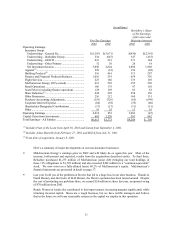

Berkshire Hathaway 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.13

This category also includes a highly satisfactory – but rapidly diminishing – income stream from our

Berkadia investment in Finova (described in last year’ s report). Our partner, Leucadia National

Corp., has managed this operation with great skill, willingly doing far more than its share of the

heavy lifting. I like this division of labor and hope to join with Leucadia in future transactions.

On the minus side, the Finance line also includes the operations of General Re Securities, a

derivatives and trading business. This entity lost $173 million pre-tax last year, a result that, in part,

is a belated acknowledgment of faulty, albeit standard, accounting it used in earlier periods.

Derivatives, in fact, deserve an extensive look, both in respect to the accounting their users employ

and to the problems they may pose for both individual companies and our economy.

Derivatives

Charlie and I are of one mind in how we feel about derivatives and the trading activities that go with

them: We view them as time bombs, both for the parties that deal in them and the economic system.

Having delivered that thought, which I’ ll get back to, let me retreat to explaining derivatives, though

the explanation must be general because the word covers an extraordinarily wide range of financial contracts.

Essentially, these instruments call for money to change hands at some future date, with the amount to be

determined by one or more reference items, such as interest rates, stock prices or currency values. If, for

example, you are either long or short an S&P 500 futures contract, you are a party to a very simple derivatives

transaction – with your gain or loss derived from movements in the index. Derivatives contracts are of

varying duration (running sometimes to 20 or more years) and their value is often tied to several variables.

Unless derivatives contracts are collateralized or guaranteed, their ultimate value also depends on the

creditworthiness of the counterparties to them. In the meantime, though, before a contract is settled, the

counterparties record profits and losses – often huge in amount – in their current earnings statements without

so much as a penny changing hands.

The range of derivatives contracts is limited only by the imagination of man (or sometimes, so it

seems, madmen). At Enron, for example, newsprint and broadband derivatives, due to be settled many years

in the future, were put on the books. Or say you want to write a contract speculating on the number of twins

to be born in Nebraska in 2020. No problem – at a price, you will easily find an obliging counterparty.

When we purchased Gen Re, it came with General Re Securities, a derivatives dealer that Charlie

and I didn’ t want, judging it to be dangerous. We failed in our attempts to sell the operation, however, and

are now terminating it.

But closing down a derivatives business is easier said than done. It will be a great many years before

we are totally out of this operation (though we reduce our exposure daily). In fact, the reinsurance and

derivatives businesses are similar: Like Hell, both are easy to enter and almost impossible to exit. In either

industry, once you write a contract – which may require a large payment decades later – you are usually stuck

with it. True, there are methods by which the risk can be laid off with others. But most strategies of that kind

leave you with residual liability.

Another commonality of reinsurance and derivatives is that both generate reported earnings that are

often wildly overstated. That’ s true because today’ s earnings are in a significant way based on estimates

whose inaccuracy may not be exposed for many years.

Errors will usually be honest, reflecting only the human tendency to take an optimistic view of one’ s

commitments. But the parties to derivatives also have enormous incentives to cheat in accounting for them.

Those who trade derivatives are usually paid (in whole or part) on “earnings” calculated by mark-to-market

accounting. But often there is no real market (think about our contract involving twins) and “mark-to-model”

is utilized. This substitution can bring on large-scale mischief. As a general rule, contracts involving

multiple reference items and distant settlement dates increase the opportunities for counterparties to use

fanciful assumptions. In the twins scenario, for example, the two parties to the contract might well use

differing models allowing both to show substantial profits for many years. In extreme cases, mark-to-model

degenerates into what I would call mark-to-myth.

Of course, both internal and outside auditors review the numbers, but that’ s no easy job. For

example, General Re Securities at yearend (after ten months of winding down its operation) had 14,384