Avnet 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2002

Unprecedented Environment. Unprecedented Action. Unprecedented Opportunity.

Table of contents

-

Page 1

Annual Report 2002 Unprecedented Environment. Unprecedented Action. Unprecedented Opportunity. -

Page 2

... and electromechanical components; enterprise network and computer equipment; and embedded subsystems from leading manufacturers. Serving customers around the world, Avnet markets, inventories and adds value to these products and provides world-class technical and supply-chain management services. -

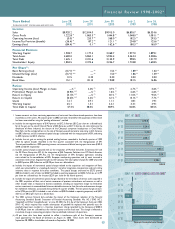

Page 3

... gain on the sale of Channel Master of $33.8 pre-tax and $17.2 after-tax, (ii) costs relating to the divestiture of Avnet Industrial, the closure of the Company's corporate headquarters in Great Neck, New York, and the anticipated loss on the sale of Company-owned real estate, amounting to $13.3 pre... -

Page 4

... year, the Company attained cost savings from global economies of scale that were created during the previous decade's aggressive acquisition period. STRENGTHENING AVNET'S FINANCIAL POSITION Since December 2000, Avnet's management team has concentrated on removing cost and working capital from our... -

Page 5

..., software and services for value-added resellers, and enterprise solutions for end users. Applied Computing (AC) AC markets and adds value through engineering assistance, supply-chain management and end product integration to embedded technology subsystems, including computer platforms and servers... -

Page 6

..., Bob Mason joined the Company as chief information officer, chartered with leveraging our investments and globalizing our capabilities. At Avnet, we believe that having best-in-class 1997 CALENDAR YEAR SALES IN BILLIONS Avnet Arrow Future Electronics Pioneer-Standard Memec Bell Micro $10.6 $10... -

Page 7

... market share. During the '90s, the Company focused more on mergers and acquisitions, growing earnings and leveraging the economies of scale we had built.Today, we possess a new code.With a fervent commitment to value-based management, we have aligned our culture, goals, structure and compensation... -

Page 8

... of the technology supply chain, Computer Marketing markets high-end enterprise computing products and services to global companies. At the back end, Electronics Marketing sells electronic components and services to electronics manufacturing customers. And in the middle, Applied Computing serves the... -

Page 9

... 4.3% 7.0% Semiconductors $4.43 Computer Products $3.48 Connectors $0.38 Passives, $0.63 Electromechanical and Other investment opportunity From a broad array of components and computing systems to the services that support them, Avnet creates value across the technology supply... -

Page 10

...employees and shareholders as the premier technology marketing and services company, globally. Financial Objective Avnet strives to create shareholder value while stabilizing earnings growth by: • Improving return on capital employed (ROCE) through the creation of a value-based management culture... -

Page 11

...of incorporation or organization) 11-1890605 (I.R.S. Employer IdentiÃ'cation No.) 2211 South 47th Street, Phoenix, Arizona (Address of principal executive oÇces) 85034 (Zip Code) Registrant's telephone number, including area code (480) 643-2000 Securities registered pursuant to Section 12(b) of... -

Page 12

...Disclosures About Market Risk Financial Statements and Supplementary Data Changes in and Disagreements with Accountants on Accounting and Financial Disclosures PART III Directors and Executive OÇcers Executive Compensation Security Ownership of Certain BeneÃ'cial Owners and Management Certain... -

Page 13

...distributors of electronic components and computer products may increase signiÃ'cantly through industry consolidation, entry of new competitors or otherwise. ‚ General... impact our credit ratings and debt covenant compliance. ‚ Costs or diÇculties related to the integration into Avnet of newly-... -

Page 14

...marketing, assembly and/or distribution of electronic and electromechanical components and certain computer products, principally for industrial and some commercial and military use. EM also oÃ...ers an array of value-added services to its customers, such as supply-chain management, engineering design... -

Page 15

..., South Africa, Turkey, Egypt and Israel. ‚ EM Asia is a value-added distributor of electronic components and services in 10 Asian countries and Australia and New Zealand. All of EM Asia's operations have access to the products and services provided by EM globally. The 2001 acquisition of Sunrise... -

Page 16

...-chain services to OEMs, contract manufacturers and electronic component manufacturers. Computer Marketing (""CM'') CM is an international distributor/reseller of computer products to VARs and end users focusing primarily on middle- to high-end, value-added computer products and services. CM's 2002... -

Page 17

... as part of the VEBA Group of companies. AC's European operations accounted for over half of the operating group's sales in 2002. SigniÃ'cant Acquisitions To better focus on its core business and to grow Avnet's presence in world markets for electronic components and computer products, Avnet has... -

Page 18

... Cosco Electronics/Jung Kwang PCD Italia S.r.l. and Matica S.p.A. Orange Coast Companies(B) Marshall Industries SEI Macro Group Integrand Solutions Advacom, Inc.(B) Sabre-Data, Inc.(B) North America China Israel Germany North America Netherlands Netherlands Korea Italy North America North America... -

Page 19

...reÃ-ected as opening balance sheet adjustments recorded as part of purchase accounting. In May 2001, Avnet acquired Sunrise, a privately held, electronic components distribution company serving indigenous and multinational OEMs and contract manufacturers in the PRC and Hong Kong. The acquisition has... -

Page 20

... a small number of stores in customers' facilities. Avnet sells to customers in over 60 countries. Competition & Markets The Company is currently the world's largest industrial distributor (based on sales) of electronic components and computer products according to Electronic News, a prominent... -

Page 21

...of space, respectively, of which approximately 56% is located in the United States. EM's principal facilities for warehousing and value-added operations are located in Chandler, AZ, Poing, Germany, Tongeren, Belgium, Oxford, NC, and Grapevine, TX, where EM has approximately 395,000, 230,000, 217,000... -

Page 22

In early May 2002, the Company and the current owner of property in Huguenot, New York were named as PRPs by the New York State Department of Environmental Conservation (""NYSDEC'') regarding an environmental clean-up site. The estimated cost of the environmental clean-up of the site, based on ... -

Page 23

The current executive oÇcers of the Company are: Name Age OÇce Roy Vallee David R. Birk Andrew S. Bryant Edward Kamins Raymond Sadowski Richard Hamada John F. Cole 50 55 47 53 48 44 60 Chairman of the Board and Chief Executive OÇcer Senior Vice President, General Counsel and Secretary ... -

Page 24

PART II Item 5. Market for Registrant's Common Equity and Related Stockholder Matters Market price per share.* The Company's common stock is listed on the New York Stock Exchange and the PaciÃ'c Exchange. Quarterly market prices (as reported for the New York Stock Exchange composite transactions) ... -

Page 25

... the sale of Channel Master of $33.8 pre-tax and $17.2 after-tax, (ii) costs relating to the divestiture of Avnet Industrial, the closure of the Company's corporate headquarters in Great Neck, New York, and the anticipated loss on the sale of Company-owned real estate, amounting to $13.3 pretax and... -

Page 26

... 2002. The net special charges amounted to $79.6 pre-tax ($21.6 included in cost of sales and $58.0 included in operating expenses) and $62.1 aftertax, or $0.52 per share on a diluted basis. (f) The 2002 summary Ã'nancial data excludes the impact of the Company's adoption of the Financial Accounting... -

Page 27

... EM, retired from the Company eÃ...ective June 28, 2002 in conjunction with the close of the Ã'scal year. Andrew Bryant, a 22-year Avnet employee and prior president of CM, was appointed the new global president of EM. Richard Hamada, a 20-year Avnet employee, was promoted to president of CM worldwide... -

Page 28

... cost (Ã'rst in ÃŒ Ã'rst out) or estimated market value. The Company's inventories include high-technology components, embedded systems and computing technologies sold into rapidly changing, cyclical and competitive markets whereby such inventories may be subject to early technological obsolescence... -

Page 29

... Company's consolidated Ã'nancial statements. In June 2002, the FASB issued Statement of Financial Accounting Standards No. 146 (""SFAS 146''), ""Accounting for Costs Associated with Exit or Disposal Activities.'' SFAS 146 supercedes former guidance addressing the Ã'nancial accounting and reporting... -

Page 30

... decline in semiconductor sales on a global level. This may also be indicative of a technology industry shift in revenue mix away from the Americas, which declined year-over-year, partly toward the Asia region where Avnet's 2002 operations were also bolstered by the acquisition of Sunrise late in... -

Page 31

... and other non-recurring items, generally taken in response to business conditions at the time of the charge. Management believes that the Company's future results of operations will continue to beneÃ't from the cost savings resulting from its acquisitions and integrations of new businesses and 20 -

Page 32

... the Kent acquisition, net of approximately $16.0 million pre-tax in cash recoveries of certain charges recorded as part of the special charges taken in the fourth quarter of 2001. The write-downs of Kent-related assets were recorded at the earliest date that management had suÇcient information to... -

Page 33

... of costs incurred in completing the acquisition, including signiÃ'cant change-in-control and other executive beneÃ'trelated payments made as a result of the acquisition ($68.3 million), professional fees for investment banking, legal and accounting services rendered to both Avnet and Kent ($12... -

Page 34

...EM's European operations consisted primarily of costs related to the centralization of warehousing operations into the Company's new facility in Tongeren, Belgium. These charges were for severance, adjustment of the carrying value of Ã'xed assets, real property lease terminations, duplicate employee... -

Page 35

.... Operating proÃ't margins before special charges in 2002 deteriorated substantially from 2001 and 2000 levels. However, management believes that the combination of cost savings derived from synergies realized from the Company's recent acquisitions as well as restructured operations and additional... -

Page 36

..., for working capital and acquisitions, net of cash received from dispositions of businesses, during 2000 and 2001. Interest expense in 2001 compared to 2000 was also impacted by increased interest rates as a result of the Federal Reserve's actions to increase short-term rates and the Company... -

Page 37

... there was an impairment of goodwill related to the Company's EM and CM operations in both EMEA and Asia. The Company identiÃ'ed no impairment of goodwill in the Americas region. In the second step of the process, the implied fair value of the aÃ...ected reporting unit's goodwill was compared to its... -

Page 38

... Company also used $34.1 million for acquisitions of operations and investments during 2002. The combined net cash proceeds discussed above of $869.0 million along with $394.3 million of cash generated from new long-term debt Ã'nancing were used to repay $150.0 million under the accounts receivable... -

Page 39

...These Ã'nancing arrangements include public bonds, short-term and long-term bank loans, commercial paper and an accounts receivable securitization program. For a detailed description of the Company's external Ã'nancing arrangements outstanding at June 28, 2002, please refer to Note 7 in the notes to... -

Page 40

... Ã'nancing arrangements, the Company has several small lines of credit in various locations to fund the short-term working capital, foreign exchange, overdraft and letter of credit needs of its wholly owned subsidiaries in Europe and Asia. These facilities are generally guaranteed by Avnet. The 29 -

Page 41

... these facilities at June 28, 2002. The Company is also required to maintain minimum senior unsecured credit ratings in order to continue using the receivable securitization program in its present form. If the Company's credit rating is reduced below Baa3 and BBB¿ by Moody's Investors Services, Inc... -

Page 42

...classiÃ'ed as current a total of $796.8 million of debt related to both the Kent 4.5% Convertible Notes due 2004, substantially all of which were ""put'' back to the Company in 2002, and amounts outstanding under a long-term bank facility the Company was in the process of renegotiating at the end of... -

Page 43

... fair value of the forward foreign exchange contracts at June 28, 2002, which would generally be oÃ...set by an opposite eÃ...ect on the related hedged positions. Item 8. Financial Statements and Supplementary Data The Ã'nancial statements and supplementary data are listed under Item 14 of this Report... -

Page 44

... qualiÃ'ed or modiÃ'ed as to uncertainty, audit scope or accounting principles. During the two most recent Ã'scal years of Avnet ended June 28, 2002 and June 29, 2001, through the date of Arthur Andersen's dismissal, neither the Company nor anyone on its behalf consulted with KPMG regarding any of... -

Page 45

... 7, 2002. Item 12. Security Ownership of Certain BeneÃ'cial Owners and Management The information called for by Item 12 (except for the Equity Compensation Plan Information set forth below) is incorporated in this Report by reference to the Company's deÃ'nitive proxy statement relating to the Annual... -

Page 46

... and 5,400 for Ã'scal 2002, 2001 and 2000, respectively. Item 13. Certain Relationships and Related Transactions The information called for by Item 13 is incorporated in this Report by reference to the Company's deÃ'nitive proxy statement relating to the Annual Meeting of Stockholders anticipated to... -

Page 47

..., Avnet's Chairman and CEO, at the JP Morgan 30th Annual H&Q Technology Conference; (5) Current Report on Form 8-K bearing cover date of May 13, 2002 in which the Company reported under Item 5 that it issued a press release announcing the speech of Roy Vallee at the Merrill Lynch 23rd Annual EMS... -

Page 48

... indicated on September 26, 2002. Signature Title /s/ ROY VALLEE Roy Vallee Chairman of the Board, Chief Executive OÇcer and Director Director ... LAWRENCE W. CLARKSON Lawrence W. Clarkson Director /s/ EHUD HOUMINER Ehud Houminer Director /s/ JAMES A. LAWRENCE James A. Lawrence Director... -

Page 49

Signature Title /s/ GARY L. TOOKER Gary L. Tooker Director /s/ RAYMOND SADOWSKI Raymond Sadowski Senior Vice President, Chief Financial OÇcer and Assistant Secretary Controller and Principal Accounting OÇcer /s/ JOHN F. COLE John F. Cole 38 -

Page 50

... information included in this annual report, fairly present in all material respects the Ã'nancial condition, results of operations and cash Ã-ows of the registrant as of, and for, the periods presented in this annual report. 3. Date: September 26, 2002 /s/ ROY VALLEE Roy Vallee Chief Executive... -

Page 51

CERTIFICATION OF CHIEF FINANCIAL OFFICER I, Raymond Sadowski, Chief Financial OÇcer of Avnet, Inc., certify that: 1. 2. I have reviewed this annual report on Form 10-K of Avnet, Inc.; Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state... -

Page 52

... material respects, the information set forth therein. As discussed in Note 6 to the consolidated Ã'nancial statements, the Company changed its method of accounting for goodwill and other intangible assets during its Ã'scal year ended June 28, 2002. /s/ Phoenix, Arizona August 7, 2002 KPMG LLP 41 -

Page 53

... and the schedule referred to below are the responsibility of the Company's management. Our responsibility is to express an opinion on these Ã'nancial statements based on our audits. We did not audit the Ã'nancial statements of Kent Electronics Corporation and Subsidiaries, a company acquired during... -

Page 54

... are the responsibility of the Company's management. Our responsibility is to express an opinion on these Ã'nancial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we... -

Page 55

... assets Property, plant and equipment, net (Note 5 Goodwill (Note 6 Other assets Total assets Liabilities: Current liabilities: Borrowings due within one year (Note 7 Accounts payable Accrued expenses and other (Note 8 Total current liabilities Long-term debt, less due within one year... -

Page 56

... June 30, 2002 2001 2000 (Thousands, except per share amounts) Sales Cost of sales (Note 17 Gross proÃ't Selling, general and administrative expenses (Note 17 Operating income (loss Other income, net Interest expense Income (loss) from continuing operations before income taxesÃÃ Income tax... -

Page 57

...30 per share Acquisitions of operations Kent's net income for the quarter ended June 30, 2000 (Note 2) ÃÃÃ Other, net, principally stock option and incentive programs Balance, June 29, 2001 Net loss Translation adjustments (Note 4) ÃÃ Minimum pension liability adjustment, net of tax of $11... -

Page 58

... accounting principle (Note 6 Net income (loss) from continuing operations Non-cash and other reconciling items: Depreciation and amortization Deferred taxes (Note 9 Other, net (Note 15 Changes in (net of eÃ...ects from businesses acquisitions and dispositions): Receivables Inventories Payables... -

Page 59

... Ì over the applicable remaining lease term or useful life if shorter. Internal use software costs are expensed or capitalized depending upon the stage of the project, in accordance with the AICPA's Statement of Position 98-1, ""Accounting for the Costs of Computer Software Developed or Obtained... -

Page 60

... accounts receivable. The Company invests its excess cash primarily in overnight Eurodollar time deposits and institutional money market funds with quality Ã'nancial institutions. The Company sells electronic components and computer products primarily to original equipment manufacturers, including... -

Page 61

..., including cash and cash equivalents, receivables and accounts payable approximate their fair values at June 28, 2002 due to the short-term nature of these instruments. See Note 7 for further discussion of the fair value of the Company's Ã'xed rate long-term debt instruments and see Investments for... -

Page 62

... consisted of Marshall Industries, Integrand Solutions, Eurotronics B.V., the SEI Macro Group, PCD Italia S.r.l. and Matica S.p.A. (counted as a single acquisition), Cosco Electronics/Jung Kwang, the remaining 60% of SEI Nordstar S.p.A and Orange Coast Data Comm, Inc., Orange Coast Cabling, Inc. and... -

Page 63

... stock options (net of related tax beneÃ'ts of $454,000), less a receivable of $25,299,000 for income tax credits related to the acquisition of the VEBA Group. In addition, the Company paid $79,063,000 of Kent acquisition-related costs, consisting primarily of change-in-control and other executive... -

Page 64

... of $1,570,000 of cash on the books of the companies acquired), of which $675,030,000 was paid in cash, $351,877,000 in Avnet stock, $11,745,000 in Avnet stock options ($6,985,000 net of related tax beneÃ'ts) and amounts payable at June 30, 2000 of $854,000. In the aggregate, the operations acquired... -

Page 65

... selling, general and administrative expenses. The Company measures the fair value of its retained interests at the time of a securitization and throughout the term of the Program using a present value model incorporating two key assumptions: (1) a weighted average life of 45 days and (2) a discount... -

Page 66

... of operations as part of the realized gains and losses recorded during the year ended June 29, 2001. 5. Property, plant and equipment, net: Property, plant and equipment are recorded at cost and consist of the following: June 28, June 29, 2002 2001 (Thousands) Land Buildings Machinery, Ã'xtures... -

Page 67

... eÃ...ective on June 30, 2001, the date the Company early adopted the provisions of SFAS 142. The following table presents the pro forma Ã'nancial results for 2001 and 2000, respectively, on a basis consistent with the new accounting principle applied in 2002: Years Ended June 28, June 29, June 30... -

Page 68

..., for the periods presented: Electronics Marketing Computer Applied Marketing Computing (Thousands) Total Carrying value at June 29, 2001 Cumulative eÃ...ect of change in accounting principle Other Carrying value at June 28, 2002 7. External Ã'nancing: Short-term debt consists of the following... -

Page 69

... on October 23, 2002 and provides up to $488,750,000 in Ã'nancing. Management does not intend to renew this facility upon its expiration. The term loan facility, which matured on November 16, 2001, was a U.S. dollar facility that provided up to $82,500,000 in Ã'nancing. The Company may select from... -

Page 70

... of the following: June 28, June 29, 2002 2001 (Thousands) Payroll, commissions and related Insurance Income taxes Dividends payable Other $117,221 14,654 14,983 ÃŒ 179,435 $326,293 $122,979 18,647 4,543 8,840 259,731 $414,740 The Company had decided to more eÃ...ectively deploy its cash... -

Page 71

... rate and the eÃ...ective tax rate is as follows: June 28, 2002 Years Ended June 29, June 30, 2001 2000 Federal statutory rate State and local income taxes, net of federal beneÃ't Amortization and disposition of goodwill Non-deductible costs related to the acquisition of Kent (Note 17) Impairment... -

Page 72

...a beneÃ't based upon a percentage of current salary, which varies with age, and interest credits. At June 28, 2002, the market value of the pension plan assets was $141,130,000. These assets were comprised of common stocks (58%), corporate debt obligations (27%), U.S. Government securities (13%) and... -

Page 73

...follows: 2002 2001 Discount rate Expected return on plan assets 7.50% 8.25% 9.50 9.50 Under the cash balance plan, service costs are based solely on current year salary levels; therefore, projected salary increases are not taken into account. Components of net periodic pension costs during the... -

Page 74

... 2006 98,500 159,250 85% November 19, 2007 95,150 85% November 21, 2009 2,148,675 As applicable, the excess of the fair market value at the date of grant over the exercise price is considered deferred compensation, which is amortized and charged against income as it is earned. The maximum term of... -

Page 75

... plan: In October 1995, the Company implemented the Avnet Employee Stock Purchase Plan (""ESPP''). Under the terms of the ESPP, eligible employees of the Company are oÃ...ered options to purchase shares of Avnet common stock at a price equal to 85% of the fair market value on the Ã'rst or last day... -

Page 76

... forma information: The Company follows Accounting Principles Board Opinion No. 25 (""APB 25''), ""Accounting for Stock Issued to Employees,'' in accounting for its stock-based compensation plans. In applying APB 25, no expense was recognized for options granted under the various stock option plans... -

Page 77

... threatened litigation, taxes and environmental and other matters. The Company has been designated a potentially responsible party or has had other claims made against it in connection with environmental clean-ups at several sites. Based upon the information known to date, the Company believes that... -

Page 78

...Income taxes 16. Segment information: $126,945 40,109 $183,236 201,578 $ 82,860 227,901 The Company currently consists of three major operating units: Electronics Marketing (""EM''), Computer Marketing (""CM'') and Applied Computing (""AC''), which began operating in the Americas and in Europe... -

Page 79

... the needs of embedded systems OEMs that require technical services such as product prototyping, conÃ'gurations and other value-added services. June 28, 2002 Years Ended June 29, 2001 (Millions) June 30, 2000 Sales: Electronics Marketing Computer Marketing Applied Computing $4,841.9 2,399... -

Page 80

.... AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS ÃŒ (Continued) June 28, 2002 Years Ended June 29, 2001 (Millions) June 30, 2000 Sales, by geographic area, are as follows: Americas EMEA (Europe, Middle East and Africa Asia/PaciÃ'c $5,295.2 2,900.3 724.7 $8,920.2 $ 8,746.0 3,511... -

Page 81

... in the Kent acquisition, net of approximately $16,037,000 pre-tax in cash recoveries of certain charges recorded as part of the special charges taken in the fourth quarter of 2001. The write-downs of Kent-related assets were recorded at the earliest date that management had suÇcient information to... -

Page 82

...of costs incurred in completing the acquisition including signiÃ'cant change-in-control and other executive beneÃ't-related payments made as a result of the acquisition ($68,343,000 pre-tax), professional fees for investment banking, legal and accounting services rendered to both Avnet and Kent ($12... -

Page 83

... at June 28, 2002. During the Ã'rst quarter of 2000, the Company recorded $6,111,000 pre-tax and $3,976,000 after-tax ($0.04 per share on a diluted basis) of incremental special charges associated with the reorganization of the EM European operations consisting primarily of costs related to the... -

Page 84

... expenses) and $62.1 million after-tax, or $0.52 per share on a diluted basis for the fourth quarter and year ended June 28, 2002. (c) Includes the impact of incremental special charges associated with the acquisition and integration of Kent and for costs related to actions taken in response to... -

Page 85

SCHEDULE II AVNET, INC. AND SUBSIDIARIES VALUATION AND QUALIFYING ACCOUNTS Years Ended June 28, 2002, June 29, 2001 and June 30, 2000 Column A Column B Balance at beginning of period Column C Additions Charged to Charged to costs and other accountsexpenses describe (Thousands) Column D Column E ... -

Page 86

... Arrow Electronics, Inc., Avnet, Inc. and Cherrybright Limited (incorporated herein by reference to the Company's Current Report on Form 8-K dated September 22, 2000, Exhibit 2).* Amended and Restated Agreement and Plan of Merger dated as of March 21, 2001, between the Company and Kent Electronics... -

Page 87

.... 10W. 10X. 10Y. 10Z. Managing Director Contract dated January 22, 2001 between the Company's Avnet Alfapower GmbH subsidiary and Axel Hartstang (incorporated by reference to the Company's Current Report on Form 8-K dated as of February 12, 2000, Exhibit 99). Employment Agreement dated May 1, 2000... -

Page 88

...as of February 6, 2002 among Avnet Receivables Corporation, as Seller, Avnet, Inc., as Servicer, the Companies, as deÃ'ned therein, the Financial Institutions, as deÃ'ned therein, and Bank One, NA (Main OÇce Chicago) as Agent (incorporated herein by reference to the Company's Current Report on Form... -

Page 89

... LLP. Notice regarding consent of Arthur Andersen LLP. Consent of Grant Thornton LLP. CertiÃ'cation by Roy Vallee, Chief Executive OÇcer, under Section 906 of the Sarbanes-Oxley Act of 2002. CertiÃ'cation by Raymond Sadowski, Chief Financial OÇcer, under Section 906 of the Sarbanes-Oxley Act of... -

Page 90

...at www.ir.avnet.com. Form 10-K A copy of the Company's Annual Report on Form 10-K, filed in September 2002 with the Securities and Exchange Commission, may be obtained by writing to Investor Relations, at the executive offices address or visit Avnet's Investor Relations Web site at www.ir.avnet.com... -

Page 91