Barnes and Noble 2004 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2004 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

[LETTER TO OUR SHAREHOLDERS continued ]

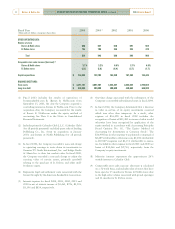

Our balance sheet remains strong. We generated free cash flow of approximately $350 million

during the fiscal year. Our liquidity position is solid, with a debt-to-equity ratio of 0.21 to 1. At

year-end, our revolving credit facility had no outstanding balance; the only debt on the

company’s books was a $245 million term loan. In fact, the company had a cash position, net

of debt, of $291 million at the end of the year.

During 2004, we redeemed $300 million in convertible notes, resulting in a reduction of

approximately nine million dilutive shares. We also distributed more than $500 million of

GameStop stock to Barnes & Noble shareholders through the tax-free spin-off. In addition, in

March 2005, our Board of Directors authorized a new share repurchase program of up to $200

million of common shares. This new share repurchase program follows the company’s previous

$250 million share repurchase program, which was recently completed in full.

Looking ahead, we will continue to nurture our multi-channel strategy by making it easier for

customers to shop with us, whether they visit our stores or shop from their desktops, laptops

and handhelds. We plan to open 30 to 40 stores this year, a comfortable pace enabling us to both

upgrade existing locations that are near the end of their leases, open in new communities, and

enter new markets. This year, we will open a new store in Morgantown, West Virginia, giving

Barnes & Noble stores a presence in all 50 states.

We remain focused on delivering exceptional value to our shareholders consistently over time.

Over the last five years, our stock price increased 63 percent and our total return to shareholders

was 130 percent.

As always, we are grateful to our shareholders for their continued support, and to our

booksellers, whose commitment to providing extraordinary service to our customers continues

to set Barnes & Noble apart.

Sincerely,

Leonard Riggio

Chairman

[LETTER TO OUR SHAREHOLDERS continued ]

5

2004 Annual Report Barnes & Noble, Inc.