Barnes and Noble 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Barnes & Noble

Annual Report 2011

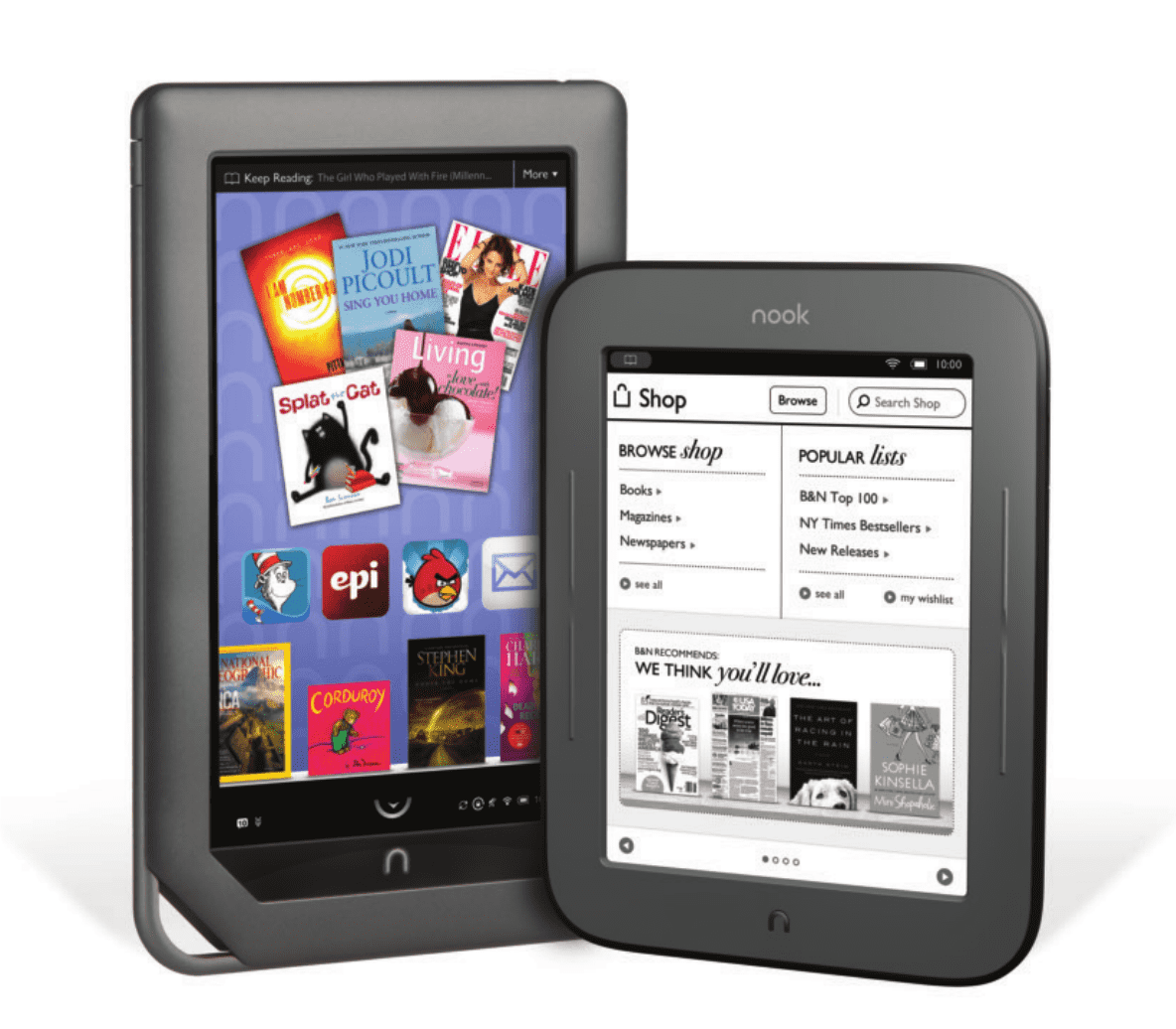

NOOK Color™

“Best value in the tablet world”

–msnbc.com, 04/25/2011

All-New NOOK™

“New NOOK beats Kindle”

–CNET, 06/01/2011

Table of contents

-

Page 1

Barnes & Noble Annual Report 2011 NOOK Colorâ„¢ "Best value in the tablet world" -msnbc.com, 04/25/2011 All-New NOOKâ„¢ "New NOOK beats Kindle" - CNET, 06/01/2011 -

Page 2

If you love reading, this is your tablet. â„¢ More New York Times Best Sellers than any other eReader. Plus get magazines, newspapers, and interactive kids' books-only on NOOK Color. Now with apps, email, Web browsing, and video, too. Experience NOOK Color at your neighborhood Barnes & Noble or ... -

Page 3

... Balance Sheet Consolidated Statements of Changes in Shareholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm Reports of Management Shareholder Information Corporate Information Barnes & Noble... -

Page 4

... for investors to sit up and take notice. Total company sales grew by 5%, without the addition of Barnes & Noble College Booksellers. With College, total company sales grew to $7 billion, an increase of 20 percent. College performed better than expected despite an off year for retailers generally. -

Page 5

2011 Annual Report 3 Consider: • Buyers of our NOOK devices, in effect walk around with a fully stocked Barnes & Noble superstore in their pockets. • Our Members with a NOOK device buy on average almost 50% more total units from the company than they did before they owned a device. • In ... -

Page 6

... to better align the Company's ï¬scal year with the business cycles of both Barnes & Noble, Inc. and B&N College. The Statement of Operations Data for the 52 weeks ended April 30, 2011 (ï¬scal 2011), 52 weeks ended May 1, 2010 (ï¬scal 2010), 13 weeks ended May 2, 2009 (transition period), and 52... -

Page 7

... per share data) STATEMENT OF OPERATIONS DATA Fiscal 2011 13 weeks Fiscal ended 2010 May 2, 2009 13 weeks ended May 3, 2008 Fiscal 2008 Fiscal 2007 Fiscal 2006 Sales Barnes & Noble Retail Barnes & Noble Collegea Barnes & Noble.com Total sales Cost of sales and occupancy Gross proï¬t Selling... -

Page 8

... 63,662 66,221 65,212 68,388 Number of stores Barnes & Noble stores Barnes & Noble College B. Dalton stores Total Comparable sales increase (decrease) Barnes & Noble Retaile Barnes & Noble Collegef Barnes & Noble.comg Capital expendituresh BALANCE SHEET DATA 705 636 - 1,341 720 637 - 1,357 726... -

Page 9

... selling price of a new or used textbook when rented, rather than solely the rental fee received and amortized over the rental period. g Comparable sales increase (decrease) is calculated on a 52-week basis and includes sales of physical and digital products made online through the Company's website... -

Page 10

... course materials through a proprietary digital platform (NOOK Study™). B&N College offers its customers a full suite of textbook options - new, used, digital and rental. The Company previously licensed the "Barnes & Noble" trade name from B&N College under certain agreements. The Acquisition... -

Page 11

... 30, 2011, primarily under the Barnes & Noble Booksellers trade name. These stores generally offer a NOOK Boutique/ Counter, a comprehensive trade book title base, a café, a children's section, an Educational Toys & Games department, a DVDs/BluRay department, a gift department, a music department... -

Page 12

... their campus stores, including textbooks and course-related materials, emblematic apparel and gifts, trade books, computer products and eReaders, school and dorm supplies, and convenience and café items. In ï¬scal 2011, B&N College began offering a textbook rental option to its customers, and... -

Page 13

... selling price of a new or used textbook when rented, rather than solely the rental fee received and amortized over the rental period. c Comparable sales increase (decrease) is calculated on a 52-week basis and includes sales of physical and digital products made online through the Company's website... -

Page 14

... 2009, the Company entered the eBook market with its acquisition of Fictionwise, a leader in the eBook marketplace, and the popularity of its eBook site continues to grow. Since then, the Company launched its NOOKâ„¢ brand of eReading products, which provide a fun, easy-to-use and immersive digital... -

Page 15

... major competitive asset. The Company plans to integrate its traditional retail, trade book and college bookstores businesses with its electronic and internet offerings, using retail stores in attractive geographic markets to promote and sell digital devices and content. Customers can see, feel and... -

Page 16

... OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued primarily due to higher NOOK and related accessories and digital content sales, as well as higher sales of physical products. In ï¬scal 2011, the Company opened one Barnes & Noble store and closed 16, bringing its total number of Barnes... -

Page 17

... Begin Smart acquisition date are included in the consolidated ï¬nancial statements. Net Earnings (Loss) Attributable to Barnes & Noble, Inc. 52 weeks ended Dollars in thousands Net Earnings (Loss) Attributable to Barnes & Noble, Inc. April 30, 2011 Diluted EPS May 1, 2010 Diluted EPS The Company... -

Page 18

... 9.9% January 31, 2009 % Total 90.8% 0.0% 9.2% 100.0% - 469,138 In ï¬scal 2010, the Company opened eight Barnes & Noble stores and closed 1 , bringing its total number of Barnes & Noble stores to 720 with 1 .7 million square feet. In ï¬scal 2010 since the date of Acquisition, the Company added 11... -

Page 19

... result of the lower volume of Barnes & Noble new store openings. Operating Proï¬t (Loss) 52 weeks ended Dollars in thousands B&N Retail B&N College B&N.com Total Operating Proï¬t May 1, 2010 $ 179,231 76 (106,061) $ 73,246 % Sales 4.1% 0.0% (18.5%) 1.3% January 31, 2009 $ 177,570 - (34,239) $ 143... -

Page 20

...also due to lower average online order values. During the 13 weeks ended May 2, 2009, the Company opened six Barnes & Noble stores and closed six, bringing its total number of Barnes & Noble stores to 726 with 1 . million square feet. The Company closed one B. Dalton store, ending the period with 51... -

Page 21

... 200 for a settlement with the State of California regarding the collection of sales and use taxes on sales made by Barnes & Noble.com from 1999 to 2005. Depreciation and Amortization 13 weeks ended Dollars in thousands B&N Retail B&N.com Total Depreciation and Amortization May 2, 2009 % Sales $ 41... -

Page 22

... number and timing of new store openings. Although the Company believes cash on hand, cash ï¬,ows from operating activities, funds available from its senior credit facility and short-term vendor ï¬nancing provide the Company with adequate liquidity and capital resources for seasonal working capital... -

Page 23

...were used for general corporate purposes, including seasonal working capital needs. The 2009 Credit Facility replaced the Company's prior $ 50.0 million credit agreement (Prior Credit Facility) which had a maturity date of July 31, 2011, as well as B&N College's $400.0 million credit agreement which... -

Page 24

22 Barnes & Noble, Inc. MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued Selected information related to the Company's Amended Credit Facility, 2009 Credit Facility and Prior Credit Facility (in thousands): Fiscal 2011 Credit facility at period end... -

Page 25

... period of payment. See Note 9 to the Notes to Consolidated Financial Statements. Revenue Recognition See also Note to the Notes to Consolidated Financial Statements for information concerning the Company's Pension and Postretirement Plans. Off-Balance Sheet Arrangements Revenue from sales of the... -

Page 26

... College's textbook and trade book inventories are valued using the LIFO method, where the related reserve was not material to the recorded amount of the Company's inventories or results of operations. Market is determined based on the estimated net realizable value, which is generally the selling... -

Page 27

... used cash ï¬,ows that reï¬,ected management's forecasts and discount rates that included risk adjustments consistent with the current market conditions. Based on the results of the Company's step one testing, the fair values of the Barnes & Noble Retail, Barnes & Noble College and B&N.com reporting... -

Page 28

... in ï¬scal 2011. Recent Accounting Pronouncements The Company sells gift cards which can be used in its stores or on Barnes & Noble.com. The Company does not charge administrative or dormancy fees on gift cards, and gift cards have no expiration dates. Upon the purchase of a gift card, a liability... -

Page 29

...of government regulation on the Company's business, including its online and digital businesses (including with respect to the agency pricing model for digital content distribution), the performance and successful integration of acquired businesses, the success of the Company's strategic investments... -

Page 30

28 Barnes & Noble, Inc. C O N SOLIDATED STATEMEN TS OF OPERAT I O N S (In thousands, except per share data) Sales Cost of sales and occupancy Gross proï¬t Selling and administrative expenses Depreciation and amortization Pre-opening expenses Operating proï¬t (loss) Interest income (expense), ... -

Page 31

... stock, at cost, 33,410 and 33,285 shares, respectively Total Barnes & Noble, Inc. Shareholders' equity Noncontrolling interest Total shareholders' equity Commitments and contingencies Total liabilities and shareholders' equity See accompanying notes to consolidated ï¬nancial statements. 90 1,323... -

Page 32

... 280 common stock options Stock options and restricted stock tax beneï¬ts Stock-based compensation expense Sale of Calendar Club (See Note 16) Cash dividend paid to stockholders Treasury stock acquired, 83 shares Balance at May 2, 2009 See accompanying notes to consolidated ï¬nancial statements. -

Page 33

2011 Annual Report 31 C O NSOLIDATE D STATEMEN TS OF CHA N G E S I N S H A R E H O LD E R S ' E Q U I T Y Barnes & Noble, Inc. Shareholders' Equity ACCUMLATED ADDITIONAL OTHER PAID-IN COMPREHENSIVE CAPITAL GAINS (LOSSES) TREASURY STOCK AT COST (In thousands) Balance at May 2, 2009 COMPREHENSIVE ... -

Page 34

... interest Acquisition of Barnes & Noble College Booksellers, Inc (net of cash acquired) Acquisition of Tikatok Inc. (net of cash acquired) Net cash ï¬,ows used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES Payment of short term note payable Payment received for Calendar Club... -

Page 35

2011 Annual Report 33 C O NSOLIDATE D STATEMEN TS OF CAS H FLO W S FISCAL YEAR (In thousands) Fiscal 2011 - - - - (1,536) 60,965 $ 59,429 $ (43,718) (5,251) 19,889 88,289 $ 59,209 Fiscal 2010 - - - - (25,629) 86,594 60,965 119,358 228,822 (56,675) (349,596) (58,091) 13 weeks ended May 2, 2009 ... -

Page 36

... Color™ and The All-New NOOK™ eBook Reader devices),4 and related accessories, bargain books, magazines, gifts, café products and services, educational toys & games, music and movies direct to customers through its bookstores or on Barnes & Noble.com. The Acquisition of B&N College (see Note 12... -

Page 37

... College's textbook and trade book inventories are valued using the LIFO method, where the related reserve was not material to the recorded amount of the Company's inventories or results of operations. Market is determined based on the estimated net realizable value, which is generally the selling... -

Page 38

...recognized at the time of sale, provided all other conditions for revenue recognition are met. Revenue allocated to the PCS and the wireless access is deferred and recognized on a straight-line basis over the 2-year estimated life of NOOKâ„¢. The Company also pays certain vendors who distribute NOOK... -

Page 39

... credits from vendors pursuant to co-operative advertising and other programs, including payments for product placement in stores, catalogs and online. In accordance with ASC 605-50-25-10, Customer's Accounting for Certain Consideration Received from a Vendor, the Company classiï¬es certain co-op... -

Page 40

...Consolidated Financial Statements for a further discussion on stock-based compensation. Gift Cards The Company sells gift cards which can be used in its stores or on Barnes & Noble.com. The Company does not charge administrative or dormancy fees on gift cards and gift cards have no expiration dates... -

Page 41

... Credit Facility were used for general corporate purposes, including seasonal working capital needs. The 2009 Credit Facility replaced the Company's prior $ 50,000 credit agreement (Prior Credit Facility) which had a maturity date of July 31, 2011, as well as B&N College's $400,000 credit agreement... -

Page 42

40 Barnes & Noble, Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued in ï¬scal 2010 was related to the 2009 Company's Credit Agreement entered into on September 30, 2009 in connection with the Acquisition. The Company has no agreements to maintain compensating balances. 3. ST O CK- B A ... -

Page 43

2011 Annual Report 41 Stock-Based Compensation Activity The following table presents a summary of the Company's stock option activity: NUMBER OF SHARES (in thousands) WEIGHTED WEIGHTED AVERAGE AGGREGATE AVERAGE REMAINING INTRINSIC EXERCISE CONTRACTUAL VALUE PRICE TERM (in thousands) Balance, ... -

Page 44

...May 1, 2010 324,528 150,000 31,375 505,903 Receivables represent customer, private and public institutional and government billings, credit/debit card, advertising, landlord and other receivables due within one year as follows: April 30, 2011 Trade accounts Credit/debit card receivables Advertising... -

Page 45

... Seller Notes is consistent with comparable market debt issues. In accordance with ASC 260-10-45, Share-Based Payment Arrangements and Participating Securities and the Two-Class Method, the Company's unvested restricted shares and shares issuable under the Company's deferred compensation plan... -

Page 46

...Barnes & Noble, Inc. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued The following is a reconciliation of the Company's basic and diluted earnings per share calculation: Fiscal 2011 Numerator for basic earnings per share Income (loss) from continuing operations attributable to Barnes & Noble... -

Page 47

.... Total Company contributions charged to employee beneï¬t expenses for the Savings Plan were $14,212, $12,954, $3,062 and $11,645 during ï¬scal 2011, ï¬scal 2010, the transition period and ï¬scal 200 , respectively. In addition, the Company provides certain health care and life insurance bene... -

Page 48

... Deferred tax assets: Loss and credit carryovers Lease transactions Estimated accruals Stock-based compensation Insurance liability Pension Inventory Investments in equity securities Total deferred tax assets Net deferred tax liabilities Balance Sheet caption reported in: Prepaid expenses and other... -

Page 49

... gain, net of tax Foreign currency translation adjustments Balance at January 31, 2009 Sale of Calendar Club (See Note 16) Balance at May 2, 2009 Net actuarial loss, net of tax Amortization of net actuarial gain, net of tax Prior service credit Balance at May 1, 2010 Net actuarial loss, net of tax... -

Page 50

... Stock Purchase Agreement dated as of August 7, 2009 among the Company and the Sellers. Mr. Riggio is the Chairman of the Company's Board of Directors and a signiï¬cant stockholder. As part of the transaction, the Company acquired the Barnes & Noble trade name that had been owned by B&N College and... -

Page 51

...scal 2010: 52 weeks ended May 1, 2010 Sales Net loss $ 833,648 $ 3,344 Acquired intangible assets consisted primarily of the trade name and customer relationships. Trade Name The Company previously licensed the "Barnes & Noble" trade name from B&N College under certain agreements. The Acquisition... -

Page 52

... certain performance and technology related targets. The acquisition provided a core component to the Company's overall digital strategy, enabling the launch of one of the world's largest eBookstores on July 20, 2009. The eBookstore on Barnes & Noble.com enables customers to buy eBooks and read them... -

Page 53

... using an accelerated method over their ï¬ve-year useful life. The Company recorded $1,445 and $2,176 in amortization related to these intangibles during ï¬scal 2011 and ï¬scal 2010, respectively. The Fictionwise results of operations for the period subsequent to the Fictionwise acquisition date... -

Page 54

...day of April. Accordingly, the Company is presenting audited ï¬nancial statements for the 13 week transition period ended May 2, 2009. The following table provides certain unaudited comparative ï¬nancial information for the 13 weeks ended May 3, 200 . 13 weeks ended May 2, 2009 Sales Cost of sales... -

Page 55

... amended from time to time, the Rights Agreement) with Mellon Investor Services LLC, as Rights Agent. The Rights will be exercisable upon the earlier of (i) such date the Company learns that a person or group, without Board approval, acquires or obtains the right to acquire beneï¬cial ownership... -

Page 56

... under contracts by B&N College. The 636 B&N College stores generally sell textbooks and course-related materials, emblematic apparel and gifts, trade books, computer products and eReaders, school and dorm supplies, and convenience and café items. B&N.com This segment includes the Company's online... -

Page 57

... most popular mobile and computing devices using free NOOKâ„¢ software. Summarized ï¬nancial information concerning the Company's reportable segments is presented below: 52 weeks 52 weeks ended 52 weeks 13 weeks ended April 30, ended ended January 31, 2011 May 1, 2010 May 2, 2009 2009 $ 4,364,246... -

Page 58

... seeking contact information for the putative class. B&N Booksellers provided that information on October 15, 2010. The previously scheduled Case Management Conference was continued to January 27, 2011. Plaintiff 's counsel ï¬led an amended complaint on January 26, 2011, adding two new named... -

Page 59

... with the Company's acquisition of Barnes & Noble College Booksellers, the adoption of the Shareholder Rights Plan, and other unspeciï¬ed instances of alleged mismanagement and alleged wrongful conduct. The complaint also generally alleges violations of Section 14(a) of the Securities Exchange Act... -

Page 60

...of the Company's Board of Directors and a signiï¬cant stockholder. The Company is a party to a Stock Purchase Agreement dated as of August 7, 2009 among the Company and the Sellers. As part of the Acquisition, the Company acquired the Barnes & Noble trade name that had been owned by B&N College and... -

Page 61

... Agreement, B&N College made a tax distribution payment of $54,997 to the Sellers related to taxes imposed on the Sellers' pro rata share of B&N College S corporation taxable earnings from January 1, 2009 through the date of Acquisition. The Company pays COBRA beneï¬ts for certain former employees... -

Page 62

... com, Barnes & Noble.com was granted the right to sell college textbooks over the Internet using the "Barnes & Noble" name. Pursuant to the Textbook License Agreement, Barnes & Noble.com paid Textbooks.com a royalty on revenues (net of product returns, applicable sales tax and excluding shipping and... -

Page 63

... the Company in an amount equal to 7% of the gross sales of such departments, which totaled $9 9, $1,061, $250 and $1,250, during ï¬scal 2011, ï¬scal 2010, the transition period and ï¬scal 200 , respectively. GameStop sells new and used video games and consoles on the Barnes & Noble. com website... -

Page 64

... close of business on December 10, 2010. On February 22, 2011, the Company announced that its Board of Directors was suspending its quarterly dividend payment of $0.25 per share. This will provide the Company the ï¬nancial ï¬,exibility to continue investing into its high growth digital strategies... -

Page 65

... Annual Report 63 23. SE L E CT E D Q UA R T E R LY FIN A NC IA L IN FO R MATION (UN AUDITED) A summary of quarterly ï¬nancial information for ï¬scal 2011 and ï¬scal 2010 is as follows: Fiscal 2011 Quarter Ended On or About Sales Gross proï¬t Net earnings (loss) attributable to Barnes & Noble... -

Page 66

...N G FI R M Board of Directors and Stockholders Barnes & Noble, Inc. New York, New York We have audited the accompanying consolidated balance sheets of Barnes & Noble, Inc., as of April 30, 2011 and May 1, 2010 and the related consolidated statements of operations, changes in shareholders' equity and... -

Page 67

... the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Barnes & Noble, Inc. as of April 30, 2011 and May 1, 2010 and the related consolidated statements of operations, changes in... -

Page 68

... standards of the Public Company Accounting Oversight Board. The report of BDO USA, LLP accompanies the Consolidated Financial Statements. The management of Barnes & Noble, Inc. is responsible for establishing and maintaining adequate internal control over ï¬nancial reporting, as such term is de... -

Page 69

... Officer Switch & Data Facilities Company, Inc. Irene R. Miller Vice President and Chief Merchandising Officer David S. Deason Chief Executive Officer Akim, Inc. Margaret T. Monaco Vice President of Barnes & Noble Development Gene DeFelice Vice President, General Counsel and Corporate Secretary... -

Page 70

... restricted stock that have voting rights and are held by members of the Board of Directors and the Company's employees. The Company's most recent quarterly dividend of $0.25 per common share was paid in December 2010. Effective February 22, 2011 the Company suspended the payment of its quarterly... -

Page 71

..., New York Independent Public Accountants: BDO Seidman, LLP, New York, New York Stockholder Services: $200 $150 Inquiries from our stockholders and potential investors are always welcome. General ï¬nancial information can be obtained via the Internet by visiting the Company's Corporate Website... -

Page 72

... & Schuster Water for Elephants Rick Riordan Hyperion The Short Second Life of Bree Tanner Justin Halpern HarperCollins Daily Show with Jon Stewart Presents Earth (the Book) Charlaine Harris Penguin Safe Haven Heidi Murkoff and Sharon Mazel Workman Publishing Company The Five Love Languages... -

Page 73

... Little, Brown & Company The Immortal Life of Henrietta Lacks Stieg Larsson Knopf Doubleday The Girl Who Played with Fire Rebecca Skloot Crown Publishing Room Stieg Larsson Knopf Doubleday The Confession John Grisham Knopf Doubleday Hunger Games Emma Donoghue Little, Brown & Company Empire of... -

Page 74

... Kim Echlin Grove/Atlantic Fiction The Autobiography of an Execution Paolo Bacigalupi Night Shade Books THE EDGAR AWARD BEST N OVEL The Lock Artist Terrance Hayes Penguin Poetry Mockingbird David R. Dow Grand Central Publishing Non-Fiction Steve Hamilton St. Martin's Press Kathryn Erskine... -

Page 75

...01/2011 "Best E Ink reader"- CNET, 06/01/2011 "Blows the current Kindle out of the water" - ZDNET, 05/24/2011 The all-new NOOK. The Simple Touch Reader™ and the critics' choice. Smaller, lighter, and twice the battery life of Kindle®.* Touch the all-new NOOK at your neighborhood Barnes & Noble or... -

Page 76

... books are read and all the pens are put down and everything there is to learn is learned till the heroes retire and the monsters return to their dens and all the plots are wrapped up till that day by hook or by crook by book or by NOOK I will read. NOOK Color by Barnes & Noble