Berkshire Hathaway 1998 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 1998 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

Management's Discussion (Continued)

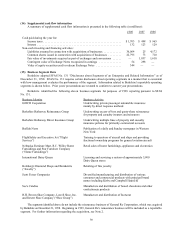

Non-Insurance Business Segments (continued)

1998 compared to 1997 (continued)

Scott Fetzer Companies (continued)

The increase in revenues was primarily due to increases at Campbell Hausfeld somewhat offset by lower World Book

revenues. Operating profits of $137 million increased $18 million (15.1%) from the prior year. Increased sales at

Campbell Hausfeld along with improved results from World Book’s international businesses account for a significant

portion of the improved results.

See’s Candies

See’s revenues increased $19 million (7.1%) over comparable prior year amounts. Total pounds of candy sold

increased about 3.3% with 3% to 4% increases being achieved both in See’s quantity order business as well as its retail

stores. Operating profits increased $3 million (5.1%) as compared to the prior year.

Shoes

This segment includes H. H. Brown Shoe Company, Inc., Lowell Shoe, Inc. and Dexter Shoe Companies.

These businesses manufacture and distribute work, dress, casual and athletic footwear. In addition, over 100 retail

shoe stores are included in this segment. Revenues for this segment decreased by $42 million (7.7%) in 1998 as

compared to 1997. Operating profits of $33 million in 1998 decreased $16 million (32.7%) from the prior year. The

unfavorable results represent a continuation of a trend which began three years ago. Manufacturers such as Brown,

Lowell and Dexter are facing reduced demand for their products. Additionally, major retailers are offering promotions

to generate sales which is resulting in an ongoing margin squeeze. Management of these businesses is working to

align production activity to the reduced sales levels.

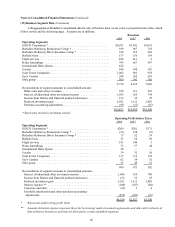

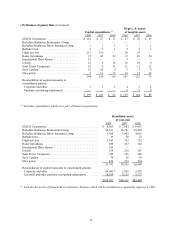

1997 compared to 1996

Revenues from the non-insurance business segments increased $516 million (17.9%) in 1997 as compared

to 1996. Operating profits of $512 million during 1997 increased $152 million (42.2%) from the comparable 1996

amount. The most significant factor which gave rise to the increase in both revenues and operating profits was the

acquisition of FlightSafety at the end of 1996. With the exception of the shoe group, all other reportable segments

reported excellent results in 1997 as compared to 1996.

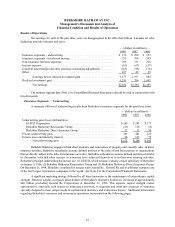

Realized Investment Gain

Realized investment gain has been a recurring element in Berkshire's net earnings for many years. The

amount — recorded when investments are sold, other-than-temporarily impaired or in certain situations, as required

by GAAP, when investments are marked-to-market with the corresponding gain or loss included in earnings — may

fluctuate significantly from period to period, with a meaningful effect upon Berkshire's consolidated net earnings.

However, the amount of realized investment gain or loss for any given period has no predictive value, and variations

in amount from period to period have no practical analytical value, particularly in view of the net unrealized price

appreciation now existing in Berkshire's consolidated investment portfolio.

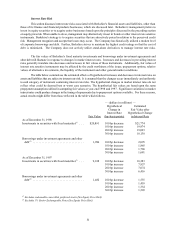

The Consolidated Statement of Earnings for 1997 reflects a pre-tax realized investment gain of $1.1 billion

($704 million after-tax). A significant portion ($678 million pre-tax) of this gain resulted from Travelers Group Inc.'s

acquisition of Salomon Inc. The Consolidated Statement of Earnings for 1996 reflects a pre-tax realized investment

gain of $2.5 billion ($1.6 billion after-tax). Most of this gain resulted from The Walt Disney Company's acquisition

of Capital Cities/ABC, Inc. See Note 5 to Consolidated Financial Statements for additional details regarding these

transactions.

While the effects of these transactions are material to the Consolidated Statements of Earnings, the completion

of these acquisitions had a minimal impact on Berkshire's shareholders' equity. This is due to the fact that Berkshire's

investments in Salomon Inc and Capital Cities had been carried in prior periods' consolidated financial statements at

market value with unrealized gains, net of tax, reported as a separate component of shareholders' equity.