Asus 2009 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2009 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.158

ASUSTeK COMPUTER INC. AND SUBSIDIARIES

Notes to Financial Statements

(Continued)

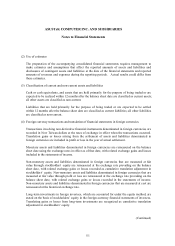

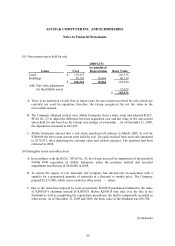

According to ROC SFAS No. 18 “Accounting for Pensions”, the Company and domestic

subsidiaries have their pension plan actuarially valued at year-end and recognizes the net periodic

pension costs, including service cost, net unrecognized transaction assets, prior service cost, and

gains or losses on pension over the average remaining service period of the employees. If the

minimum pension liability exceeds the total of unamortized prior service cost and unamortized

unrecognized transaction net benefit liabilities, the net loss not recognized as pension cost is

recognized and classified as a reduction of stockholders’ equity. In addition, except for a few

foreign employees, the Company had settled its financial obligations to its employees’ under the

pension plan accounted for base on SFAS No. 18 as of December 31, 2007.

The new Labor Pension Act became effective on July 1, 2005, and prescribes a defined

contribution pension plan for all new employees and for any employees employed before that date

who opted to adopt it. Under this defined contribution pension plan, the Company and domestic

subsidiaries contribute monthly at the rate of no less than 6% of salaries and wages to employees’

individual pension fund accounts with the Bureau of Labor Insurance, and this contribution is

recorded as pension expenses in the accompanying statements of income.

The overseas subsidiaries which adopt a defined contribution pension plan contribute periodically

on the basis of each local labor law, and such contribution is recorded as current expense.

(17) Revenue recognition

The Group recognizes revenue when the revenue earning process has been significantly completed,

which means the revenue has been realized or is readily realizable and earned. Cost is recognized

when the related revenue is accrued; expenses are recognized as current expenses when incurred.

(18) Employees’ bonuses and directors’ and supervisors’ remuneration and share-based payment

Appropriation of earnings after January 1, 2008, for employees’ bonuses and directors’

remuneration according to the R.O.C. Company Act and each entity’ s article of incorporation

accounts, is accounted for in accordance with Interpretation (96) 052 issued by the ARDF.

Accordingly, the Company and domestic subsidiaries estimate the amount of directors’ and

supervisors’ remuneration according to the Interpretation and recognize it as expenses. Differences

between the amount approved in the shareholders’ meeting and recognized in the financial

statements, if any, are accounted for as changes in accounting estimates and recognized as profit or

loss. The Group adopts R.O.C. SFAS No. 39 to account for the transfer of equity instruments

from shareholders and the Group to the Group’ s employees.