Barnes and Noble 2002 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2002 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

margin decreased to 5.8% of sales during fiscal 2001,

before the effect of the legal settlement expense, from

6.5% of sales during fiscal 2000, before the effect of

the impairment charge.

Interest Expense, Net and Amortization

of Deferred Financing Fees

Interest expense, net of interest income, and amortization

of deferred financing fees, decreased $17.2 million to

$36.3 million in fiscal 2001 from $53.5 million in fiscal

2000. The decrease was primarily the result of reduced

borrowings due to effective working capital management

and lower interest rates on the Company’s outstanding

debt, partially through the issuance of the Company’s

convertible subordinated notes sold in March 2001.

Equity in Net Loss of Barnes & Noble.com

In November 2000, Barnes & Noble.com acquired

Fatbrain.com, Inc. (Fatbrain), the third largest online

bookseller. Barnes & Noble.com issued shares of its

common stock to Fatbrain shareholders. As a result

of this merger, the Company and Bertelsmann each

retained an approximate 36 percent interest in Barnes

& Noble.com. Accordingly, the Company’s share in

the net loss of Barnes & Noble.com is based on an

approximate 40 percent equity interest from the

beginning of fiscal 2000 through November 2000 and

approximately 36 percent thereafter. The Company’s

equity in the net loss of Barnes & Noble.com for fiscal

2001 and fiscal 2000 was $88.4 million and $103.9

million, respectively.

Other Expense

Other expense of $11.7 million in fiscal 2001 was

due to $4.0 million in equity losses in iUniverse.com,

$2.5 million in equity losses in BOOK®magazine and

$5.5 million in equity losses in enews, inc., partially

offset by a one-time gain of $0.3 million from the

partial sale of Indigo. Other expense of $9.3 million in

fiscal 2000 was primarily due to the equity losses of

iUniverse.com, partially offset by a one-time gain of

$0.3 million from the partial sale of iUniverse.com.

Provision for Income Taxes

Barnes & Noble’s effective tax rate in fiscal 2001 decreased

to 41.5 percent compared with (57.5) percent during fiscal

2000. The fiscal 2001 decrease was primarily related to the

goodwill write-down associated with the impairment

charge, which provided no tax benefit in fiscal 2000.

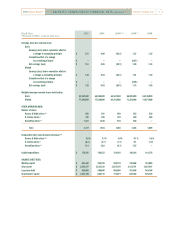

Earnings (Loss)

As a result of the factors discussed above, the Company

reported consolidated net earnings of $64.0 million (or

$0.94 per share) during fiscal 2001 compared with a

net loss of ($52.0) million (or ($0.81) per share) during

fiscal 2000. Components of diluted earnings per share

are as follows:

Fiscal Year 2001 2000

Retail EPS $ 1.70 1.69

EPS Impact of Investing Activities

Share in net losses of

Barnes & Noble.com ( 0.66 ) ( 0.98 )

Share of net losses from other

investments (including

earnings from Calendar Club) ( 0.07 ) ( 0.08 )

Total Investing Activities $ ( 0.73 ) ( 1.06 )

Other Adjustments

Legal settlement expense $ ( 0.03 ) --

Impairment charge -- ( 1.44 )

Total Other Adjustments $ ( 0.03 ) ( 1.44 )

Consolidated EPS $ 0.94 ( 0.81 )

SEASONALITY

The Company's business, like that of many retailers, is

seasonal, with the major portion of sales and operating

profit realized during the quarter which includes the

holiday selling season.

LIQUIDITY AND CAPITAL RESOURCES

Working capital requirements are generally at their

highest in the Company's fiscal quarter ending on or

about January 31 due to the higher payments to

vendors for holiday season merchandise purchases.

In addition, the Company’s sales and merchandise

inventory levels will fluctuate from quarter to quarter

as a result of the number and timing of new store

openings, as well as the amount and timing of sales

contributed by new stores.

Cash flows from operating activities, funds available

under its revolving credit facility and short-term vendor

17

2002 Annual Report Barnes & Noble, Inc.

[MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS continued ]