Baskin Robbins 2011 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2011 Baskin Robbins annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

five popular Dunkin’ Donuts flavors, including Original Blend, Dunkin’ Decaf, French Vanilla, Hazelnut and

Dunkin’ Dark®. In addition, participating Dunkin’ Donuts restaurants offer, on occasion, Keurig Single-Cup

Brewers for sale. We believe this alliance is a significant long-term growth opportunity that will generate

incremental sales and profits for our Dunkin’ Donuts franchisees. We believe there has been no significant

cannibalization of our other coffee business to date from the sale of K-Cups.

Extend leadership in breakfast daypart while growing afternoon daypart. As we maintain and grow our

current leading market position in the breakfast daypart through innovative bakery and breakfast sandwich

products like the Big N’ ToastedTM and the Wake-Up Wrap®, we plan to expand Dunkin’ Donuts’ position in the

afternoon daypart (between 2:00 p.m. and 5:00 p.m.), which currently represents only approximately 12% of our

franchisee-reported sales. We believe that our extensive coffee- and beverage-based menu, coupled with new

“hearty snack” introductions, such as bakery sandwiches and tuna and chicken salad sandwiches, positions us for

further growth in this daypart. We believe this will require minimal additional capital investment by our

franchisees.

Continue to develop enhancements in restaurant operations. We will continue to maintain a highly

operations-focused culture to help our franchisees maximize the quality and consistency of their customers’

in-store experience, as well as to increase franchisee profitability. In support of this, we have enhanced initial and

ongoing restaurant manager and crew training programs and developed new in-store planning and tracking

technology tools to assist our franchisees. As evidence of our recent success in these areas, over 164,000

respondents, representing approximately 93% of all respondents, to our Guest Satisfaction Survey program in

December 2011 rated their overall experience as “Satisfied” or “Highly Satisfied.”

Continue Dunkin’ Donuts U.S. contiguous store expansion

We believe there is a significant opportunity to grow our points of distribution for Dunkin’ Donuts in the U.S.

given the strong potential outside of the Northeast region to increase our per-capita penetration to levels closer to

those in our core markets. Our development strategy resulted in 243 net new U.S. store openings in fiscal 2011.

In 2012, we expect our franchisees to open an additional 260 to 280 net new points of distribution in the U.S.,

principally in existing developed markets. We believe that our strategy of focusing on contiguous growth has the

potential to, over approximately the next 20 years, more than double our current U.S. footprint and reach a total

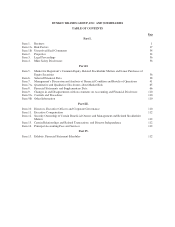

of 15,000 points of distribution in the U.S. The following table details our per-capita penetration levels in our

U.S. regions.

Region Population (in millions) Stores1Penetration

Core .................................................. 36.0 3,768 1:9,560

Eastern Established. ...................................... 53.8 2,227 1:24,160

Eastern Emerging ........................................ 88.7 891 1:99,600

West .................................................. 130.0 129 1:1,008,100

1As of December 31, 2011

Increase penetration in existing markets. In our traditional core markets of New England and New York, we

now have one Dunkin’ Donuts store for every 9,560 people. In the near term, we intend to focus our development

on other markets east of the Mississippi River, where we currently have only approximately one Dunkin’ Donuts

store for every 99,600 people. In certain established Eastern U.S. markets outside of our core markets, such as

Philadelphia, Chicago and South Florida, we have already achieved per-capita penetration of greater than one

Dunkin’ Donuts store for every 24,160 people.

Expand into new markets using a disciplined approach. We believe that the Western part of the U.S.

represents a significant growth opportunity for Dunkin’ Donuts. However, we believe that a disciplined approach

to development is the best one for our brand and franchisees. Specifically, in the near term, we intend to focus on

-4-