Atmos Energy 1998 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 1998 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company is committed to improving the profitability of its propane operations through

internal growth and through acquisitions. Currently, Atmos Propane, Inc. is the 33rd largest

propane company in the United States. Our non-utility operations also include a 45 percent

interest in Woodward Marketing, LLC, a natural gas services firm. Woodward’s strategy

for continued growth is to increase gas usage by existing customers and to add new

customers. We also may seek an electric partner to become a member of Woodward

Marketing, LLC, and create the opportunity to market electricity to Woodward customers.

How does Atmos plan to offer retail services to its customers?

The cornerstone of our retail services strategy is to position the Company to sell the gas

commodity to customers behind the meter through partnerships with commodity

providers. We are limited in our ability to implement this part of our retail strategy until

the states in which we operate permit us to offer these services. Until unbundling

occurs, we are focusing on three key areas. First, we are preparing to sell other products

and services to our customers by establishing partnerships with third parties that have

mass marketing expertise. Our focus is on products and services that have recurring

monthly revenues. A second key area is restructuring our non-regulated agricultural and

industrial businesses to separate them from the utility so that we can clearly focus on

the needs and expectations of these customers. The third key area is identifying tech-

nological opportunities that can increase our cash flow, earnings and gas throughput, such

as introducing natural gas-fired electric generator units for irrigation.

We believe our approach to retail services offers many advantages, including minimal

investment or operating expenses with limited risk. Our retail strategy also positions the

Company for unbundling when it does occur.

What competitive advantages does Atmos have in providing services in an

unbundled environment?

Tomorrow’s customers will insist on competitive rates, a choice of providers, superior

customer service that exceeds expectations, and enhanced product and service offerings

beyond the core business. We believe unbundling will occur in the long-term, although

it may be slower and less comprehensive than some have predicted. The states we serve

are taking a very measured, cautious approach to make sure that customers receive real

benefits. We have developed a consistent set of guiding principles for unbundling across

all regulatory jurisdictions in the areas we serve, and are participating in the proceedings

in those jurisdictions to ensure rules being developed provide for a level playing field.

As unbundling occurs, we believe that the incumbent utility or one of its affiliates will

have an advantage, both as a seller of the natural gas commodity and as the seller of other

products and services. We have an organization that is efficient and responsive to customers,

and our desire is to make it convenient for customers to do business with us.

How is Atmos using technology to support its vision for growth?

We are using technology to gain efficiencies in our current operations and to enhance

the services and convenience provided to our customers. We plan to eventually allow

customers the opportunity to receive their bills on line and remit payment electronically,

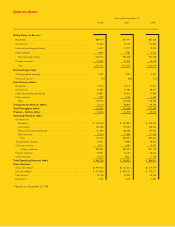

Total Assets

■ 94 $ 829,385

■ 95 $ 900,948

■ 96 $1,010,610

■ 97 $1,088,311

■ 98 $1,141,390

94 95 96 97 98

QAA Conversation with Bob Best (continued)

6