Atmos Energy 1998 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 1998 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Describe Atmos’ vision for the future and its underlying operating philosophy.

Best: Since joining the Company in March 1997, we have reconfirmed the vision for the

future with four major strategies for achieving the vision. We intend to be as successful

in the future as we have been in the past by running our utility operations exceptionally

well; growing the market share of the non-utility operations (propane and gas marketing);

developing retail energy services; and growing through acquisitions.

We have worked to define our organizational structure and governance policies. Our

business units have established brand names and are closest to our customers, giving them

greater ability to determine customer expectations. Our shared services approach to

administration and support avoids duplication of functions in our business units and

allows us to quickly integrate acquisitions. We are committed to providing the highest

level of service to our customers, and investing in technology to remain competitive and

efficient in our operations. We intend to grow our net income every year. Our new total

rewards compensation and benefits strategy supports our values and aligns the interests

of our Board of Directors, officers and employees with those of our shareholders.

I have visited every business unit communicating to our employees our values and how

we will live out those values in the workplace. We’ve invested considerable time this year

in team-building and visiting with all employees about their role in achieving our vision

and strategy.

The Company has pursued an aggressive corporate development strategy. Will

that strategy continue in the future?

With our vision and strategy confirmed, our top priorities are execution of our plans and

acquisition strategy. We will not be satisfied as a “maintenance” utility just managing,

although very well, our current operations. To achieve our objective, we must continue the

acquisition strategy that has successfully brought Atmos to this point. We also believe

that larger scale operations will have an even greater competitive advantage with the

unbundling of energy services and an increasingly competitive marketplace.

We continually evaluate opportunities. However, the decision is not solely in our hands.

Potential partners have to share our vision and see the benefits and synergies of a larger

company. We have been successful in acquiring companies, integrating them quickly and

efficiently, retaining the local company’s brand identity, and adding value to the share-

holders of both companies. Our track record makes us an attractive partner for a company

looking for a partner that is focused on a combination that is “seamless” to the customer

and value creating for shareholders.

How do you intend to grow your non-utility business?

Our non-utility operations contributed about 24 percent of our consolidated net income in

1998.If you exclude the one-time gain from asset sales, our non-utility business contributed

20 percent of 1998 consolidated net income. Our objective is for continued growth in both

our utility and non-utility businesses, and for our non-utility operations to continue to

contribute about 20 percent to net income each year.

A Conversation with Bob Best QA

Thinking

like a

winner.

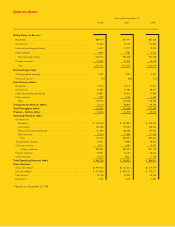

Gross Profit

■ 94 $297,020

■ 95 $300,158

■ 96 $324,412

■ 97 $329,654

■ 98 $331,836

94 95 96 97 98

5