Atmos Energy 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

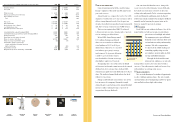

September 30 (Dollars in thousands, except share data) 2003 2002

Assets

Property, plant and equipment $ 2,463,992 $ 2,103,428

Construction in progress 16,147 24,399

2,480,139 2,127,827

Less accumulated depreciation and amortization 964,150 827,507

Net property, plant and equipment 1,515,989 1,300,320

Current assets

Cash and cash equivalents 15,683 47,991

Cash held on deposit in margin account 17,903 10,192

Accounts receivable, less allowance for doubtful accounts of $13,051 in 2003

and $10,509 in 2002 216,783 136,227

Gas stored underground 168,765 91,783

Other current assets 38,863 44,962

Total current assets 457,997 331,155

Goodwill and intangible assets 273,499 190,380

Deferred charges and other assets 271,023 159,530

$ 2,518,508 $ 1,981,385

Capitalization and Liabilities

Shareholders’ equity

Common stock, no par value (stated at $.005 per share);

100,000,000 shares authorized; issued and outstanding:

2003 – 51,475,785 shares, 2002 – 41,675,932 shares $ 257 $ 208

Additional paid-in capital 736,180 508,265

Retained earnings 122,539 106,142

Accumulated other comprehensive loss (1,459) (41,380)

Shareholders’ equity 857,517 573,235

Long-term debt 863,918 670,463

Total capitalization 1,721,435 1,243,698

Current liabilities

Accounts payable and accrued liabilities 179,852 136,773

Other current liabilities 127,923 159,727

Short-term debt 118,595 145,791

Current maturities of long-term debt 9,345 21,980

Total current liabilities 435,715 464,271

Deferred income taxes 223,350 134,540

Deferred credits and other liabilities 138,008 138,876

$ 2,518,508 $ 1,981,385

Condensed Consolidated Statements of Income

Condensed Consolidated Balance Sheets

24 25

September 30 (Dollars in thousands, except per share data) 2003 2002 2001

Operating revenues

Utility segment $ 1,554,082 $ 937,526 $ 1,380,148

Natural gas marketing segment 1,668,493 1,031,874 447,096

Other nonutility segment 21,630 24,705 59,436

Intersegment eliminations (444,289) (343,141) (161,199)

2,799,916 1,650,964 1,725,481

Purchased gas cost

Utility segment 1,062,679 559,891 1,017,363

Natural gas marketing segment 1,644,328 994,318 445,504

Other nonutility segment 1,540 8,022 48,605

Intersegment eliminations (443,607) (342,407) (161,199)

2,264,940 1,219,824 1,350,273

Gross profit 534,976 431,140 375,208

Operating expenses

Operation and maintenance 205,090 158,119 139,608

Depreciation and amortization 87,001 81,469 67,664

Taxes, other than income 55,045 36,221 37,655

Total operating expenses 347,136 275,809 244,927

Operating income 187,840 155,331 130,281

Other income (expense)

Equity in earnings of Woodward Marketing, L.L.C. ——8,062

Miscellaneous income (expense) 2,191 (1,321) (1,874)

Total other income (expense) 2,191 (1,321) 6,188

Interest charges 63,660 59,174 47,011

Income before income taxes and cumulative effect of accounting change 126,371 94,836 89,458

Income tax expense 46,910 35,180 33,368

Income before cumulative effect of accounting change 79,461 59,656 56,090

Cumulative effect of accounting change, net of income tax benefit (7,773) ——

Net income $ 71,688 $ 59,656 $ 56,090

Per share data

Basic income per share:

Income before cumulative effect of accounting change $ 1.72 $ 1.45 $ 1.47

Cumulative effect of accounting change, net of income tax benefit (.17) ——

Net income $ 1.55 $ 1.45 $ 1.47

Diluted income per share:

Income before cumulative effect of accounting change $ 1.71 $ 1.45 $ 1.47

Cumulative effect of accounting change, net of income tax benefit (.17) ——

Net income $ 1.54 $ 1.45 $ 1.47

Weighted average shares outstanding:

Basic 46,319 41,171 38,156

Diluted 46,496 41,250 38,247