Avnet 2014 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2014 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

______________________

4,700 shares in May.

Item 6. Selected Financial Data

16

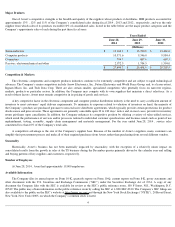

Period

Total Number

of Shares

Purchased

(1)

Average Price

Paid per Share

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs

Approximate Dollar

Value of Shares That

May Yet Be Purchased

Under the Plans

or Programs

April

3,800

$47.18

—

$223,223,000

May

180,774

$41.82

176,074

$215,860,000

June

—

—

—

$215,860,000

(1)

Consists of purchases of Avnet's common stock associated with the Company's ESPP as follows: 3,800 shares in April and

Years Ended

June 28,

2014 June 29,

2013 June 30,

2012 July 2,

2011 July 3,

2010

(Millions, except for per share and ratio data)

Income:

Sales

$

27,499.7

$

25,458.9

$

25,707.5

$

26,534.4

$

19,160.2

Gross profit

3,225.7

2,979.8

3,050.6

3,107.8

2,280.2

Operating income

(a)

789.9

626.0

884.2

930.0

635.6

Income tax expense

(b)

155.5

99.2

223.8

201.9

174.7

Net income

(c)

545.6

450.1

567.0

669.1

410.4

Financial Position:

Working capital

(d)

3,975.4

3,535.4

3,455.7

3,749.5

3,190.6

Total assets

11,255.5

10,474.7

10,167.9

9,905.6

7,782.4

Long-term debt

1,213.8

1,207.0

1,272.0

1,273.5

1,243.7

Shareholders’ equity

4,890.2

4,289.1

3,905.7

4,056.1

3,009.1

Per Share:

Basic earnings

3.95

3.26

3.85

4.39

2.71

Diluted earnings

3.89

3.21

3.79

4.34

2.68

Cash dividends paid

0.60

—

—

—

—

Book value per diluted share

34.90

30.64

26.12

26.28

19.66

Ratios:

Operating income as a

percentage of sales

2.9

%

2.5

%

3.4

%

3.5

%

3.3

%

Net income as a percentage of

sales

2.0

%

1.8

%

2.2

%

2.5

%

2.1

%

Return on capital

11.4

%

10.6

%

12.9

%

15.2

%

14.0

%

Quick ratio

1.2:1

1.2:1

1.2:1

1.2:1

1.4:1

Working capital

(d)

1.8:1

1.7:1

1.7:1

1.8:1

1.9:1

Total debt to capital

29.8

%

32.3

%

35.4

%

27.2

%

29.8

%

(a)

All fiscal years presented include restructuring, integration and other expenses, which totaled $94.6 million before tax, $70.8 million after

tax and $0.50 per share on a diluted basis in fiscal 2014, $149.5 million before tax, $116.4 million after tax and $0.83 per share on a diluted

basis in fiscal 2013, $73.6 million before tax, $53.0 million after tax and $0.35 per share on a diluted basis in fiscal 2012, $77.2 million

before tax, $56.2 million after tax and $0.36 per share on a diluted basis in fiscal 2011 and $25.4 million before tax, $18.8 million after tax

and $0.12 per share on a diluted basis in fiscal 2010.

(b)

Certain fiscal years presented included the impact of tax benefits primarily due to the release of valuation allowances net of additional

reserves including $43.8 million and $0.31 per share on a diluted basis in fiscal 2014, $50.4 million and $0.36