Barnes and Noble 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company is continuing its controlled descent in

the number of its smaller format B. Dalton bookstores

in response to declining sales attributable primarily to

book superstore competition. Part of the Company’s

strategy has been to close underperforming stores,

which has resulted in the closing of 915 B. Dalton book-

stores since 1989.

The Company has a multi-channel marketing strategy

that deploys various merchandising programs and

promotional activities to drive traffi c to both its stores

and website. At the center of this program is Barnes &

Noble.com, which receives over 365 million visits annu-

ally, ranking it among the top 15 multi-channel retailer

websites in terms of traffi c, as measured by Comscore

Media Metrix. As a result of this reach, the Company

believes that its website provides signifi cant advertising

power which would be valued in the tens of millions of

dollars if such advertising were placed with third-party

websites with comparable reach. In this way, Barnes

& Noble.com serves as both the Company’s direct-to-

home delivery service and as an important broadcast

channel and advertising medium for the Barnes & Noble

brand. For example, the online store locator at Barnes &

Noble.com receives millions of customer visits each year

providing store hours, directions, information about

author events and other in-store activities. Additionally,

customers can view store availability for book, music

and video products through the website and reserve the

available items for pick-up at the store. The Company

fi rmly believes that its website is a key factor behind its

industry-leading comparable store sales performance.

The Company’s subsidiary Sterling Publishing is one

of the leading publishers of non-fi ction trade titles,

with more than 5,000 books in print. Founded in 1949,

Sterling publishes a wide range of non-fi ction and

illustrated books, consisting primarily of subjects such

as crafts, food and wine, mind / body / spirit, photog-

raphy, puzzles and games, current aff airs and children’s

books. Sterling also publishes books for a number of

brands, including many of the Hearst magazines such

as Good Housekeeping and Cosmopolitan, Hasbro, The

American Museum of Natural History and AARP.

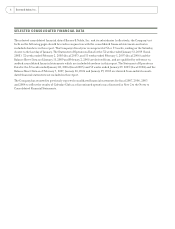

RESULTS OF OPERATIONS

FISCAL YEAR 2008 2007 2006

Sales (in thousands) $ 5,121,804 5,286,674 5,139,618

Earnings From Continuing Operations (in thousands) $ 85,426 134,911 149,186

Diluted Earnings Per Common Share From Continuing Operations $ 1.49 2.01 2.16

Comparable Store Sales Increase (Decrease)

Barnes & Noble storesa (5.4)% 1.8% (0.3)%

Barnes & Noble.comb (1.3)% 13.4% (1.1)%

STORES OPENED

Barnes & Noble stores 35 31 32

B. Dalton stores — — —

Total 35 31 32

STORES CLOSED

Barnes & Noble stores 22 13 18

B. Dalton stores 33 13 20

Total 55 26 38

NUMBER OF STORES OPEN AT YEAR END

Barnes & Noble stores 726 713 695

B. Dalton stores 52 85 98

Total 778 798 793

SQUARE FEET OF SELLING SPACE AT YEAR END (in millions)

Barnes & Noble stores 18.7 18.2 17.5

B. Dalton stores 0.2 0.3 0.4

Total 18.9 18.5 17.9

a Comparable store sales increase (decrease) is calculated on a 52-week basis, and includes sales of stores that have been open at least 15 months

and does not include closed or relocated stores.

b Comparable online sales increase (decrease) is calculated by adjusting the prior year results to conform with the fi scal 2008 presentation.

8 Barnes & Noble, Inc. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS continued