Audiovox 1997 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 1997 Audiovox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

established. Premiums and discounts are amortized or accreted over

the life of the related held-to-maturity security as an adjustment to

yield using the effective interest method. Dividend and interest

income are recognized when earned.

(h) Debt Issuance Costs

Costs incurred in connection with the issuance of the convertible

subordinated debentures and restructuring of the Series A and Series

B convertible subordinated notes (Note 10) and the restructuring of

bank obligations (Note 9(a)) have been capitalized. These charges

are amortized over the lives of the respective agreements.

Amortization expense of these costs amounted to $37, $1,109, and

$1,319 for the years ended November 30, 1997, 1996 and 1995, respec-

tively. During 1997 and 1996, the Company wrote off $245 and

$3,249, respectively, of debt issuance costs (Note 10).

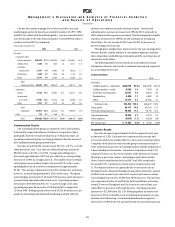

(i) Property, Plant, and Equipment

Property, plant, and equipment are stated at cost. Equipment

under capital lease is stated at the present value of minimum lease

payments. Depreciation is calculated on the straight-line method

over the estimated useful lives of the assets as follows:

Buildings 20 years

Furniture, fixtures and displays 5-10 years

Machinery and equipment 5-10 years

Computer hardware and software 5 years

Automobiles 3 years

Leasehold improvements are amortized over the shorter of the

lease term or estimated useful life of the asset. Assets acquired under

capital lease are amortized over the term of the lease.

(j) Intangible Assets

Intangible assets consist of patents, trademarks, non-competition

agreements, and the excess cost over fair value of assets acquired for

certain subsidiary companies and equity investments. Excess cost

over fair value of assets acquired is being amortized over periods not

exceeding twenty years. The costs of other intangible assets are

amortized on a straight-line basis over their respective lives.

Accumulated amortization approximated $1,759 and $1,413 at

November 30, 1997 and 1996, respectively. Amortization of the excess

cost over fair value of assets acquired and other intangible assets

amounted to $363, $145, and $127 for the years ended November 30,

1997, 1996, and 1995, respectively. During 1997, the Company made

investments in two companies that resulted in additional excess cost

over fair value of assets acquired (Note 8).

On an ongoing basis, the Company reviews the valuation and

amortization of its intangible assets. As a part of its ongoing review,

the Company estimates the fair value of intangible assets taking into

consideration any events and circumstances which may diminish fair

value.

The recoverability of the excess cost over fair value of assets

acquired is assessed by determining whether the amortization over

its remaining life can be recovered through undiscounted future

operating cash flows of the acquired operation. The amount of

impairment, if any, is measured based on projected discounted

future operating cash flows using a discount rate reflecting the

Company’s average cost of funds. The assessment of the recoverabili-

ty of the excess cost over fair value of assets acquired will be impact-

ed if estimated future operating cash flows are not achieved.

(k) Equity Investments

The Company has common stock investments which are

accounted for by the equity method (Note 8).

(l) Cellular Telephone Commissions

Under various agreements, the Company typically receives an ini-

tial activation commission for obtaining subscribers for cellular tele-

phone services. Additionally, the agreements typically contain provi-

sions for commissions based upon usage and length of continued

subscription. The agreements also typically provide for the reduction

or elimination of initial activation commissions if subscribers deacti-

vate service within stipulated periods. The Company has provided a

liability for estimated cellular deactivations which is reflected in the

accompanying consolidated financial statements as a reduction of

accounts receivable.

The Company recognizes sales revenue for the initial activation,

length of service commissions, and residual commissions based

upon usage on the accrual basis. Such commissions approximated

$35,749, $37,930, and $43,307 for the years ended November 30,

1997, 1996, and 1995, respectively. Related commissions paid to out-

side selling representatives for cellular activations are reflected as cost

of sales in the accompanying consolidated statements of income

(loss) and amounted to $19,924, $20,443, and $15,374 for the years

ended November 30, 1997, 1996, and 1995, respectively.

(m) Advertising

The Company expenses the production costs of advertising as

incurred and expenses the costs of communicating advertising when

the service is received. During the years ended November 30, 1997,

1996, and 1995, the Company had no direct response advertising.

(n) Warranty Expenses

Warranty expenses are accrued at the time of sale based on the

Company’s estimated cost to repair expected returns for products. At

November 30, 1997 and 1996, the liability for future warranty expense

amounted to $2,257 and $2,618, respectively.

(o) Foreign Currency

Assets and liabilities of those subsidiaries and equity investments

located outside the United States whose cash flows are primarily in

local currencies have been translated at rates of exchange at the end

of the period. Revenues and expenses have been translated at the

weighted average rates of exchange in effect during the period. Gains

and losses resulting from translation are accumulated in the cumula-

tive foreign currency translation account in stockholders’ equity.

Exchange gains and losses on hedges of foreign net investments and

on intercompany balances of a long-term investment nature are also

recorded in the cumulative foreign currency translation adjustment

account. Other foreign currency transaction gains and losses are

included in net income, none of which were material for the years

ended November 30, 1997, 1996, and 1995.

(p) Income Taxes

Income taxes are accounted for under the asset and liability

method. Deferred tax assets and liabilities are recognized for the

future tax consequences attributable to differences between the

AUDIOVOX CORPORATION AND SUBSIDIARIES

N o t e s t o C o n s o l i d a t e d F i n a n c i a l S t a t e m e n t s

(continued)

20