Barnes and Noble 2002 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2002 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

[LETTER TO OUR SHAREHOLDERS ]

2

2002 Annual ReportBarnes & Noble, Inc.

DEAR SHAREHOLDER:

Fiscal 2002 was not a particularly good year for the economy or for the retail sector. The

entire book industry, including Barnes & Noble, experienced the effects of the slowdown in

consumer spending. For the second straight year, we’ve seen softness in retail with no end

in sight, as we go to press with this annual report. The conflict with Iraq has already taken

its toll on the first quarter of 2003.

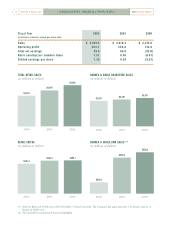

On the brighter side, we continued to lead the book industry in sales, operating profit

and cash flow. More importantly, we posted a 48 percent increase in earnings per share

year-over-year as a result of some very positive developments:

1) Expense reductions in the bookselling business mitigated some, though not all,

of the shortfall in sales as compared to plan.

2) Losses in Barnes & Noble.com declined again, resulting from increased sales and

reduced operating expenses.

3) Our investment in GameStop continued to deliver increased value to Barnes & Noble

shareholders by substantially adding to our EPS growth.

Looking at the retail bookselling component, which remains our core business, some

good news and many achievements deserve recognition. To begin with, Barnes & Noble

ranked number one in quality among all retail brands in the “Fall 2002 EquiTrend Brand

Study” by Harris Interactive. We came out ahead of such giants as Home Depot, Target

and Wal-Mart, and ahead of all retailers, large and small alike, who are identified with

high-quality merchandising. Over time, superior branding and superior execution are the

keys to any retailer’s success.

Sales, though less than plan, increased 6.4 percent from the previous year, and 47 new

stores—almost one million square feet of retail space—were added. Within the four walls of

the stores, we posted increases in our music, café and gift departments, while we struggled

to breakeven in the book sector. Even here, we had some good news as sales in fiction,

children’s books, how-to books, and the lifestyle categories bucked the trend.

While we remain dependent on the vitality of the publishing industry, which is clearly

experiencing some setbacks at the moment, we have taken bold initiatives to enhance our

own publishing programs in order to ensure our future. The acquisition of Sterling Publishing

Co., Inc., one of the nation’s top 25 publishers, augments our already robust publishing

unit. Sterling’s valuable backlist will provide myriad opportunities to create added sales in

our bookstores and margin to our bottom line, while their distribution capabilities will find

new outlets for the many more titles we intend to publish. In addition, the launch of Barnes

& Noble Classics in April 2003 heralds the beginning of a new era for the company, and

an exciting new application for our brand: The Barnes & Noble imprint stands for better

content, binding, graphics, and far better value for readers everywhere.