Barnes and Noble 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 ANNUAL REPORT

Table of contents

-

Page 1

2002 ANNUAL REPORT -

Page 2

... OF OPERATIONS CONSOLIDATED STATEMENTS OF OPERATIONS CONSOLIDATED BAL ANCE SHEETS CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUIT Y CONSOLIDATED STATEMENTS OF CASH FLOWS NOTES TO CONSOLIDATED FINANCIAL STATEMENTS REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS SHAREHOLDER INFORMATION -

Page 3

...execution are the keys to any retailer's success. Sales, though less than plan, increased 6.4 percent from the previous year, and 47 new stores-almost one million square feet of retail space-were added. Within the four walls of the stores, we posted increases in our music, café and gift departments... -

Page 4

... web site and to offer a compelling group of benefits for customers. While online sales of most other retailers suffered in 2002, Barnes & Noble.com increased sales by 4.5 percent which, together with a 50 percent reduction in operational expenses, inched it ever closer to its goal of profitability... -

Page 5

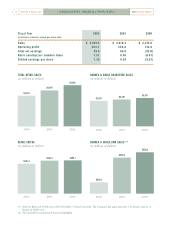

... DAT E D F I N A N C I A L H I G H L I G H T S ] 2002 Annual Report Fiscal Year (In millions of dollars, except per share data) 2002 $ 5,269.3 264.1 99.9 1.51 1.39 2001 $ 4,870.4 245.8 64.0 0.96 0.94 2000 $ 4,375.8 133.8 ( 52.0 ) (0.81 ) ( 0.81 ) Sales Operating profit Total net earnings Basic... -

Page 6

2002 Annual Report [ S E L E C T E D C O N S O L I DAT E D F I N A N C I A L DATA ] Barnes & Noble, Inc. 5 Company) set forth on the following pages should be read in conjunction with the consolidated financial statements and notes included elsewhere in this report. The Company's fiscal year is ... -

Page 7

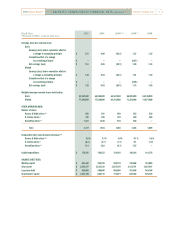

... share data) 2002 2001 2000 (1)(2) 1999 (3) 1998 STATEMENT OF OPERATIONS DATA: Sales Barnes & Noble stores (4) B. Dalton stores (5) Other Total bookstore sales GameStop stores (6) Total sales Cost of sales and occupancy Gross profit Selling and administrative expenses Legal settlement expense... -

Page 8

...OPERATING DATA: Number of stores Barnes & Noble stores (4) B. Dalton stores (5) GameStop stores (6) Total Comparable store sales increase (decrease) (14) Barnes & Noble stores (4) B. Dalton stores (5) GameStop stores (6) Capital expenditures BALANCE SHEET DATA: Working capital Total assets Long-term... -

Page 9

... Gemstar-TV Guide International, Inc. (Gemstar) and Indigo Books & Music Inc. (Indigo) to their fair market value. In fiscal 2000, the Company recorded a non-cash charge to adjust the carrying value of certain assets, primarily goodwill relating to the purchase of B. Dalton and other mall-bookstore... -

Page 10

...-replenishment system, resulting in high in-stock positions and productivity at the store level through efficiencies in receiving, cashiering and returns processing. During fiscal 2002, the Company added 1.0 million square feet to the Barnes & Noble bookstore base, bringing the total square footage... -

Page 11

... retailer of books, music, DVD/video and online courses. Since opening its online store (www.bn.com) in March 1997, Barnes & Noble.com has attracted more than 13.6 million customers in 232 countries. Barnes & Noble.com's bookstore includes the largest in-stock selection of in-print book titles with... -

Page 12

... has determined that it has two reporting units, bookstores and video-game and entertainment-software stores. The Company completed its initial impairment test on the goodwill in the second quarter of fiscal 2002 and its annual impairment test in November 2002. Both tests indicated that the fair... -

Page 13

...) 2002 2001 2000 SALES Bookstores Video Game & Entertainment Software stores Total OPERATING PROFIT Bookstores (1) Video Game & Entertainment Software stores Total COMPARABLE STORE SALES INCREASE (DECREASE) (2) Barnes & Noble stores B. Dalton stores GameStop stores STORES OPENED Barnes & Noble... -

Page 14

...: Fiscal Year 2002 2001 2000 Sales Cost of sales and occupancy Gross margin Selling and administrative expenses Legal settlement expense Depreciation and amortization Pre-opening expenses Impairment charge Operating margin Interest expense, net and amortization of deferred financing fees Equity in... -

Page 15

... 2001, primarily due to the increase in bookstore expenses from the opening of 47 Barnes & Noble stores in fiscal 2002 and to the growth in the Video Game & Entertainment Software segment. Selling and administrative expenses decreased to 18.3% of sales in fiscal 2002 from 18.6% in fiscal 2001. This... -

Page 16

... sale of Indigo. Provision for Income Taxes Barnes & Noble's effective tax rate in fiscal 2002 decreased to 40.25 percent compared with 41.50 percent during fiscal 2001. Minority Interest During fiscal 2002, minority interest for GameStop was $19.1 million based on a 36.5% basic weighted average... -

Page 17

... to growth in the Video Game & Entertainment Software segment and the increase in bookstore expenses from the opening of 40 Barnes & Noble stores in fiscal 2001. Selling and administrative expenses remained unchanged at 18.6% of sales during fiscal 2001 and 2000. Legal Settlement Expense In fiscal... -

Page 18

... of the number and timing of new store openings, as well as the amount and timing of sales contributed by new stores. Cash flows from operating activities, funds available under its revolving credit facility and short-term vendor Provision for Income Taxes Barnes & Noble's effective tax rate in... -

Page 19

... the number of new stores opened during the fiscal year decreases as a percentage of the existing store base, the increasing operating profits of Barnes & Noble stores are expected to generate a greater portion of the cash flows required for working capital, including new store inventories, capital... -

Page 20

... of directors under Delaware law. The Company leases space for its executive offices in properties in which Leonard Riggio, Chairman of the Board and principal stockholder of Barnes & Noble, has a minority interest. The space was rented at an aggregate annual rent including real estate taxes of... -

Page 21

..., benefits administration, insurance (property, casualty, medical, dental, life, etc.), tax, traffic, fulfillment and telecommunications. In accordance with the terms of such agreements, the Company has received, and expects to continue to receive, fees in an amount equal to the direct costs plus... -

Page 22

...GameStop's total payroll expense, property and equipment, and insurance claim history. During fiscal 2002, these charges amounted to $1.7 million. In fiscal 2001, Barnes & Noble.com and GameStop entered into an agreement whereby Barnes & Noble.com's Web site refers customers to the GameStop Web site... -

Page 23

... R AT I O N S c o n t i n u e d ] 2002 Annual Report the prices charged by publishers and other third-party freight distributors. Since 1993, the Company has used AEC One Stop Group, Inc. (AEC) as its primary music and DVD/video supplier and to provide a music and video database. AEC is one of the... -

Page 24

... telephone systems, possible work stoppages or increases in labor costs, possible increases in shipping rates or interruptions in shipping service, effects of competition, possible disruptions or delays in the opening of new stores or the inability to obtain suitable sites for new stores, higherthan... -

Page 25

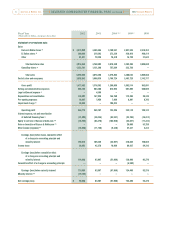

...2002 Annual Report Fiscal Year (Thousands of dollars, except per share data) 2002 2001 2000 Sales Cost of sales and occupancy Gross profit Selling and administrative expenses Legal settlement expense Depreciation and amortization Pre-opening expenses Impairment charge Operating profit Interest... -

Page 26

... Annual Report [ C O N S O L I DAT E D B A L A N C E S H E E T S ] Barnes & Noble, Inc. 25 (Thousands of dollars, except per share data) February 1, 2003 February 2, 2002 Assets Current assets: Cash and cash equivalents Receivables, net Barnes & Noble.com receivable Merchandise inventories... -

Page 27

...): Unrealized loss on available-for-sale securities net of reclassification adjustment Unrealized loss on derivative instrument Total comprehensive earnings Exercise of 2,163,893 common stock options, including tax benefits of $15,769 Balance at February 2, 2002 Comprehensive earnings: Net earnings... -

Page 28

... credit facility Proceeds from issuance of long-term debt Proceeds from exercise of common stock options Purchase of treasury stock through repurchase program Net cash flows from financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of year Cash... -

Page 29

.... 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Business Barnes & Noble, Inc. (Barnes & Noble), through its subsidiaries (collectively, the Company), is primarily engaged in the sale of books, video games and entertainment-software products. The Company employs two principal bookselling strategies... -

Page 30

... has determined that it has two reporting units, bookstores and video-game and entertainment-software stores. The Company completed its initial impairment test on the goodwill in the second quarter of fiscal 2002 and its annual impairment test in November 2002. Both tests indicated that the fair... -

Page 31

... cash flows using a discount rate determined by the Company's management to be commensurate with the risk involved. period based upon historical spending patterns for Barnes & Noble customers. Refunds of membership fees due to cancellations within the first 30 days are minimal. Subscription... -

Page 32

...from a Vendor", addressing the accounting of cash consideration received by a customer from a vendor, including vendor rebates and refunds. The consensus reached states that Fiscal Year 2002 2001 2000 Net earnings (loss) - as reported Compensation expense, net of tax BKS stock options GME stock... -

Page 33

...e d ] 2002 Annual Report consideration received should be presumed to be a reduction of the prices of the vendor's products or services and should therefore be shown as a reduction of cost of sales in the income statement of the customer. The presumption could be overcome if the vendor receives an... -

Page 34

... the Company to pay a commitment fee of 0.375 percent of the unused portion. The seasonal credit facility was guaranteed by all restricted subsidiaries of Barnes & Noble. The Company from time to time enters into interest rate swap agreements to manage interest-costs and risk associated with changes... -

Page 35

... balance sheet at their fair market value as a component of other noncurrent assets. The following marketable equity securities as of February 1, 2003 and February 2, 2002 have been classified as available-for-sale securities: Fiscal 2002 Gemstar International Ltd. Indigo Books & Music Inc. Total... -

Page 36

...,935 -72,788 GameStop diluted EPS GameStop shares owned by Barnes & Noble $0.87 36,009 $ 31,328 108,263 77,680 $1.39 $ -72,788 77,839 $0.94 (a) Represents interest on convertible subordinated notes, net of taxes. (b) In February 2002, GameStop completed an initial public offering (IPO). Prior to... -

Page 37

... and February 3, 2001, respectively. Summarized financial information for Barnes & Noble.com follows: 12 months ended December 31, 2002 2001 2000 Net sales Gross profit Net loss (a) Cash and cash equivalents Other current assets Noncurrent assets Current liabilities Minority interest Net assets... -

Page 38

... health care and life insurance benefits (the Postretirement Plan) to retired employees, limited to those receiving benefits or retired as of April 1, 1993. A summary of the components of net periodic cost for the Pension Plan and the Postretirement Plan follows: Pension Plan Fiscal Year 2002... -

Page 39

38 Barnes & Noble, Inc. [ N OT E S TO C O N S O L I DAT E D F I N A N C I A L STAT E M E N T S c o n t i n u e d ] 2002 Annual Report The following table provides a reconciliation of benefit obligations, plan assets and funded status of the Pension Plan and the Postretirement Plan: Pension Plan ... -

Page 40

... increase in GameStop Investment in Barnes & Noble.com Goodwill amortization Pension GameStop undistributed earnings Total deferred tax liabilities Deferred tax assets: Lease transactions Investments in equity securities Estimated accruals Restructuring charge Inventory Pension Insurance liability... -

Page 41

...é, a children's section, a music department, a magazine section and a calendar of ongoing events, including author appearances and children's activities. This segment also includes 258 small format mall-based stores under the B. Dalton Bookseller, Doubleday Book Shops and Scribner's Bookstore trade... -

Page 42

... and allocates resources to them based on operating profit. Summarized financial information concerning the Company's reportable segments is presented below: Sales Fiscal Year Bookstores 2002 2001 2000 Depreciation and Amortization 2002 2001 2000 Video Game & Entertainment Software stores Total... -

Page 43

42 Barnes & Noble, Inc. [ N OT E S TO C O N S O L I DAT E D F I N A N C I A L STAT E M E N T S c o n t i n u e d ] 2002 Annual Report A reconciliation of operating profit from reportable segments to earnings before income taxes and cumulative effect of a change in accounting principle in the ... -

Page 44

... assets was based on anticipated future cash flows discounted at a rate commensurate with the risk involved. 17. STOCK OPTION PLANS The Company grants options to purchase Barnes & Noble, Inc. (BKS) and GameStop Corp. (GME) common shares under the incentive plans discussed below. In accordance with... -

Page 45

...13 and $7.86, respectively, using the BlackScholes option-pricing model with the following assumptions: Fiscal Year 2002 2001 2000 A summary of the status of the Company's BKS stock options is presented below: Weighted-Average Exercise Price (Thousands of shares) Shares Balance, January 29, 2000... -

Page 46

... years from issuance. A summary of the status of the Company's GME stock options is presented below: Weighted-Average Exercise Price (Thousands of shares) Shares Balance, January 29, 2000 Granted Exercised Forfeited Balance, February 3, 2001 Granted Exercised Forfeited Balance, February 2, 2002... -

Page 47

... all insurance, taxes and other maintenance costs. Percentage rentals are based on sales performance in excess of specified minimums at various stores. Rental expense under operating leases are as follows: The Company leases one of its distribution facilities located in South Brunswick, New Jersey... -

Page 48

... Superior Court of California for the County of Orange (Case No. 03CC00088). The complaint alleges that the Company improperly classified the assistant store managers, department managers and receiving managers working in its California stores as salaried exempt employees. The complaint alleges that... -

Page 49

..., benefits administration, insurance (property, casualty, medical, dental, life, etc.), tax, traffic, fulfillment and telecommunications. In accordance with the terms of such agreements, the Company has received, and expects to continue to receive, fees in an amount equal to the direct costs plus... -

Page 50

...upon GameStop's total payroll expense, property and equipment, and insurance claim history. During fiscal 2002, these charges amounted to $1,726. In fiscal 2001, Barnes & Noble.com and GameStop entered into an agreement whereby Barnes & Noble.com's Web site refers customers to the GameStop Web site... -

Page 51

...2002 Annual Report 21. SELECTED QUARTERLY FINANCIAL INFORMATION (UNAUDITED) A summary of quarterly financial information for each of the last two fiscal years is as follows: Fiscal 2002 Quarter End On or About April 2002 July 2002 October 2002 January 2003 Total Fiscal Year 2002 Sales Gross profit... -

Page 52

... , I n c . 51 REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS The Board of Directors Barnes & Noble, Inc. We have audited the accompanying consolidated balance sheets of Barnes & Noble, Inc. and subsidiaries as of February 1, 2003 and February 2, 2002 and the related consolidated statements of... -

Page 53

... Public Affairs David S. Deason Vice President of Barnes & Noble Development Gary King Vice President and Chief Information Officer Joseph J. Lombardi Vice President and Controller Michelle Smith Vice President of Human Resources Dennis Williams Vice President and Director of Stores Michael N. Rosen... -

Page 54

...INFORMATION Corporate Headquarters: Barnes & Noble, Inc. 122 Fifth Avenue New York, New York 10011 (212) 633-3300 Common Stock: Fiscal Year High 2002 Low High 2001 Low New York Stock Exchange, Symbol: BKS Transfer Agent and Registrar: The Bank of New York Shareholder Relations Department P.O. Box... -

Page 55

... Phyllis Pellman Good, Good Books (87,794) Life Strategies Phillip C. McGraw, Ph.D., Hyperion (84,870) Rich Dad's Retire Young, Retire Rich Robert T. Kiyosaki, Sharon L. Lechter C.P.A., Warner (81,623) SLEEPERS The Power of Now: A Guide to Spiritual Enlightenment Eckhart Tolle, New World Library (71... -

Page 56

... the Age of Genocide Samantha Power Basic Books Biography & Autobiography Charles Darwin: The Power of Place Janet Browne Knopf Poetry Early Occult Memory Systems of the Lower Midwest B.H. Fairchild W.W. Norton Criticism Tests of Time William H. Gass Knopf DISCOVER AWARDS Fiction The Shell Collector... -

Page 57

-

Page 58

-

Page 59

Barnes & Noble, Inc â- 122 Fifth Avenue â- New Yo r k , NY 10011