Baker Hughes 2015 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2015 Baker Hughes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

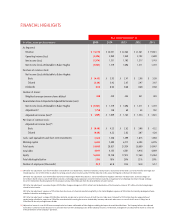

As a result of these industry dynamics,

customer activity and spending

declined significantly throughout

2015, which was reflected in the 46%

decline in the global rig count since

the fourth quarter of 2014. While

the decline in the North American

market was most severe, this has

truly been a global downturn.

The entire oilfield services industry was

negatively affected by these spending

cuts as the customer community

increasingly focused on reducing

costs and preserving cash flow. This

environment likewise had a negative

impact on our results as BakerHughes

reported a revenue decline of 36% to

$15.7 billion in 2015 compared to 2014.

On a GAAP basis, Baker Hughes

reported a net loss for 2015 of $2

billion ($4.49 per diluted share),

versus net income of $1.7billion

($3.92 per diluted share) in 2014.

Given the difficult market conditions

throughout 2015, we took significant

actions to align our business and cost

structure with the market environment,

while ensuring that the company’s

competitive position remained strong.

We also incurred merger-related

costs as we worked to close our

pending business combination with

Halliburton and plan for a successful

integration. Excluding these one-time

charges, adjusted net loss (a non-

GAAP measure) for 2015 was $209

million ($0.48 per diluted share).

Knowing that the market environment

was fluid and would remain

challenging throughout the year,

we managed the company with a

quarter-to-quarter focus, adapting to

the rapidly changing environment. In

short, we focused on controlling those

factors within our control, such as

efficiently managing our cost structure,

strengthening our cash performance

and balance sheet, improving

capital discipline, and delivering

innovative solutions and outstanding

performance to our customers.

In spite of the revenue headwinds, we

were able to contain losses by taking

actions to reduce costs companywide,

After years of growth, 2015 was an increasingly challenging

year marked by retrenchment, recalibration, transition and

transformation in the global oil and gas industry as the sector

wrestled with the impact of a supply-demand imbalance causing

oil prices to drop to seven-year lows by the end of the year.

TO OUR SHAREHOLDERS

Martin Craighead

CHAIRMAN AND CHIEF EXECUTIVE OFFICER