Atmos Energy 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4| ATMOS ENERGY 2008 SUMMARY ANNUAL REPORT

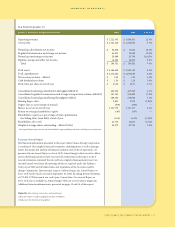

Fiscal 2008 consolidated net income increased 7 percent, year

over year, to $180.3 million, and earnings per diluted share

went up 4.2 percent from $1.92 in scal 2007 to $2.00 in scal

2008. Looking at the longer trend, Atmos Energy’s compound

average growth rate for diluted earnings per share over the

past ve years was 5.4 percent—furthering our stated goal

of increasing earnings, on average, between 4 percent and 6

percent a year.

In scal 2008, we paid dividends totaling $1.30 per share,

with a dividend payout ratio of 65 percent. In November 2008,

the board of directors again raised the annual dividend by

2 cents a share to an indicated rate of $1.32. is increase,

taking into account all mergers and acquisitions, marked the

company’s 25th consecutive annual dividend increase.

Rate strategy aids

regulated operations

Net income from regulated operations in 2008 contributed

almost three-fourths of net income, or $1.49 per diluted

share. Combined earnings from our natural gas distribution

segment and from our regulated transmission and storage

segment increased 24 percent to $134.1 million.

During the scal year, we resolved 12 rate cases and other

regulatory proceedings, which contributed $34.5 million of

incremental revenues. In the largest of these cases, we negoti-

ated a three-year settlement with 438 of the 439 Texas cities

served by our Mid-Tex Division. We obtained desired

outcomes in other cases that were concluded in Georgia,

Louisiana, Kansas, Tennessee, Virginia and West Texas.

ese rate-case results support our goal of stabilizing

our regulated earnings by decoupling our distribution

revenues from our customers’ gas consumption. Today

about 97 percent of our distribution margins are unaected

by changes in weather due to weather normalization and

similar rate-design mechanisms. We are continuing to seek

additional improvements in our rate design to eliminate or

reduce price volatility and provide more predictable and

stable utility bills for our customers.

Traditional rate structures have discouraged utilities

from oering energy-saving products and services by tying

the recovery of their allowed rate of return to the amount of

OUR 2008 FISCAL YEAR, ENDED SEPTEMBER 30, WAS HIGHLY

SUCCESSFUL. Yet, at year-end, the economy was overshadowed by the

world’s worst nancial and credit crisis since the Great Depression—

causing growing uncertainties for both our customers and investors. Such

a sobering situation makes our latest record earnings all the more

valuable while it emphasizes the importance of prudent strategies to

achieve continued performance.

Dear Fellow

Shareholder

$1.58

$1.72

$2.00

$1.92

$1.82

04 05 06 07 08

Net Income per Diluted Share