Bank of the West 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

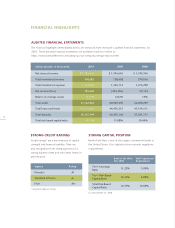

FINANCIAL HIGHLIGHTS

STRONG CREDIT RATINGS

Credit ratings* are a key measure of capital

strength and financial stability. They are

also recognition from rating agencies of a

strong balance sheet and consistent financial

performance.

* long-term deposit ratings

Moody’s A1

Standard & Poor’s A+

Fitch AA-

Agency Rating

As of December 31, 2010

STRONG CAPITAL POSITION

Bank of the West is one of the largest commercial banks in

the United States. Our capital position exceeds regulatory

requirements.

Tier 1 Leverage

Ratio 11.22% 5.00%

Tier 1 Risk-Based

Capital Ratio 13.32% 6.00%

Total Risk-Based

Capital Ratio 14.59% 10.00%

Bank of the West Well-Capitalized

Q4, 2010 Requirement

AUDITED FINANCIAL STATEMENTS

The financial highlights immediately below are extracted from the bank’s audited financial statements for

2010. These detailed financial statements are available in print or online at:

https://www.bankofthewest.com/about-us/our-company/annual-reports.html

20

(dollar amounts in thousands) 2010 2009 2008

Net interest income $ 1,783,045 $ 1,704,645 $ 1,749,346

Total noninterest income 358,682 158,408 279,016

Total noninterest expense 1,354,005 1,329,713 1,273,298

Net income (loss) 184,600 (403,356) 92,143

Return on average assets 0.31% (.63)% .15%

Total assets 57,652,826 60,000,590 66,890,239

Total loans and leases 43,115,160 44,476,351 47,194,511

Total deposits 39,547,244 40,205,146 37,261,171

Total risk based capital ratio 14.59% 11.08% 10.44%