Avnet 2007 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2007 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

consolidated sales were impacted by the Access and Azure acquisitions, the businesses divested in fiscal 2006 and

the change to net revenue reporting.

Avnet’s ongoing focus on the management of operating costs and returns on capital has resulted in its highest

level of operating income, operating income margin and returns on capital since before the multi-year economic and

industry downturn that began in 2001. On a consolidated basis, operating income grew 56.6% to a record

$678.3 million as compared with fiscal 2006 operating income of $433.1 million. Operating profit margin also

increased year over year to 4.3%, up 129 basis points from 3.0% in the prior fiscal year. Both operating groups

contributed to the year-over-year increase in operating profit margin, with EM and TS reporting operating profit

margins of 5.5% (an increase of 95 basis points) and 3.9% (an increase of 55 basis points), respectively, for fiscal

2007. For EM, the fourth quarter of fiscal 2007 marks the sixth quarter in a row that operating income margin is over

5.0%. For TS, the fourth quarter of fiscal 2007 marks the sixteenth consecutive quarter of year-over-year

improvement in both operating income dollars and margin. The consolidated current and prior year results

included certain restructuring, integration and other items discussed further in this MD&A, which amounted to

$7.4 million for fiscal 2007 and $69.9 million ($9.0 million of which was included in “cost of sales”) for the prior

year. Despite these charges, the year-over-year operating income improved primarily as a result of continued focus

on profitable growth, cost efficiencies and the effect of the realization of a full year of synergies after the successful

integration of the Memec acquisition.

Operating efficiency and working capital management will remain a key focus of Avnet’s overall value-based

management initiatives to increase return on capital and its efforts to continue to grow profitability at a faster rate

than its growth in revenues.

It is difficult for the Company, as a distributor, to forecast the material trends of the electronic component and

computer products industry, aside from some of the normal seasonality discussed herein, because Avnet does not

typically have material forward-looking information available from its customers and suppliers beyond a few

months of forecast information by way of incoming order rates. As such, management relies on the publicly

available information published by certain industry groups and other related analyses in evaluating its business

plans in the longer term.

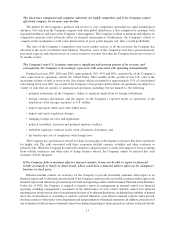

Sales

The table below provides a year-over-year summary of sales for the Company and its operating groups:

Three-Year Analysis of Sales: By Operating Group and Geography

June 30,

2007

%of

Total

July 1,

2006

%of

Total

July 2,

2005

%of

Total

2007 to

2006

2006 to

2005

Years Ended Percent Change

(Dollars in millions)

Sales by Operating Group:

EM................. $ 9,679.8 61.7% $ 9,262.4 65.0% $ 6,259.0 56.6% 4.5% 48.0%

TS ................. 6,001.3 38.3 4,991.2 35.0 4,807.8 43.4 20.2 3.8

$15,681.1 $14,253.6 $11,066.8 10.0 28.8

Sales by Geographic Area:

Americas............. $ 7,826.2 49.9% $ 7,223.9 50.7% $ 5,804.9 52.4% 8.3% 24.4%

EMEA .............. 4,885.7 31.2 4,374.2 30.7 3,669.8 33.2 11.7 19.2

Asia/Pacific . . . ........ 2,969.2 18.9 2,655.5 18.6 1,592.1 14.4 11.8 66.8

$15,681.1 $14,253.6 $11,066.8 10.0 28.8

20