Assurant 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 ▪ 2014 ASSURANT ANNUAL REPORT

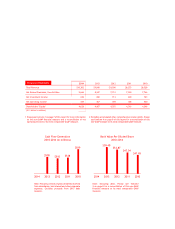

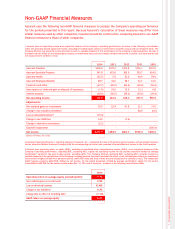

Net operating income

(1)

was $439.0 million. Operating return on equity, excluding accumulated other

comprehensive income (AOCI)

(2)

, was 9. 7 percent. Our book value per diluted share, excluding AOCI

(3)

,

increased 9.0 percent compared to the previous year-end.

In 2014, our operating segments generated signifi cant free cash fl ow. This allowed us to invest in the business

to support organic growth and return $296 million to shareholders through share repurchases and common stock

dividends. Last year, we increased our dividend again as we have every year since becoming a public company.

We also deployed $162 million to complete four acquisitions to further strengthen our specialty capabilities.

After taking these actions, we ended the year with $560 million of holding company capital.

ADAPT

During 2014, we continued to adapt our portfolio of specialty products and services in response to the

evolving marketplace and to capitalize on macro trends. We invested in areas such as mobile, mortgage

solutions, multi-family housing and voluntary benefi ts where we believe we can leverage our skills and

deliver profi table long -term growth. In aggregate, these targeted growth areas now account for 25 percent

of total revenue. Additionally, earnings from these product lines more than tripled year over year.

There are many examples of our progress in aligning resources toward these targeted offerings.

Protect ing consumers’ increasingly connected lives from disruption was the driving force behind the launch

of Assurant Solutions’ Connected Living platform in 2014. With a comprehensive array of mobile and extended

warranty programs for smart phones, appliances, consumer electronics and other devices, we see many

opportunities to serve the rapidly expanding base of connected consumers. In 2014, Assurant Solutions

delivered exceptional results by leveraging an integrated offering and our deep expertise. To build on our

momentum, we completed the integration of Lifestyle Services Group and added the CWI Group to further

expand our global footprint and distribution capabilities.

Assurant Specialty Property also took many steps in 2014 to further diversify our sources of revenue and

profi tability long term. We added StreetLinks and eMortgage Logic, which along with Field Asset Services,

now constitute our Mortgage Solutions business and we are capturing market share. In addition, our Multi-

F amily Housing business expanded its distribution and now protects more than one million policyholders. The

Mortgage Solutions and Multi- Family Housing businesses are increasingly important as the broader U.S.

housing market improves and our lender-placed insurance business continues to normalize.

2014 also marked substantial change for the health insurance market with the introduction of guaranteed

issue and the public exchanges under the Affordable Care Act. Our colleagues at Assurant Health demonstrated

agility in adapting to an evolving landscape. For the fi rst time, we offered consumers individual medical

coverage through our participation on public exchanges in 16 states for 2015-effective policies. Sales were

strong, yet net operating income was disappointing. We have accelerated actions to improve performance

and achieve the specialty returns we require and our shareholders expect.