Avnet 2007 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2007 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

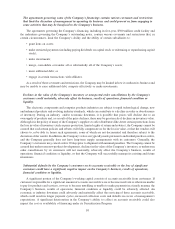

On July 5, 2005, the Company completed the acquisition of Memec, a global distributor that marketed and sold

a portfolio of semiconductor devices from industry-leading suppliers, and a provider of engineering expertise and

design services. The acquisition of Memec is the Company’s largest acquisition to date, based on annual sales.

Memec recorded sales of $2.28 billion in the twelve months prior to the July 5, 2005 close of the acquisition. The

consideration for the Memec acquisition consisted of stock and cash valued at approximately $506.9 million,

including transaction costs, plus the assumption of approximately $240.0 million of Memec’s net debt (debt less

cash acquired). Under the terms of the purchase agreement, Memec investors received approximately

24.011 million shares of Avnet common stock plus approximately $64.0 million in cash. The shares of Avnet

common stock were valued at $17.42 per share, which represents the five-day average stock price beginning two

days before the acquisition announcement on April 26, 2005.

Avnet has historically pursued a strategic acquisition program to grow its presence in world markets for

electronic components and computer products. This program was a significant factor in Avnet becoming one of the

largest industrial distributors of such products worldwide. Avnet will continue to pursue strategic acquisitions as

part of its overall growth strategy, with its focus likely directed at smaller targets in markets where the Company is

seeking to expand its global presence or to increase its scale and scope where an acquisition may be beneficial.

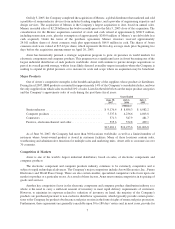

Major Products

One of Avnet’s competitive strengths is the breadth and quality of the suppliers whose products it distributes.

During fiscal 2007, IBM products accounted for approximately 14% of the Company’s consolidated sales, and was

the only supplier from which sales exceeded 10% of sales. Listed in the table below are the major product categories

and the Company’s approximate sales of each during the past three fiscal years:

June 30,

2007

July 1,

2006

July 2,

2005

Years Ended

(Millions)

Semiconductors ................................... $ 9,176.4 $ 8,896.3 $ 6,082.2

Computer products ................................ 5,337.8 4,236.6 4,003.8

Connectors ...................................... 571.3 547.9 481.7

Passives, electromechanical and other ................... 595.6 572.8 499.1

$15,681.1 $14,253.6 $11,066.8

As of June 30, 2007, the Company had more than 300 locations worldwide, as well as a limited number of

instances where Avnet-owned product is stored in customer facilities. Many of these locations contain sales,

warehousing and administrative functions for multiple sales and marketing units. Avnet sells to customers in over

70 countries.

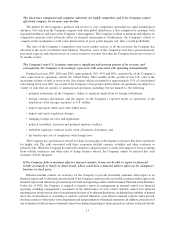

Competition & Markets

Avnet is one of the world’s largest industrial distributors, based on sales, of electronic components and

computer products.

The electronic component and computer products industry continues to be extremely competitive and is

subject to rapid technological advances. The Company’s major competitors include Arrow Electronics, Inc., Future

Electronics and World Peace Group. There are also certain smaller, specialized competitors who focus upon one

market or product or a particular sector. As a result of these factors, Avnet must remain competitive in its pricing of

goods and services.

Another key competitive factor in the electronic component and computer product distribution industry as a

whole is the need to carry a sufficient amount of inventory to meet rapid delivery requirements of customers.

However, to minimize its exposure related to valuation of inventory on hand, the majority of the Company’s

products are purchased pursuant to non-exclusive distributor agreements, which typically provide certain protec-

tions to the Company for product obsolescence and price erosion in the form of rights of return and price protection.

Furthermore, these agreements are generally cancelable upon 30 to 180 days’ notice and, in most cases, provide for

7