Aviva 2001 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2001 Aviva annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

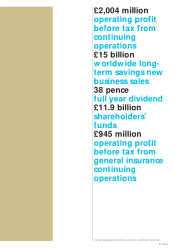

06 CGNU plc Annual report + accounts 2001

Overview

Introduction During my first year as group chief executive of

CGNU we have taken further important steps forward in line with

our strategic objectives. Significant progress has been made in

repositioning and strengthening the group as one of the world’s

major insurers while, at the same time, achieving increased operating

profit and record long-term savings new business sales.

Our focus is on our three core businesses – long-term savings, fund

management and general insurance. Some 70% of our premiums

come from long-term savings, with the remaining 30% from general

insurance (2000: 67%-33%).Ninety per cent of our total business

comes from Europe, which makes CGNU’s presence in Europe the

largest of any UK-based insurer (2000: 89%).

Long-term savings business in Europe is a market that we expect to

develop strongly as the responsibility for providing financial support

for ageing populations increasingly shifts from the state to the private

individual. In addition, we believe customers will continue to seek

the reassurance of trusted brands providing high-quality products

and services.

Building for the future The group now holds top-five positions in

many key markets, a good position from which to build. This growth

is being achieved through the organic development of existing

businesses and through acquisitions, partnerships and new ventures

that extend our distribution capabilities.

Effective and flexible methods of distribution, tailored for individual

markets, are important because we believe they will help us achieve

our ambitious growth targets. For example, while financial advisers

generate around 75%of our long-term savings business in the UK,

bancassurance accounted for nearly 90% of our combined new

business sales in Spain and Italy in 2001.

A significant achievement last year was the further strengthening

of our bancassurance partnerships in Spain, Italy and Singapore,

and continuing development in the UK. These distribution

arrangements give the group access to more than 20 million

potential customers worldwide.

Strategic acquisitions were made, at the right price, to increase

shareholder value. For example, our acquisition of Fortis Australia in

July consolidated our top-five position in the Australian general

insurance market.

We also made a number of smaller acquisitions in strategic and

emerging markets. Our Dutch company, Delta Lloyd, bought Bank

Nagelmackers, an important step in developing the Delta Lloyd

savings and investment business in Belgium.

The acquisition of Mébit, the sixth-largest life insurance business in

Hungary, strengthens our position in the long-term savings markets

of central and eastern Europe. We continue to develop our operations

in these newer, dynamic markets, including Poland and Turkey

(where we already hold top-five positions), Romania and Lithuania.

Group Chief Executive’s review

“We have

reshaped the

business and built

a strong base for

profitable growth”

£317 million

integration

savings