Barnes and Noble 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

Table of contents

-

Page 1

-

Page 2

-

Page 3

... Balance Sheets Consolidated Statements of Changes in Shareholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm Reports of Management Shareholder Information Corporate Information Barnes & Noble...

-

Page 4

... to $115 million, including a $22 million investment in Yuzuâ„¢, our new digital education platform. College opened 30 new stores, and we see a strong pipeline ahead. The number of new and used titles available for rent increased signiï¬cantly, driving textbook rental growth of 61% for the year...

-

Page 5

... the best reading experience in the marketplace. In June 2012, Barnes & Noble's Board of Directors authorized management to separate Barnes & Noble's Retail and NOOK Mediaâ„¢ businesses into two separate public companies. We believe these businesses will have the best opportunity to optimize...

-

Page 6

...2012 and April 27, 2013 are derived from, and are incorporated by reference to, audited consolidated ï¬nancial statements which are included elsewhere in this report. The Statement of Operations Data for the 52 weeks ended April 30, 2011 (ï¬scal 2011), May 1, 2010 (ï¬scal 2010), the Balance Sheet...

-

Page 7

... Report

5

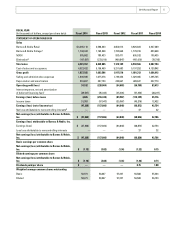

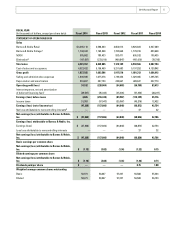

FISCAL YEAR

(In thousands of dollars, except per share data)

STATEMENT OF OPERATIONS DATA

Fiscal 2014

Fiscal 2013

Fiscal 2012

Fiscal 2011

Fiscal 2010

Sales Barnes & Noble Retail Barnes & Noble Collegea NOOK Eliminationb Total sales Cost of sales and occupancy Gross proï¬t Selling...

-

Page 8

...

Fiscal 2014

Fiscal 2013

Fiscal 2012

Fiscal 2011

Fiscal 2010

Number of stores Barnes & Noble stores Barnes & Noble College Total Comparable sales increase (decrease) Barnes & Noble Retaile Barnes & Noble Retail Core comparable salesf Barnes & Noble Collegeg Capital expenditures

BALANCE SHEET...

-

Page 9

... customers a full suite of textbook options-new, used, digital and rental. To address dynamic changes in the book selling industry, Barnes & Noble has transformed its business from a storebased model to a multi-channel model centered on its retail stores, Internet and digital commerce. The Company...

-

Page 10

8

Barnes & Noble, Inc.

MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued

The Company has a multi-channel marketing strategy that deploys various merchandising programs and promotional activities to drive traffic to both its stores and website. At ...

-

Page 11

... to be customized and co-branded by NOOK Media Sub. Such devices will be produced by Samsung. The co-branded NOOK tablet devices may be sold by NOOK Media through Barnes & Noble retail stores, www.barnesandnoble.com, www.nook.com and other Barnes & Noble and NOOK Media websites. NOOK Media Sub...

-

Page 12

... and course-related materials, emblematic apparel and gifts, trade books, computer products, NOOK® products and related accessories, school and dorm supplies, convenience and café items. B&N College provides extensive textbook rental options to its customers and has expanded its digital textbooks...

-

Page 13

... time, it will continue to leverage all Barnes & Noble retail, digital and partnership assets, as well as existing NOOK customer relationships. The Company intends to continue to provide the resources necessary for quality customer service and support sales of new devices and those in use by NOOK...

-

Page 14

... & Noble stores Barnes & Noble College stores Total

SQUARE FEET OF SELLING SPACE AT YEAR END (in millions)

Barnes & Noble stores

a Comparable store sales increase (decrease) is calculated on a 52-week basis, including sales from stores that have been open for at least 15 months and all eReader...

-

Page 15

... services: bookstore management, textbook rental and digital delivery. The Company is making further investments in its college business, including its most recent launch of Yuzuâ„¢. The Company believes higher education provides a long-term growth opportunity. NOOK represents the Company's digital...

-

Page 16

..., trade book and college bookstores businesses with its electronic and Internet offerings, using retail stores in attractive geographic markets to promote and sell digital devices and content. Customers can see, feel and experiment with NOOK® products in the Company's stores. Although the stores...

-

Page 17

... College on a sell through basis. The decrease versus prior year was due to the lower device sales at B&N Retail. NOOK sales, net of this elimination, accounted for 5.3% of total Company sales.

In ï¬scal 2012, the Company opened three and closed 17 Barnes & Noble stores, bringing its total number...

-

Page 18

16

Barnes & Noble, Inc.

MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued

• NOOK cost of sales and occupancy decreased as a percentage of sales to 83.7% in ï¬scal 2012 from 115.7% in ï¬scal 2013. During ï¬scal 2013, the Company recorded $222.2 ...

-

Page 19

...set by R&D tax credits, state loss carryforwards and changes to unrecognized tax beneï¬ts.

The following table summarizes the Company's sales for the 52 weeks ended April 27, 2013 and April 28, 2012:

52 weeks ended Dollars in thousands B&N Retail B&N College NOOK Elimination Total Sales April 27...

-

Page 20

...by higher content sales. Digital content sales increased 16.2% during the 52 weeks ended April 27, 2013. • The elimination represents sales from NOOK to B&N Retail and B&N College on a sell through basis. • In ï¬scal 2013, the Company opened two and closed 18 Barnes & Noble stores, bringing its...

-

Page 21

... expenses. • B&N College selling and administrative expenses increased as a percentage of sales to 16.7% in ï¬scal 2013 from 16.0% in ï¬scal 2012. This increase was due to new stores and increased expenses for digital higher education initiatives. • NOOK selling and administrative expenses...

-

Page 22

20

Barnes & Noble, Inc.

MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued

Income Taxes

52 weeks ended Dollars in thousands Income Taxes April 27, 2013 $ (97,543) Effective Rate 38.2% April 28, 2012 $ (25,067) Effective Rate 27.9%

Income tax bene...

-

Page 23

..., 2013. This decrease was due

to the reclassiï¬cation of the Junior Seller Note to shortterm and lower deferred rent partially offset by proceeds received from the Microsoft Commercial Agreement. The Company has arrangements with third-party manufacturers to produce certain NOOK® products. These...

-

Page 24

...

Barnes & Noble, Inc.

MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued

interests have a liquidation preference equal to Microsoft's original investment. Concurrently with its entry into this agreement, the Company has also entered into a Commercial...

-

Page 25

...investment agreement between the Company and Liberty pursuant to which the Company issued and sold to Liberty, and Liberty purchased, 202,000 shares of the Company's Series J Preferred Stock, par value $0.001 per share (Preferred Stock), for an aggregate purchase price of $202.0 million in a private...

-

Page 26

24

Barnes & Noble, Inc.

MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued

Selected information related to the Company's credit facilities (in thousands):

Fiscal 2014 Credit facility at period end Average balance outstanding during the period Maximum...

-

Page 27

... these estimates.

Revenue Recognition

The "Management's Discussion and Analysis of Financial Condition and Results of Operations" section of this report discusses the Company's consolidated ï¬nancial statements, which have been prepared in accordance with accounting principles generally accepted...

-

Page 28

... follows: vendor-speciï¬c objective evidence, third-party evidence of selling price, or best estimate of selling price. NOOK® device revenue is recognized at the segment point of sale. The Company includes post-service customer support (PCS) in the form of software updates and potential increased...

-

Page 29

... term of stock option awards granted is derived from historical exercise experience under the Company's stock option plans and represents the period of time that stock option awards granted are expected to be outstanding. The assumptions used in calculating the fair value of stock-based payment...

-

Page 30

..., the Company used cash ï¬,ows that reï¬,ected management's forecasts and discount rates that included risk adjustments consistent with the current market conditions. Based on the results of the Company's step one testing, the fair values of the B&N Retail, B&N College and NOOK reporting units...

-

Page 31

...ective tax rate would have affected the Company's results of operations in ï¬scal 2012 by $0.05 million.

The Company sells gift cards, which can be used in its stores, on barnesandnoble.com and NOOK devices. The Company does not charge administrative or dormancy fees on gift cards and gift cards...

-

Page 32

... estimated, the risk that digital sales growth is less than expectations and the risk that it does not exceed the rate of investment spend, higher-than-anticipated store closing or relocation costs, higher interest rates, the performance of Barnes & Noble's online, digital and other initiatives, the...

-

Page 33

2014 Annual Report

31

C O NSOLIDATE D STATEMEN TS OF OPE R AT I O N S

(In thousands, except per share data) Sales Cost of sales and occupancy Gross proï¬t Selling and administrative expenses Depreciation and amortization Operating income (loss) Interest expense, net and amortization of deferred ...

-

Page 34

... payable Total current liabilities Long-term debt Long-term deferred taxes Other long-term liabilities Redeemable Preferred Shares; $.001 par value; 5,000 shares authorized; 204 and 204 shares issued, respectively Preferred Membership Interests in NOOK Media, LLC Shareholders' equity: Common stock...

-

Page 35

...Barnes & Noble, Inc. Shareholders' Equity (In thousands) Balance at April 30, 2011 Net loss Minimum pension liability, net of tax Exercise of 92 common stock options Stock options and restricted stock tax beneï¬ts Stock-based compensation expense... notes to consolidated ï¬nancial statements.

-

Page 36

...Barnes & Noble, Inc. Shareholders' Equity (In thousands) Balance at April 27, 2013 Net loss Minimum pension liability, net of tax Exercise of 66 common stock options Stock options and restricted stock tax beneï¬ts Stock-based compensation expense... notes to consolidated ï¬nancial statements.

-

Page 37

... proceeds from Microsoft Commercial Agreement ï¬nancing arrangement Proceeds from credit facility Payments on credit facility Proceeds from exercise of common stock options Purchase of treasury stock Excess tax beneï¬t from stock-based compensation Cash dividends paid to shareholders Net proceeds...

-

Page 38

..., NET:

Fiscal 2014 $ 5,388 176,134 (287) (113,607) $ 67,628

Fiscal 2013 20,578 151,072 (7,085) (71,974) 92,591

Fiscal 2012 (19,653) (186,479) (23,748) 65,090 (164,790)

Receivables, net Merchandise inventories Prepaid expenses and other current assets Accounts payable and accrued liabilities...

-

Page 39

... gifts, school and dorm supplies, café products and services, educational toys & games, music and movies direct to customers through its bookstores or on barnesandnoble.com. The Company also offers a textbook rental option to its customers, as well as digital textbooks and other course materials...

-

Page 40

...cash ï¬,ows that reï¬,ected management's forecasts and discount rates that included risk adjustments consistent with the current market conditions. Based on the results of the Company's step one testing, the fair values of the B&N Retail, B&N College and NOOK reporting units as of that date exceeded...

-

Page 41

...as follows: vendorspeciï¬c objective evidence, third-party evidence of selling price, or best estimate of selling price. NOOK® device revenue is recognized at the segment point of sale. The Company includes post-service customer support (PCS) in the form of software updates and potential increased...

-

Page 42

...rst 30 days. Revenue is recognized over the twelve-month period based upon historical spending patterns for Barnes & Noble Members.

Research and Development Costs for Software Products

The Company follows the guidance in ASC 85-20, Cost of Software to Be Sold, Leased or Marketed, regarding software...

-

Page 43

... Company's stock option plans and represents the period of time that stock option awards granted are expected to be outstanding. The assumptions used in calculating the fair value of

The Company sells gift cards, which can be used in its stores, on barnesandnoble.com and NOOK devices. The Company...

-

Page 44

... rate at end of period

a Includes commitment fees.

In May 2012, the FASB issued Accounting Standard Update No. 2012-0 , Revenue from Contracts with Customers (ASU 2012-0 ). The standard provides companies with a single model for use in accounting for revenue arising from contracts with customers...

-

Page 45

... to the expected term of the option granted. The Company recognizes stock-based compensation costs, net of estimated forfeitures, for only those shares expected to vest on a straight-line basis over the requisite service period of the award. The Company estimates the forfeiture rates based on its...

-

Page 46

... stock awards. That cost is expected to be recognized over a weighted average period of 0.2 years.

3,381

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the difference between the Company's closing stock price on the last trading day of the related...

-

Page 47

... include accrued pension liabilities, store closing expenses and long-term deferred revenues. The Company had the following long-term liabilities at May 3, 2012 and April 27, 2013:

May 3, 2014 Deferred rent Junior Seller Note (see Note 19) Microsoft Commercial Agreement ï¬nancing transaction (see...

-

Page 48

46

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

are measured using a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. These tiers include: Level 1 - Observable inputs that reï¬,ect quoted prices in active markets Level 2 - ...

-

Page 49

... used to calculate pension costs are reviewed annually. Pension expense was $2,265, $2,836 and $1, 70 for ï¬scal 2012, ï¬scal 2013 and ï¬scal 2012, respectively. The Company maintains a deï¬ned contribution plan (the Savings Plan) for the beneï¬t of substantially all employees. Total Company...

-

Page 50

... and credit carryovers Lease transactions Pension Stock-based compensation Investments in equity securities Other Gross deferred tax assets Valuation allowance Net deferred tax assets Deferred tax liabilities: Prepaid expenses Goodwill and intangible asset amortization Investment in Barnes & Noble...

-

Page 51

...8,325 6,419 $ 297,392 (6,824) (7,312) (5,942)

For the 53 weeks ended May 3, 2014 For the 52 weeks ended April 27, 2013 For the 52 weeks ended April 28, 2012 Total Estimated Amortization Expense: (12 months ending on or about April 30) 2015 2016 2017 2018 2019 3,886 1,013 477

$ 17,835 $ 21,426 $ 18...

-

Page 52

... selling and administrative expenses, which represented all the goodwill in the NOOK reporting unit.

Pursuant to the agreement, Microsoft invested $300,000 in NOOK Media in exchange for 300,000 Series A Preferred interests, representing approximately 17.6% of the common membership interests in NOOK...

-

Page 53

... 27, 2013, NOOK Media entered into an amendment to the commercial agreement that extends the term of the agreement and the timing of the measurement period to meet certain revenue share milestones.

The patent agreement provides for Microsoft and its subsidiaries to license to the Company and its...

-

Page 54

... amended February 17, 2010, June 23, 2010, October 2 , 2010 and August 18, 2011, the Rights Agreement) with Mellon Investor Services LLC, as Rights Agent. The Rights expired on November 17, 2012. On May 15, 2007, the Company's Board of Directors authorized a stock repurchase program for the purchase...

-

Page 55

... 2012, primarily under the Barnes & Noble Booksellers trade name. The 661 Barnes & Noble stores generally offer a dedicated NOOK® area, a comprehensive trade book title base, a café, and departments dedicated to Juvenile, Toys & Games, DVDs, Music, Gift, Magazine and Bargain products. The stores...

-

Page 56

...

digital textbooks, course-related materials, emblematic apparel and gifts, trade books, computer products, NOOK® products and related accessories, school and dorm supplies, and convenience and café items.

NOOK

Capital Expenditures B&N Retail B&N College NOOK Total

53 weeks ended May 3, 2014...

-

Page 57

...against the Company in the United States District Court for the Northern District of California. The complaint similarly alleges that the Company is infringing the '336 patent through the importation and sale in the United States of NOOKâ„¢ products. The complaint also alleges that Barnes & Noble is...

-

Page 58

.... A case management conference is scheduled on July 11, 2012.

Adrea LLC v. Barnes & Noble, Inc., barnesandnoble.com llc and Nook Media LLC

On June 12, 2013, Adrea LLC ï¬led a complaint against Barnes & Noble, Inc., barnesandnoble.com llc and Nook Media LLC (B&N) in the United States District Court...

-

Page 59

... class action complaints (three in federal district court in the Northern District of Illinois and one in the Northern District of California), each of which alleged on behalf of national and other classes of customers who swiped credit and debit cards in Barnes & Noble Retail stores common law...

-

Page 60

...10, 2012.

Taylor v. Barnes & Noble, Inc., et al. Maitland-Lewis v. Barnes & Noble, Inc., et al.

On January 25, 2013, Steven Trimmer (Trimmer), a former Assistant Store Manager (ASM) of the Company, ï¬led a complaint in the United States District Court for the Southern District of New York alleging...

-

Page 61

... the Company's Vice Chairman and Chief Executive Officer) and other members of the Riggio family. MBS is a new and used textbook wholesaler, which also sells textbooks online and provides bookstore systems and distant learning distribution services. Pursuant to the Supply Agreement, which has a term...

-

Page 62

... 2013, the Company also entered into an agreement with MBS Direct, a division of MBS, pursuant to which the marketplace program on the Barnes & Noble.com website was made available through the MBS Direct website. The Company receives a fee from third party sellers for sales of marketplace items sold...

-

Page 63

... its subcontractors for ï¬scal 2012, ï¬scal 2013 and ï¬scal 2012, respectively. Subcontractors are not related to the Company. At the time of the agreement, the cost of freight delivered to the stores by Argix was comparable to the prices charged by publishers and the Company's other third party...

-

Page 64

... facilities totaling 88,000 square feet. NOOK employees will move to a new facility in Santa Clara, California, while Barnes & Noble College's digital education employees will relocate to a facility in Mountain View, California. The relocations are expected to occur by the end of the ï¬rst quarter...

-

Page 65

... of the termination.

NOOK Media Separation

On June 25, 2012, the Company announced that its Board of Directors has authorized management of the Company to take steps to separate the NOOK Media business from Barnes & Noble Retail into two separate public companies. The Company's objective is to take...

-

Page 66

64

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

23. SE L E CT E D Q U A R T E R LY FINA N C IA L INFO R M ATION (UN AUDITED)

A summary of quarterly ï¬nancial information for ï¬scal 2012 and ï¬scal 2013 is as follows:

July 27, 2013 $ 1,329,502 $ 368,201 $ (87,022) ...

-

Page 67

...N G FI R M

The Board of Directors and Shareholders of Barnes & Noble, Inc. We have audited the accompanying consolidated balance sheets of Barnes & Noble, Inc. as of May 3, 2012 and April 27, 2013, and the related consolidated statements of income, comprehensive income, shareholders' equity and cash...

-

Page 68

... Board (United States), the consolidated balance sheets of Barnes & Noble, Inc. as of May 3, 2012 and April 27, 2013, and the related consolidated statements of income, comprehensive income, shareholders' equity and cash ï¬,ows for the ï¬scal years then ended of Barnes & Noble, Inc. and our report...

-

Page 69

... statement of operations of Barnes & Noble, Inc., as of April 28, 2012 and the related statements of comprehensive income (loss), changes in shareholders' equity and cash ï¬,ows for the ï¬scal year ended April 28, 2012. These ï¬nancial statements are the responsibility of the Company's management...

-

Page 70

... compliance with the Company's statement of policy regarding ethical and lawful conduct. The Audit Committee of the Board of Directors composed of directors who are not members of management, meets regularly with management, the independent registered public accountants and the internal auditors to...

-

Page 71

..., Barnes & Noble College Booksellers

Allen W. Lindstrom

Chief Financial Officer

Mary Ellen Keating

The Company's common stock is traded on the New York Stock Exchange (NYSE) under the symbol BKS. The following table sets forth, for the quarterly periods indicated, the high and low sales prices of...

-

Page 72

...of the Company's Corporate Website: www.barnesandnobleinc.com.

All other inquiries should be directed to:

$150

$100

$50

$0

1/31/2009

5/2/2009

5/1/2010 4/30/2011 4/28/2012 4/27/2013

5/3/2014

Barnes & Noble, Inc.

S&P 500 Stock Index

Dow Jones US Speciality Retailers Index

Investor Relations...

-

Page 73

... Doubleday

Orange Is the New Black

William Golding Penguin Group (USA)

World War Z

John Green Penguin Young Readers Group

Wonder

Phil Robertson Howard Books

Max Brooks Crown

R.J. Palacio Random House Children's Books

The Elf on the Shelf

James Patterson Little, Brown

Piper Kerman Random House...

-

Page 74

.... Martin's Press

The Silent Wife

Dan Fagin Random House Biography or Autobiography General Nonï¬ction

THE N ATION AL BOOK AWARDS The Good Lord Bird

Amy Wilentz Simon & Schuster Autobiography

Distant Reading

Franco Moretti Verso Criticism

Five Days at Memorial

Kate DiCamillo Candlewick Press

THE...

-

Page 75

-

Page 76