Aviva 2001 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2001 Aviva annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

02 CGNU plc Annual report + accounts 2001

Richard Harvey has a high-calibre executive team, with a combination

of wide experience and vigour. Under his management, we have

performed to high standards under demanding conditions.

Our employees worldwide have shown resilience, courage and

tenacity, and deserve much of the credit for the encouraging progress

that we have made this year.They deserve to have the best possible

training and assistance in their personal development. Only through

investing in them can we reach our ambitious targets and aspire to

being a world-class, customer-driven service company, creating

superior shareholder value.

In February last year the European Financial Services Round Table

(EFR) was founded, and I have the privilege of being its chairman.

Its purpose is to help create a single market for financial services in

the European Union (EU). Such an open market exists, of course,

for goods, capital and people – all of which has brought benefits for

consumers. But customers are not free to buy financial services

products wherever they choose in the EU, because the market is

closed and fragmented. Pensions are not portable owing to

differences in national tax systems. Costs can be high and

consumer protection differs.

The European Council of Ministers has agreed an action plan to

create an open and transparent market, but there is a long way to go.

The EFR will help in getting there. For the first time, heads of

Europe’s leading banks and insurance companies have agreed to

work together to create a transparent, competitive market. We will

work with national governments and the European Commission to

build the single market in a practical and consumer-friendly way.

Looking to the prospects for CGNU, I believe they show great

promise. We shall certainly encounter unexpected developments

in the world while seeing the continued consolidation of financial

services groups. We shall have to be prepared to seize attractive

opportunities.

Thus, as we streamline our business, pursue growth and undergo

continuous training, we also have to be flexible enough to master

step changes in our ambition to build an ever-stronger company.

We have strengthened our position as a leading European-based

financial services group, and continue to grow the business with a

clear strategic focus on the long-term savings market.

We have successfully completed the merger of CGU and Norwich

Union to create the UK’s leading insurance and financial services

group. Annualised cost savings of £317 million have been achieved,

which exceeded our target, and we are now together as one company.

In pursuing our strategy, we have withdrawn from markets where we

would not create superior shareholder value. We completed the sale

of our US general insurance operations in June last year and exited

the London Market. Consequently, our exposure to the atrocious

attack on America on 11 September was limited.

The whole world was shaken by those tragic events, and we feel deep

sympathy for the victims and their families.Thankfully, none of our

employees lost their lives.

Markets were seriously disturbed as a consequence of the disaster.

Solvency ratios around the world were already deteriorating, and the

fall in equity prices, then and since, has significantly reduced

shareholders’funds.

Our determination to grow faster than the average for the financial

services market has met with considerable success. Our targets have

been achieved by a combination of strong organic growth, new

bancassurance arrangements and balanced acquisitions.

Our joint venture in the UK with the Royal Bank of Scotland has

good growth potential. Our new arrangements with DBS put us in a

strong position in South East Asia. In Spain we have, in less than two

years, become a leading player through agreements with four of the

country’s leading savings banks. We have also expanded our

bancassurance partnerships in the fast-growing Italian market.

In France, the Netherlands and Poland we continue to hold leading

positions through CGU France, Delta Lloyd and Commercial

Union Polska.

In line with our strategy, we are growing our long-term savings

business aggressively. It now accounts for approximately 70% of our

annual premiums. Our general insurance operations are managed for

balanced growth, sustainable profitability, and good returns which

provide cash flow to support our long-term savings growth.

We are making progress towards the development of a world-class

fund management business, and encourage sustainable development

in our investment activities. We believe it is important to invest in

companies that uphold sound ethical policies.

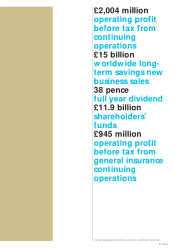

We propose a final dividend of 23.75 pence, which brings the total for

the year to 38 pence.

Since the new group was formed, we have seen our life and savings

business grow by over 30% in only 18 months.To sustain the scale

and pace of profitable growth, our long-term savings operations

require continuous investment of both cash and capital.The view of

the Board is that it is not possible to maintain the current level of the

Group’s dividend whilst pursuing this strategy.

As a result, the Board proposes a re-basing of the 2002 full year

dividend to 23 pence (2001: 38 pence).Given our outlook for the

business, this strikes the appropriate balance between dividend

payments and the retention of capital to take advantage of profitable

growth opportunities. From this new base, we expect to adopt a

progressive policy of growing dividends by approximately 5% per

annum, whilst looking to sustain a target cover in a range of 1.5 to 2.0

times operating earnings after tax, measured on a modified statutory

solvency basis.

To grow long-term savings business

aggressively and profitably.

To build a world-class fund

management business.

To take a focused approach to general

insurance with disciplined underwriting

and efficient claims handling.

To build top-five positions in key markets.

To withdraw from lines of business

or markets which do not offer the

potential for market-leading positions

or superior returns.

Group strategy