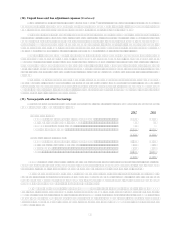

Shaw Industries, Inc. (Shaw)

On January 8, 2001, Berkshire acquired approximately 87.3% of the common stock of Shaw for $19 per share, or

$2.1 billion in total. Robert E. Shaw, Chairman and CEO of Shaw, Julian D. Saul, President of Shaw, certain family

members and related family interests of Messrs. Shaw and Saul, and certain other Shaw directors and members of

management acquired the remaining 12.7% interest. In January 2002, Berkshire acquired the remaining shares in

exchange for 4,505 shares of Berkshire Class A common stock and 7,063 shares of Class B common stock. The

aggregate market value of Berkshire stock issued was approximately $324 million.

Shaw is the world's largest manufacturer of tufted broadloom carpet and rugs for residential and commercial

applications throughout the U.S. Shaw markets its residential and commercial products under a variety of brand names.

Johns Manville Corporation (Johns Manville)

On February 27, 2001, Berkshire acquired all of the outstanding shares of Johns Manville for $13 per share, or

$1.8 billion in total. Johns Manville is a leading manufacturer of insulation and building products. Johns Manville

manufactures and markets products for building and equipment insulation, commercial and industrial roofing systems,

high-efficiency filtration media, and fibers and non-woven mats used as reinforcements in building and industrial

applications.