Avnet 2011 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2011 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Issuer Purchases of Equity Securities

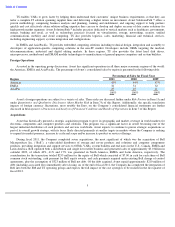

The following table presents the Company’s monthly purchases of common stock during the fourth quarter of fiscal 2011:

The purchases of Avnet common stock noted above were made on the open market to obtain shares for purchase under the

Company’s Employee Stock Purchase Plan.

In August 2011, the Board of Directors approved the repurchase of up to an aggregate of $500 million of shares of the

Company’

s common stock through a share repurchase program. The Company plans to repurchase stock from time to time at the

discretion of management in open market or privately negotiated transactions or otherwise, subject to applicable laws, regulations and

approvals, strategic considerations, market conditions and other factors. The Company may terminate or limit the stock repurchase

program at any time without prior notice.

15

Maximum Number (or

Total Number of

Approximate Dollar

Total

Shares Purchased as

Value) of Shares That

Number of

Part of Publicly

may yet be Purchased

Shares

Average Price

Announced Plans or

Under the Plans or

Period

Purchased

Paid per Share

Programs

Programs

April

4,100

$

34.80

—

—

May

6,700

$

37.07

—

—

June

4,300

$

31.74

—

—

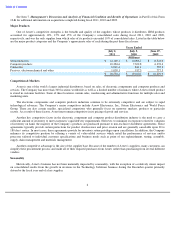

Item 6.

Selected Financial Data

Years Ended

July 2,

July 3,

June 27,

June 28,

June 30,

2011

2010

2009 (a)

2008 (a)

2007 (a)

(Millions, except for per share and ratio data)

Income:

Sales

$

26,534.4

$

19,160.2

$

16,229.9

$

17,952.7

$

15,681.1

Gross profit

3,107.8

2,280.2

2,023.0

2,313.7

2,048.6

Operating income (loss)

930.0

(b)

635.6

(c)

(1,019.0

)(d)

710.8

(e)

678.7

(f)

Income tax provision

201.9

(b)

174.7

(c)

34.7

(d)

203.8

(e)

187.9

(f)

Net income (loss)

669.1

(b)

410.4

(c)

(1,129.7

)(d)

489.6

(e)

384.4

(f)

Financial Position:

Working capital(g)

3,749.5

3,190.6

2,688.4

3,191.3

2,711.2

Total assets

9,905.6

7,782.4

6,273.5

8,195.2

7,343.7

Long

-

term debt

1,273.5

1,243.7

946.6

1,169.3

1,127.9

Shareholders

’

equity

4,056.1

3,009.1

2,760.9

4,141.9

3,417.4

Per Share:

Basic earnings (loss)

4.39

(b)

2.71

(c)

(7.49

)(d)

3.26

(e)

2.60

(f)

Diluted earnings (loss)

4.34

(b)

2.68

(c)

(7.49

)(d)

3.21

(e)

2.57

(f)

Book value per diluted share

26.28

19.66

18.30

27.17

22.84

Ratios:

Operating income (loss) margin on

sales

3.5

%(b)

3.3

%(c)

(6.3)

%(d)

4.0

%(e)

4.3

%(f)

Net income (loss) margin on sales

2.5

%(b)

2.1

%(c)

(7.0)

%(d)

2.7

%(e)

2.5

%(f)

Return on capital

15.2

%(b)

14.0

%(c)

(26.6)

%(d)

11.0

%(e)

11.2

%(f)

Quick

1.2:1

1.4:1

1.5:1

1.4:1

1.3:1

Working capital

1.8:1

1.9:1

2.1:1

2.1:1

2.0:1

Total debt to capital

27.2

%

29.8

%

26.0

%

22.7

%

25.7

%