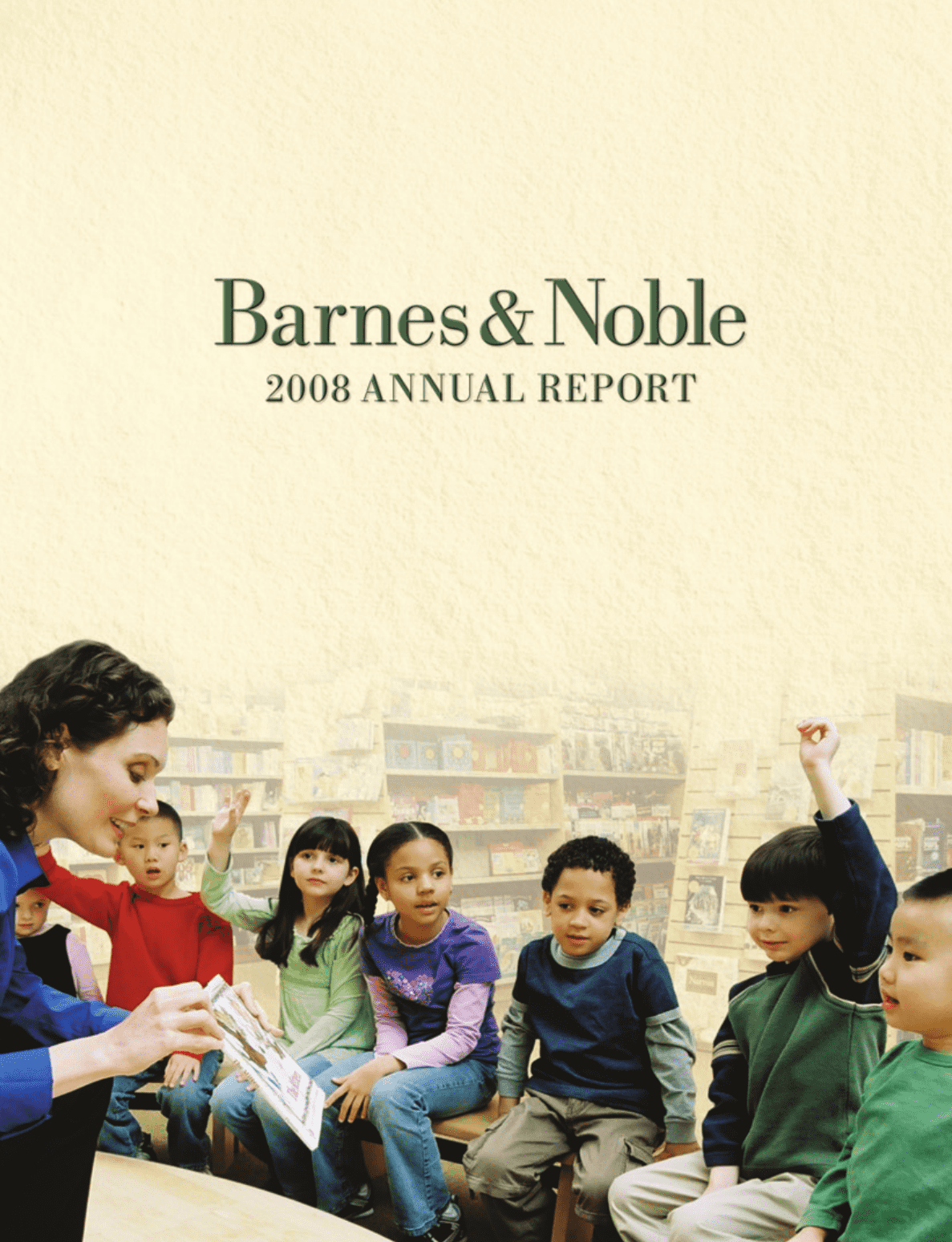

Barnes and Noble 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

Table of contents

-

Page 1

-

Page 2

... Balance Sheets Consolidated Statements of Changes in Shareholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm Reports of Management Shareholder Information Barnes & Noble Bestsellers 2008 2008...

-

Page 3

... no debt on our balance sheet and $282 million cash on hand. Even as our comparable sales declined 5.4 percent for the year, our management team again executed our business plan ï¬,awlessly, managing store payroll and store expenses in line with diminished sales, while providing world class customer...

-

Page 4

..., more efficient in every way, and most importantly, more creative. Like all Americans, the 37,000 booksellers who are the backbone of Barnes & Noble are doing all of the big and little things to make business better. Even during the worst of times business activity continues, and the miracle of...

-

Page 5

...or 53 weeks, ending on the Saturday closest to the last day of January. The Statement of Operations Data for the 52 weeks ended January 31, 2009 (ï¬scal 2008), 52 weeks ended February 2, 2008 (ï¬scal 2007), and 53 weeks ended February 3, 2007 (ï¬scal 2006) and the Balance Sheet Data as of January...

-

Page 6

2008 Annual Report

5

FISCAL YEAR

(In thousands, except per share data)

STATEMENT OF OPERATIONS DATA:

2008

2007

2006

2005

2004

Sales Barnes & Noble stores B. Dalton stores Barnes & Noble.com Other

a

$

4,525,020 67,525 466,082 63,177 5,121,804 3,540,596 1,581,208 1,251,524 173,557 12,796 ...

-

Page 7

...52-week basis, and includes sales from stores that have been open for at least 15 months and does not include closed or relocated stores. g Comparable online sales increase (decrease) is calculated by adjusting the prior year results to conform with the ï¬scal 2008 presentation. h Excludes Calendar...

-

Page 8

... employees as of January 31, 2009. Barnes & Noble stores are located in all 50 states and the District of Columbia as of January 31, 2009. With over 40 years of bookselling experience, management has a strong sense of customers' changing needs and the Company leads book retailing with a "community...

-

Page 9

... online store locator at Barnes & Noble.com receives millions of customer visits each year providing store hours, directions, information about author events and other in-store activities. Additionally, customers can view store availability for book, music and video products through the website and...

-

Page 10

... Barnes & Noble.com from 1999 to 2005. See Note 16, Legal Proceedings under "Barnesandnoble.com LLC v. Yee, et al." to the consolidated ï¬nancial statements for additional information regarding this settlement.

Stock Option Review

In July 2006, the Company created a Special Committee of the Board...

-

Page 11

... options were improperly priced, to an exercise price determined to be the appropriate fair market value by the Special Committee. The Special Committee recommended that all incorrectly dated and unexercised stock options issued to Section 16 officers and directors of the Company, other than hiring...

-

Page 12

... total number of Barnes & Noble stores to 726 with 18.7 million square feet. The Company closed 33 B. Dalton stores, ending the period with 52 B. Dalton stores and 0.2 million square feet. As of January 31, 2009, the Company operated 778 stores in the ï¬fty states and the District of Columbia.

Cost...

-

Page 13

... total number of Barnes & Noble stores to 713 with 18.2 million square feet. The Company closed 13 B. Dalton stores, ending the period with 85 B. Dalton stores and 0.3 million square feet. As of February 2, 2008, the Company operated 798 stores in the ï¬fty states and the District of Columbia.

Cost...

-

Page 14

... the number and timing of new store openings. Cash and cash equivalents on hand, cash ï¬,ows from operating activities, funds available under its senior credit facility and short-term vendor ï¬nancing continue to provide the Company with liquidity and capital resources for store expansion, seasonal...

-

Page 15

14

Barnes & Noble, Inc.

MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued

Capital Structure

Capital Investment

Strong cash ï¬,ows from operations and a continued emphasis on working capital management strengthened the Company's balance sheet in ...

-

Page 16

... and Related Transactions

Statements. See Note 17 to the Notes to Consolidated Financial Critical Accounting Policies Statements. "Management's Discussion and Analysis of Financial Condition Results of CRI T I CAL and A CCO U N T IN GOperations" P O LIC IE S discusses the Company's consolidated...

-

Page 17

...

The calculation of share-based employee compensation expense involves estimates that require management's judgment. These estimates include the fair value of each of the stock option awards granted, which is estimated on the date of grant using a Black-Scholes option pricing model. There are two...

-

Page 18

... the

The Company sells gift cards which can be used in stores or on Barnes & Noble.com. The Company does not charge administrative or dormancy fees on gift cards, and gift cards have no expiration dates. Upon the purchase of a gift card, a liability is established for its cash value. Revenue...

-

Page 19

... sites for new stores, higherthan-anticipated store closing or relocation costs, higher interest rates, the performance of the Company's online and other initiatives such as Barnes & Noble.com, the performance and successful integration of acquired businesses, the success of the Company's strategic...

-

Page 20

...02 2.17 65,212 69,226

Sales Cost of sales and occupancy Gross proï¬t Selling and administrative expenses Depreciation and amortization Pre-opening expenses Operating proï¬t Interest income (expense), net and amortization of deferred ï¬nancing fees Earnings from continuing operations before taxes...

-

Page 21

...Noble, Inc.

C ONSOL IDATED BAL AN CE SHEET S

(In thousands, except per share data)

ASSETS

JANUARY 31, 2009

FEBRUARY 2, 2008

Current assets Cash and cash equivalents Receivables, net Merchandise inventories Prepaid expenses and other current assets Current assets of discontinued operations Total...

-

Page 22

... Minimum pension liability Total comprehensive earnings Exercise of 488 common stock options Stock options and restricted stock tax beneï¬ts Stock-based compensation expense Cash dividends paid to stockholders Treasury stock acquired, 6,604 shares Balance at January 31, 2009

- - 1 - - - - $ 88...

-

Page 23

...assets Insurance proceeds from property claims Payments on GameStop note receivable Net cash ï¬,ows from investing activities

CASH FLOWS FROM FINANCING ACTIVITIES

Purchase of treasury stock through repurchase program Cash dividends paid to shareholders Proceeds from exercise of common stock options...

-

Page 24

...is generally the selling price. Reserves for non-returnable inventory are based on the Company's history of liquidating non-returnable inventory. The Company also estimates and accrues shortage for the period between the last physical count of inventory and the balance sheet date. Shortage rates are...

-

Page 25

...as goodwill in the accompanying consolidated balance sheets. At January 31, 2009, the Company had $240,008 of goodwill and $69,880 of unamortizable intangible assets (i.e., those with an indeï¬nite useful life), accounting for approximately 10.4 of the Company's total assets. SFAS No. 142, Goodwill...

-

Page 26

... the year pursuant to Statement of Position 93-7, Reporting on Advertising Costs. Advertising costs charged to selling and administrative expenses were $28,772, $27,158 and $27,335 during ï¬scal 2008, 2007 and 2006, respectively. The Company receives payments and credits from vendors pursuant to co...

-

Page 27

...CONSOLIDATED FINANCIAL STATEMENTS continued

Gift Cards

The Company sells gift cards which can be used in stores or on Barnes & Noble.com. The Company does not charge administrative or dormancy fees on gift cards, and gift cards have no expiration date. Upon the purchase of a gift card, a liability...

-

Page 28

... in Calendar Club. The Company subsequently sold its interest in Calendar Club in February 2009 to Calendar Club and its chief executive officer for $7,000, which was comprised of $1,000 in cash and $6,000 in notes. Calendar Club qualiï¬ed for held for sale accounting treatment in ï¬scal 2008 and...

-

Page 29

... interest rate Expected life Expected dividend yield

The following table presents a summary of the Company's stock options activity:

NUMBER OF SHARES (in thousands) WEIGHTED AVERAGE EXERCISE PRICE WEIGHTED AVERAGE REMAINING CONTRACTUAL TERM AGGREGATE INTRINSIC VALUE (in thousands)

Balance, January...

-

Page 30

2008 Annual Report

29

The aggregate intrinsic value in the table above represents the total pretax intrinsic value (the difference between the Company's closing stock price on the last trading day of the related ï¬scal year and the exercise price, multiplied by the related in-the-money options) ...

-

Page 31

...fference. The aggregate amount paid by the Company as cash bonuses under this program was $1,389, which was paid in January 2008 to comply with applicable tax laws.

4 . RECEIVABL ES, N ET

Receivables represent customer, credit/debit card, advertising, landlord and other receivables due within one...

-

Page 32

... date of July 31, 2011 and may be increased to $1,000,000 under certain circumstances at the option of the Company. The Revolving Credit Facility has an applicable margin that is applied to loans and standby letters of credit ranging from 0.500 to 1.000 above the stated Eurodollar rate. A fee...

-

Page 33

... ï¬scal 2008, 2007 and 2006, respectively. In addition, the Company provides certain health care and life insurance beneï¬ts (the Postretirement Plan) to retired employees, limited to those receiving beneï¬ts or retired as of April 1, 1993. Total Company contributions charged to employee bene...

-

Page 34

2008 Annual Report

33

In July 2006, the Financial Accounting Standards Board issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes (FIN 48). FIN 48 clariï¬es the accounting for uncertain income tax positions that are recognized in a company's ï¬nancial statements in ...

-

Page 35

...

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

10. O T H E R CO MPR E H E NS IV E E A R NIN G S (L O S S ), N ET OF TAX

Comprehensive earnings are net earnings, plus certain other items that are recorded directly to shareholders' equity, as follows:

FISCAL YEAR

2008...

-

Page 36

... which expire at various dates through 2036 with various renewal options for additional periods. The agreements, which have been classiï¬ed as operating leases, generally provide for both minimum and percentage rentals and require the Company to pay insurance, taxes and other maintenance costs...

-

Page 37

... in the accompanying balance sheets. On June 26, 2008, the Company exercised its purchase option under a lease on one of its distribution facilities located in South Brunswick, New Jersey from the New Jersey Economic Development Authority. Under the terms of the lease expiring in June 2011...

-

Page 38

... settlement is approved, no settlement payment will be made by the Company. If the proposed settlement is not approved, the Company intends to vigorously defend this lawsuit.

Barnesandnoble.com LLC v. Yee, et al.

On December 21, 2007, Barnes & Noble.com ï¬led a complaint in the United States...

-

Page 39

... with respect to hourly managers and/or assistant managers at Barnes & Noble stores located in the State of California: (1) failure to pay wages and overtime; (2) failure to provide meal and/or rest breaks; (3) waiting time penalties; and (4) unfair competition. The complaint contains no allegations...

-

Page 40

...corporation owned by Leonard Riggio, Barnes & Noble.com was granted the right to sell college textbooks over the Internet using the "Barnes & Noble" name. Pursuant to the Textbook License Agreement, Barnes & Noble.com pays Textbooks.com a royalty on revenues (net of product returns, applicable sales...

-

Page 41

... on insurance claims which were made under its programs prior to June 2005 and any such costs applicable to insurance claims against GameStop will be charged to GameStop at the time incurred. The Company is provided with national freight distribution, including trucking services by Argix Direct Inc...

-

Page 42

Barnes & Noble, Inc.

41

20 . SE L ECT E D Q U A R T E R LY FINA N C IAL IN F O RMATION (UN AUDITED)

A summary of quarterly ï¬nancial information for each of the last two ï¬scal years is as follows:

FISCAL 2008 QUARTER ENDED ON OR ABOUT APRIL 2008 JULY 2008 OCTOBER 2008 JANUARY 2009 TOTAL FISCAL...

-

Page 43

...I N G FI R M

Board of Directors and Stockholders Barnes & Noble, Inc. New York, New York We have audited the accompanying consolidated balance sheets of Barnes & Noble, Inc. and subsidiaries as of January 31, 2009 and February 2, 2008 and the related consolidated statements of operations, changes in...

-

Page 44

... of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Barnes & Noble, Inc. and subsidiaries as of January 31, 2009 and February 2, 2008, and the related consolidated statements of operations, changes in shareholders' equity, and cash ï¬,ows for...

-

Page 45

...ï¬cations of the Chief Executive Officer and the Chief Financial Officer of the Company as Exhibits 31.1 and 31.2 to its Annual Report on Form 10-K for ï¬scal 2008 ï¬led with the Securities and Exchange Commission, and the Company has submitted to the New York Stock Exchange a certiï¬cate of the...

-

Page 46

...Officer

Jennifer M. Daniels

Principal Probus Advisors

Lawrence S. Zilavy

Vice President, General Counsel and Corporate Secretary

David S. Deason

Senior Vice President Barnes & Noble College Booksellers, Inc.

Vice President of Barnes & Noble Development

Christopher Grady-Troia

Vice President and...

-

Page 47

...) 633-3300

Common Stock

The Annual Meeting of the Company's Stockholders will be held at 9:00 a.m. on Tuesday, June 2, 2009 at Barnes & Noble Booksellers, Union Square, 33 East 17th Street, New York, New York.

Stockholder Services

New York Stock Exchange, Symbol: BKS

Transfer Agent and Registrar...

-

Page 48

...

James Patterson Little, Brown & Company 123,930

Fearless Fourteen

David Sedaris Little, Brown & Company 133,750

Strengths Finder 2.0

John Grogan HarperCollins 170,253

Skinny Bitch

Ian McEwan Random House 140,809

Water for Elephants

J.K. Rowling Scholastic 346,456

Brisingr

Janet Evanovich St...

-

Page 49

48

Barnes & Noble, Inc.

20 08 AWARD W I N N E R S

SLE E PE RS The Shack P U LIT Z E R P R IZ E The Brief Wondrous Life of Oscar Wao THE N ATION AL B OOK AWARDS Shadow Country Children's Literature

William P. Young Windblown Media 597,164

Eat This Not That!

Junot Diaz Riverhead Books Fiction

...

-

Page 50