Audiovox 2000 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2000 Audiovox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

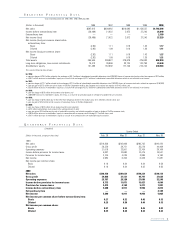

Years ended November 30, 1996, 1997, 1998, 1999 and 2000:

(Dollars in thousands)

1996 1997 1998 1999 2000

Net sales $597,915 $639,082 $616,695 $1,159,537 $1,702,296

Income before extraordinary item (26,469) 21,022 2,972 27,246 25,040

Extraordinary item — — — — 2,189

Net income (loss) (26,469) 21,022 2,972 27,246 27,229

Net income (loss) per common share before

extraordinary item:

Basic (2.82) 1.11 0.16 1.43 1.17

Diluted (2.82) 1.09 0.16 1.39 1.11

Net income (loss) per common share:

Basic (2.82) 1.11 0.16 1.43 1.27

Diluted (2.82) 1.09 0.16 1.39 1.21

Total assets 265,545 289,827 279,679 475,083 502,859

Long-term obligations, less current installments 70,413 38,996 33,724 122,798 24,440

Stockholders’ equity 131,499 187,892 177,720 216,744 330,503

This selected financial data includes:

for 1996:

•a pre-tax charge of $26.3 million related to the exchange of $41.3 million of subordinated convertible debentures into 6,806,580 shares of common stock and a related tax expense of $2.9 million;

•a $64.7 million increase in stockholders’ equity as a result of the exchange of $41.3 million of subordinated convertible debentures which is not reflected in net income.

for 1997:

•a pre-tax charge of $12.7 million related to the exchange of $21.5 million of subordinated convertible debentures into 2,860,925 shares of common stock and a related tax expense of $158,000;

•a pre-tax gain of $37.5 million on sale of shares of CellStar Corporation held by the Company and a related tax expense of $14.2 million; and

•a $33.6 million increase in stockholders’ equity as a result of the exchange of $21.5 million of subordinated convertible debentures which is not reflected in net income.

for 1998:

•a pre-tax charge of $6.6 million for inventory write-downs; and

•a $929,000 increase in stockholders’ equity, net of tax, as a result of an unrealized gain on a hedge of available-for-sale securities.

for 1999:

•a pre-tax charge of $2.0 million due to the other-than-temporary decline in the market value of its Shintom common stock; and

•a pre-tax gain of $3.8 million on the issuance of subsidiary shares to Toshiba Corporation.

for 2000:

•a pre-tax charge of $8.2 million for an analog inventory cost reduction;

•a $2.2 million extraordinary item related to the extinguishment of debt;

•a pre-tax gain of $3.9 million on the sale of marketable securities and related recognition of gain on hedge of CellStar common stock;

•a $96.6 million increase in stockholders’ equity in connection with a common stock offering of 2.3 million shares; and

•a $10.1 million decrease in stockholders’ equity as a result of an unrealized loss on marketable equity securities.

Quarter Ended

(Dollars in thousands, except per share data)

Feb. 28 May 31 Aug. 31 Nov. 30

1999

Net sales $210,266 $242,069 $296,732 $410,470

Gross profit 26,220 28,721 35,279 44,408

Operating expenses 21,018 23,501 23,764 28,108

Income before provision for income taxes 5,087 10,680 10,415 16,541

Provision for income taxes 2,105 4,226 3,986 5,160

Net income 2,982 6,454 6,429 11,381

Net income per common share:

Basic 0.16 0.34 0.34 0.59

Diluted 0.16 0.34 0.32 0.56

2000

Net sales $340,156 $381,634 $470,334 $510,172

Gross profit 34,868 37,131 42,747 37,622

Operating expenses 25,787 28,120 27,689 32,248

Income before provision for income taxes 8,773 11,071 15,427 4,694

Provision for income taxes 3,473 4,160 5,471 1,821

Income before extraordinary item 5,300 6,911 9,956 2,873

Extraordinary item — — — 2,189

Net income 5,300 6,911 9,956 5,062

Net income per common share before extraordinary item:

Basic 0.27 0.32 0.45 0.13

Diluted 0.25 0.30 0.44 0.13

Net income per common share:

Basic 0.27 0.32 0.45 0.23

Diluted 0.25 0.30 0.44 0.23

AUDIOVOX 1

SELECTED FINANCIAL DATA

(Unaudited)

QUARTERLY FINANCIAL DATA