Amgen 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Amgen annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

“It means aworld of

Amgen 2002 Annual Report

difference for me.”

Table of contents

-

Page 1

"It means a world of difference for me." Amgen 2002 Annual Report -

Page 2

... to Stockholders Therapeutic Review Selected Products and Product Candidates Financial Performance Management's Discussion and Analysis of Financial Condition and Results of Operations Consolidated Financial Statements Report of Ernst & Young LLP, Independent Auditors Corporate Information (inside... -

Page 3

" But it means a great deal more to the hundreds of thousands of patients that we serve each year and the thousands of people that we touch throughout our organization." -

Page 4

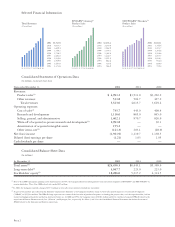

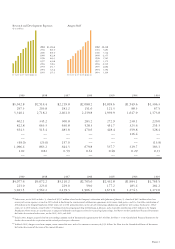

... revenues Total revenues Operating expenses: Cost of sales(2) Research and development Selling, general, and administrative Write-off of acquired in-process research and development(3) Amortization of acquired intangible assets Other items, net(4) Net (loss) income Diluted (loss) earnings per share... -

Page 5

..., net for 2002, 2001, and 2000. In July 2002, Amgen acquired all of the outstanding common stock of Immunex for approximately $17.8 billion. See Note 3 to the Consolidated Financial Statements for further discussion of the acquisition and the related purchase price allocation. In March 2002, Amgen... -

Page 6

Gail Crawford is a wife, mother, marketing professional, skier, golfer, and a recovering cancer patient. In her own words, "Anything that helps you pull yourself out of the black hole of your disease and back into your life is a miracle." "It means having the energy to reclaim my life." -

Page 7

Serena Anderson started out as a pharmacist and public health educator. In the eight years since she joined Amgen, she's managed public policy issues, championed brands, and helped introduce emerging product candidates. For Serena, "The opportunities for growth never stop." "It means finding new ... -

Page 8

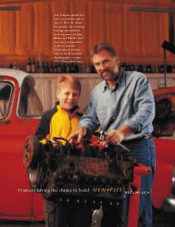

... car with his dad at age 17. Now he shares his passion for restoring vintage automobiles with his own children, Blake and Brooke. Jim may have rheumatoid arthritis, but the Johnsons are already hard at work on their third project - a rare 1958 Chevrolet Cameo. "It means having the chance to build... -

Page 9

Dave Lacey gets excited when he talks about science. That's why he left an active teaching and medical pathology practice nine years ago to join Amgen's research staff. Says Dave, "It's not about getting the credit, it's about advancing the cause." "It means having the opportunity to participate ... -

Page 10

"It means focusing the energy of an entire organization on a single overriding goal." -

Page 11

..., key Immunex leaders filled vital Amgen jobs, the clinical development of ENBREL® continued successfully across a growing number of indications, and construction was advanced on both the Seattle research site overlooking Puget Sound and the vital additional ENBREL® manufacturing facility in Rhode... -

Page 12

... stock market environments improve. Kevin W. Sharer Chairman and Chief Executive Officer March 3, 2003 achievements â- â- â- â- â- â- Received approval for Neulastaâ„¢ (pegfilgrastim) in the United States and Europe for use in the management of chemotherapy-induced neutropenia. Launched... -

Page 13

... by new technologies, and conducted at the molecular level. into the largest independent company operating in the biotechnology industry, with integrated capabilities in the discovery, development, and commercialization of human therapeutics. Amgen has now grown Amgen products are used in markets... -

Page 14

... a sound strategic approach. Amgen funds internal discovery research programs organized around five therapeutic areas - hematology, oncology, inflammation, neurology, and metabolic disorders. These programs are enhanced and expanded through external research collaborations, acquisitions, and product... -

Page 15

processes. These proteins often serve as the starting point for the development of potential new product candidates. One of the discoveries to emerge from Amgen's genomics research is osteoprotegerin, a protein found to be important in maintaining bone density. This discovery may one day play a role... -

Page 16

... form of the disease each year, a number that continues to rise in step with global population growth and longer life expectancies. Yet cancer treatments are also growing in effectiveness, improving survival rates for many patients. Chemotherapy often plays a central role. Amgen has launched two new... -

Page 17

...Amgen's original white blood cell stimulating product, Neulastaâ„¢ has been shown to decrease the incidence of infection as a result of chemotherapyinduced neutropenia. But Neulastaâ„¢ is a longer-acting form of Filgrastim, offering greater freedom for patients and caregivers with its once-per-cycle... -

Page 18

... capabilities in basic research and clinical investigation to enhance the value of its product line through better treatment options. chronic kidney disease Amgen launched EPOGEN® (Epoetin alfa), one of the first biologically derived human therapeutics, into the medical marketplace 13 years... -

Page 19

... anemia therapeutic for chronic kidney disease patients, once again advancing the treatment options for this debilitating condition. Aranesp® (darbepoetin alfa) is approved in the United States, Europe, Canada, Australia, and New Zealand for the treatment of anemia associated with chronic renal... -

Page 20

... breakthrough therapeutic developed by Immunex that targets one of the major factors in the immune system to help control the pain, swelling, fatigue, and other symptoms associated with rheumatoid arthritis. It also inhibits the progression of damage to joints caused by chronic inflammation. ENBREL... -

Page 21

... had been limited by manufacturing constraints. Increasing production of the innovative therapeutic has been a key goal for Amgen since acquiring Immunex in July 2002. In December 2002, Amgen received approval from the FDA for its ENBREL® manufacturing facility in Rhode Island, making new supplies... -

Page 22

... program Neurology & Endocrinology Primary hyperparathyroidism Parkinson's disease Cinacalcet hydrochloride GDNF (3) Phase 1 Clinical Trial Investigate safety and proper dose ranges of a product candidate in a small number of human subjects. Phase 2 Clinical Trial Investigate side effect... -

Page 23

...Financial foundation Amgen's cash flow from operations, generated largely by product sales, totaled $2.2 billion in 2002. The size and quality of the company's annual cash flow has allowed Amgen to internally finance nearly all of its operations since the company's successful market debuts of EPOGEN... -

Page 24

...requires a careful balance of near-term earnings growth and ongoing reinvestment in basic research and product development opportunities. Amgen maintains a stock repurchase program primarily to reduce the dilutive effect of the company's employee stock option and stock purchase plans. In 2002, Amgen... -

Page 25

AMGEN 2002 ANNUAL REPORT Management's Discussion and Analysis of Financial Condition and Results of Operations Acquisition of Immunex Corporation On July 15, 2002, the Company acquired all of the outstanding common stock of Immunex Corporation ("Immunex") in a transaction accounted for as a ... -

Page 26

... in the market value of the Company's stock relative to the exercise price of such options. The Company has a stock repurchase program primarily to reduce the dilutive effect of its employee stock option and stock purchase plans. In 2002, the Company repurchased 28.0 million shares of its... -

Page 27

... is $3,950.0 million. In the event the Company is required to repurchase the notes, it may choose to pay the purchase price in cash and/or shares of common stock. (2) Unconditional purchase obligations primarily relate to the Company's long-term supply agreement with Boehringer Ingelheim Pharma KG... -

Page 28

... by a number of factors, including demand, wholesaler inventory management practices, foreign exchange effects, new product launches, and acquisitions. EPOGEN®/Aranesp® In June 2001, the Company received 2001 EPOGEN® sales. The Company believes that EPOGEN® sales growth for 2002 was principally... -

Page 29

...% over the prior year. This increase was primarily due to worldwide demand growth, which includes the effect of higher prices in the United States. ENBREL® The Company began recording ENBREL® sales on July 16, 2002, subsequent to the close of the Immunex acquisition. For the period from July 16... -

Page 30

... of Immunex staff, and approximately $14.8 million of compensation costs principally payable under the Immunex Corporate Retention Plan. Outside marketing expenses in 2002 increased principally due to the launch of new products, marketing costs related to ENBREL®, and the impact of the profit share... -

Page 31

...useful lives ranging from 7 to 15 years on a straight-line basis. Other items, net In 2002, other items, net consisted of three items: 1) a onetime, non-recurring benefit of $40.1 million related to the recovery of certain expenses accrued in the fourth quarter The Company's effective tax rate was... -

Page 32

... the timing and expected costs to complete the in-process projects, projecting regulatory approvals, estimating future cash flows from product sales resulting from completed products and in-process projects, and developing appropriate discount rates and probability rates by project. The Company... -

Page 33

... on capital projects including the Puerto Rico manufacturing expansion, the Seattle inflammation research headquarters, and the new Rhode Island manufacturing plant, which will be adjacent to the existing manufacturing facility. Results of operations In the future, the Company expects growth of... -

Page 34

... in Europe, Canada, and Australia for these same indications as well as for the treatment of neutropenia in HIV patients receiving antiviral and/or other myelosuppressive medications. The Company believes future NEUPOGEN® and Neulasta™ sales growth will depend on penetration of existing markets... -

Page 35

...governments will pay to reimburse the cost of drugs. In addition, we believe the increasing emphasis on managed care in the United States has and will continue to put pressure on the price and usage of our products, which may adversely impact product sales. Further, when a new therapeutic product is... -

Page 36

... change for EPOGEN® which materially and adversely affected our EPOGEN® sales until the policies were revised. Our current products and products in development cannot be sold if we do not obtain and maintain regulatory approval. We conduct research, preclinical testing, and clinical trials and we... -

Page 37

... variables, such as the timing and actual number of production runs, production success rate, bulk drug yield, and the timing and outcome of product quality testing. For example, in the second quarter of 2002, Immunex Corporation, (the prior owner of ENBREL®), experienced a brief period where... -

Page 38

... ENBREL® sales would be restricted which could have a material adverse effect on our results of operations. We face substantial competition, and others may discover, develop, acquire or commercialize products before or more successfully than we do. duced by us at our Rhode Island facility and by... -

Page 39

AMGEN 2002 ANNUAL REPORT make it difficult for us to compete with them to successfully discover, develop, and market new products. Certain of our raw materials, medical devices and components are single-sourced from third parties; third-party supply failures could adversely affect our ability to ... -

Page 40

... of our manufacturing facilities may be required, any of which could have a material adverse effect on sales of the affected products and on our business and results of operations. For example, because ENBREL® has only been marketed since 1998, its long-term effects on the development or course of... -

Page 41

... price. Our corporate compliance program cannot guarantee that we are in compliance with all potentially applicable federal and state regulations. We have an aggressive growth plan that includes substantial and increasing investments in research and development, sales and marketing and facilities... -

Page 42

... of the companies include, among others: • consolidating research and development and manufacturing operations • retaining key employees • consolidating corporate and administrative infrastructures • coordinating sales and marketing functions • preserving ours and Immunex's research and... -

Page 43

.... In the event the Company is required to repurchase the notes, it may choose to pay the purchase price in cash and/or shares of common stock. Interest Rate Sensitivity Principal Amount by Expected Maturity as of December 31, 2001 (Dollars in millions) Average Interest Rate 2002 2003 2004 2005... -

Page 44

AMGEN 2002 ANNUAL REPORT The Company is exposed to equity price risks on the marketable portion of equity securities included in its portfolio of investments entered into for the promotion of business and strategic objectives. These investments are generally in small capitalization stocks in the ... -

Page 45

... sales Corporate partner revenues Royalty income Total revenues Operating expenses: Cost of sales Research and development Selling, general and administrative Write-off of acquired in-process research and development Amortization of acquired intangible assets (Earnings) loss of affiliates, net... -

Page 46

... Deferred tax liabilities Long-term debt Stockholders' equity: Preferred stock; $0.0001 par value; 5.0 shares authorized; none issued or outstanding Common stock and additional paid-in capital; $0.0001 par value; 2,750.0 shares authorized; outstanding - 1,289.1 shares in 2002 and 1,045.8 shares in... -

Page 47

... for the acquisition of Immunex Corporation Fair value of options assumed from Immunex Issuance of common stock upon the exercise of employee stock options and in connection with an employee stock purchase plan Tax benefits related to employee stock options Repurchases of common stock Balance at... -

Page 48

... of acquired in-process research and development Depreciation and amortization Tax benefits related to employee stock options Deferred income taxes Other non-cash expenses Cash provided by (used in) changes in operating assets and liabilities, net of acquisitions: Trade receivables, net Inventories... -

Page 49

... loss of affiliates, net" includes Amgen's equity in the operating results of affiliated companies and the minority interest others hold in the operating results of Amgen's majority controlled affiliates. On July 15, 2002, the Company completed its acquisition of Immunex Corporation ("Immunex") (see... -

Page 50

...of raw materials, work in process, and finished goods for currently marketed products. Inventories are shown net of applicable reserves and allowances. Inventories consisted of the following (in millions): December 31, 2002 2001 (1,426.9) $ 2,813.5 (1,163.8) $ 1,946.1 The Company reviews its long... -

Page 51

... and all non-human, non-research uses in the United States. The Company sells Epoetin alfa under the brand name EPOGEN®. Amgen has granted to Ortho Pharmaceutical Corporation (which has assigned its rights under the product license agreement to Ortho Biotech Products, L.P.), a subsidiary of Johnson... -

Page 52

... related to activities performed on behalf of corporate partners. Research and development costs are expensed as incurred. Acquired in-process research and development Costs to acquire in-process research and development ("IPR&D") projects and technologies which have no alternative future use and... -

Page 53

...-average number of common shares and dilutive potential common shares outstanding. Potential common shares are: 1) outstanding options under the Company's employee stock option plans including stock option plans assumed from Immunex, 2) potential issuances of stock under the employee stock purchase... -

Page 54

AMGEN 2002 ANNUAL REPORT on net (loss) income and (loss) earnings per share if the Company had applied the fair value recognition provisions of SFAS No. 123, "Accounting for Stock-Based Compensation" (see Note 7, "Employee stock option, stock purchase, and defined contribution plans"): Years ended ... -

Page 55

AMGEN 2002 ANNUAL REPORT Note 3. Immunex acquisition On July 15, 2002, the Company acquired all of the outstanding common stock of Immunex in a transaction accounted for as a business combination. Immunex was a leading biotechnology company dedicated to developing immune system science to protect ... -

Page 56

... are net of any R&D costs that will be shared under collaborations with corporate partners. Developed product technology Core technology Tradename Total $3,264.5 1,348.3 190.4 $4,803.2 14.5 years 15 years 15 years Leukine® and Novantrone® In May 2002, Immunex entered into an agreement to sell... -

Page 57

... plans Termination of collaboration agreements Legal award, net Amgen Foundation contribution $ (40.1) (151.2) 50.0 $(141.3) $203.1 - - $203.1 $ - (73.9) 25.0 $(48.9) Termination of collaboration agreements In connection with the Immunex acquisition, the Company initiated an integration plan... -

Page 58

... & Johnson's affiliate, Ortho Pharmaceutical Corporation, a license relating to certain patented technology and knowhow of the Company to sell Epoetin alfa throughout the United States for all human uses except dialysis and diagnostics. A number of disputes have arisen between Amgen and Johnson... -

Page 59

... Fixed assets Expenses capitalized for tax purposes Expense accruals Credit carryforwards Other Total deferred tax assets Valuation allowance Net deferred tax assets Deferred tax liabilities: Acquired intangibles Foreign operations Purchase of technology rights Marketable securities and investments... -

Page 60

...of a share of Series A Junior Participating Preferred Stock ("Series A Preferred Stock") of the Company (which one four-thousandth gives effect to the Stock Splits); (ii) increase the exercise price of each Right to $350.00 from $56.25 (as adjusted for the Stock Splits); (iii) extend the term of the... -

Page 61

...the surviving corporation, an exercisable Right will entitle its holder to buy shares of common stock of the acquiring company having a market value of two times the exercise price of one Right. The Company may redeem the Rights at $0.00025 per Right at any time prior to the public announcement that... -

Page 62

...salary grade and performance level. In addition, certain management and professional level employees typically receive a stock option grant upon commencement of employment. As a result of the acquisition, the Company assumed stock options to purchase Immunex common stock outstanding at July 15, 2002... -

Page 63

... December 31, 2002, 2001, and 2000, employee stock options to purchase 62.4 million, 53.4 million, and 55.5 million shares were exercisable at weighted-average prices of $27.03, $20.81, and $15.35, respectively. Information regarding employee stock options outstanding as of December 31, 2002 is as... -

Page 64

... has an employee stock purchase plan whereby, in accordance with Section 423 of the Internal Revenue Code, eligible employees may authorize payroll deductions of up to 10% of their salary to purchase shares of the Company's common stock at the lower of 85% of the fair market value of common stock on... -

Page 65

AMGEN 2002 ANNUAL REPORT the federal funds rate, or a Eurodollar base rate. Under the terms of the credit facility, the Company is required to meet a minimum interest coverage ratio and maintain a minimum level of tangible net worth. In addition, the credit facility contains limitations on ... -

Page 66

... operates in one business segment - human therapeutics. Therefore, results of operations are reported on a consolidated basis for purposes of segment reporting. Enterprise-wide disclosures about revenues by product, revenues and long-lived assets by geographic area, and revenues from major customers... -

Page 67

... Amgen acquired all of the outstanding shares of Kinetix Pharmaceuticals, Inc. ("Kinetix"), a privately held company, in a tax-free exchange for 2.6 million shares of Amgen common stock. The acquisition was accounted for under the purchase method of accounting, and accordingly, the operating results... -

Page 68

...): December 31, 2002 2001 Employee compensation and benefits Sales incentives, royalties, and allowances Due to affiliated companies and corporate partners Clinical development costs Obligations from terminating collaboration agreements (see Note 4, "Other items, net") Income taxes Other $ 370... -

Page 69

AMGEN 2002 ANNUAL REPORT Note 16. Quarterly financial data (unaudited) (In millions, except per share data) 2002 Quarter ended Dec. 31(1) Sept. 30(2) June 30 Mar. 31 Product sales Gross margin from product sales Net income (loss) Earnings (loss) per share: Basic Diluted 2001 Quarter ended $1,621... -

Page 70

.... as of December 31, 2002 and 2001, and the consolidated results of its operations and its cash flows for each of the three years in the period ended December 31, 2002, in accordance with accounting principles generally accepted in the United States. Los Angeles, California January 24, 2003 Page... -

Page 71

...Human Resources Kevin W. Sharer Chairman of the Board, Chief Executive Officer and President Stockholder Information Corporate Office One Amgen Center Drive Thousand Oaks, California 91320-1799 (805) 447-1000 Price Range of Common Stock The Company's common stock trades on The NASDAQ Stock Market... -

Page 72

Amgen Inc. One Amgen Center Drive Thousand Oaks, CA 91320-1799 www.amgen.com © 2003 Amgen Inc. All rights reserved. MC19043 850M/3-03 P50300-4