Barnes and Noble 2004 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2004 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

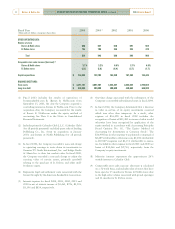

1Based upon sales reported in trade publications and public filings.

9

2004 Annual Report ■Barnes & Noble, Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS

Barnes & Noble, Inc.’s (Barnes & Noble or the

Company) fiscal year is comprised of 52 or 53 weeks,

ending on the Saturday closest to the last day of

January. As used in this section, “fiscal 2005”

represents the 52 weeks ending January 28, 2006,

“fiscal 2004” represents the 52 weeks ended January

29, 2005, “fiscal 2003” represents the 52 weeks ended

January 31, 2004 and “fiscal 2002” represents the 52

weeks ended February 1, 2003.

RESTATEMENT OF FINANCIAL STATEMENTS

As a result of a recent clarification from the Securities

and Exchange Commission, the Company re-evaluated

its lease accounting policies. Like many other

companies within the retail industry that corrected

commonly accepted lease accounting practices, the

Company has changed the way it accounts for its

leases, including the accounting for tenant allowances

and rent holidays during the store build-out period. As

a result of its review, the Company has corrected its

lease accounting policies in fiscal 2004, and while it

does not consider such corrections to be material to

any one year, has restated certain historical financial

information for prior periods. The restatement

adjustments are non-cash and had no impact on

revenues or total cash flows.

Consistent with common retail industry practice, the

Company had previously classified tenant allowances

received as a result of store openings as a reduction in

capital expenditures. The Company has reclassified

tenant allowances received from a reduction of fixed

assests to an increase in other long-term liabilities. The

related amortization of such amounts has been

reclassified from a reduction of depreciation expense to

a reduction of cost of sales and occupancy. Such

amortization reclassifications amounted to $32.1

million and $28.7 million in fiscal 2003 and

2002, respectively.

In addition, consistent with industry practice, the

Company had recognized the straight-line expense for

leases beginning on the earlier of the store opening date

or the commencement date of the lease, which had the

effect of excluding the construction period of its stores

from the calculation of the period over which it

expenses rent. In order to correct the straight-line rent

expense to include the store build-out period, in fiscal

2003 and 2002 the Company has decreased cost of sales

and occupancy and increased gross profit by $2.7

million and $2.6 million, respectively, decreased

operating profit and earnings before taxes and minority

interest by $0.1 million and $0.8 million, respectively,

and decreased net earnings by $0.1 million ($0.00 per

share) and $0.5 million ($0.01 per share), respectively.

The cumulative effect of such adjustments relating to

periods prior to fiscal 2002 amounting to $18.0 million,

has been recorded as a reduction of retained earnings as

of February 2, 2002. The Company also restated the

quarterly financial information for fiscal 2003 and the

first three quarters of fiscal 2004 (see Note 20 to the

Notes to Consolidated Financial Statements).

The January 31, 2004 balance sheet has been adjusted

to reflect the combined impact of the above re-

statements by increasing net property and equipment by

$225.0 million, increasing deferred rent (other long-

term liabilities) by $256.7 million, increasing deferred

tax assets by $13.2 million and decreasing retained

earnings and shareholders’ equity by $18.6 million.

GENERAL

The Company is the nation’s largest bookseller1, and as

of January 29, 2005 operates 820 bookstores. Of the

820 bookstores, 666 operate primarily under the Barnes

& Noble Booksellers trade name (32 of which were

opened in fiscal 2004) and 154 operate primarily under

the B. Dalton Bookseller trade name. Barnes & Noble

conducts the online part of its business through

barnesandnoble.com llc (Barnes & Noble.com), one of

the largest sellers of books on the Internet. Through

Sterling Publishing Co., Inc. (Sterling), the Company is

one of the top 25 publishers in the nation and the

industry’s leading publisher of how-to books. The

Company employed approximately 42,000 full- and

part-time employees as of January 29, 2005.

Barnes & Noble is the nation’s largest operator of

bookstores1with 666 Barnes & Noble stores located in

49 states and the District of Columbia as of January 29,

2005. With nearly 40 years of bookselling experience,

management has a strong sense of customers’ changing

needs and the Company leads book retailing with a

“community store” concept. Barnes & Noble’s typical

store offers a comprehensive title base, a café, a

children’s section, a music department, a magazine

section and a calendar of ongoing events, including

author appearances and children’s activities, that

make each Barnes & Noble store an active part of

its community.