America Online 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 America Online annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AOL INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

The testing of goodwill for impairment is required to be performed at the level referred to as the reporting

unit. During 2014, the Company had three reporting units for purposes of the goodwill impairment test; the

Brand Group, the Membership Group and AOL Platforms.

Goodwill impairment is determined using a two-step process. The first step involves a comparison of the

estimated fair value of a reporting unit to its carrying amount, including goodwill. If the estimated fair value of a

reporting unit exceeds its carrying amount, goodwill of the reporting unit is not impaired and the second step of

the impairment test is not necessary. If the carrying amount of a reporting unit exceeds its estimated fair value,

then the second step of the goodwill impairment test must be performed. To measure the amount of impairment

loss, if any, AOL determines the implied fair value of goodwill in the same manner as the amount of goodwill

recognized in a business combination. Specifically, the estimated fair value of the reporting unit is allocated to all

of the assets and liabilities of that unit (including any unrecognized intangible assets) as if the reporting unit had

been acquired in a business combination and the fair value of the reporting unit was the price paid to acquire the

reporting unit. If the carrying amount of the reporting unit’s goodwill exceeds the implied fair value of that

goodwill, an impairment loss is recognized in an amount equal to that excess.

See “Note 3” for more information on the goodwill impairment testing for 2014.

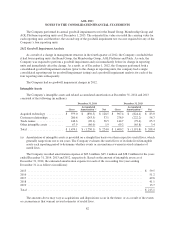

Long-lived Assets

Long-lived assets, including finite-lived intangible assets (e.g., acquired technology and customer

relationships), do not require that an annual impairment test be performed; instead, long-lived assets are tested

for impairment upon the occurrence of an indicator of potential impairment. Once an indicator of potential

impairment has occurred, the impairment test is based on whether the intent is to hold the asset for continued use

or to hold the asset for sale. If the intent is to hold the asset for continued use, the impairment test first requires a

comparison of estimated undiscounted future cash flows generated by the asset group against the carrying value

of the asset group. The Company groups long-lived assets for purposes of recognition and measurement of an

impairment loss at the lowest level for which identifiable cash flows are largely independent of the cash flows of

other assets and liabilities. If the carrying value of the asset group exceeds the estimated undiscounted future cash

flows, the asset group would be deemed to be potentially impaired. Impairment, if any, would then be measured

as the difference between the estimated fair value of the asset and its carrying value. Fair value is generally

determined by discounting the future cash flows associated with that asset group. If the intent is to hold the asset

group for sale and certain other criteria are met (i.e., the asset group can be disposed of currently, appropriate

levels of authority have approved the sale and there is an active program to locate a buyer), the impairment test

involves comparing the asset group’s carrying value to its estimated fair value less estimated costs of disposal.

To the extent the carrying value is greater than the asset group’s estimated fair value less estimated costs of

disposal, an impairment loss is recognized for the difference.

AOL recorded non-cash asset impairments and write-offs related to long-lived assets held and used and held

for sale of $13.6 million, $12.1 million and $4.9 million in 2014, 2013 and 2012, respectively, included in costs

of revenues and general and administrative expense on the consolidated statements of comprehensive income.

The charge recorded in 2014 related primarily to asset write-offs in connection with capitalized internal-use

software projects. The charge recorded in 2013 included a $7.5 million charge related to internal-use software

related to Patch. The charge recorded in 2012 related primarily to asset write-offs in connection with facility

consolidation, computer retirements and capitalized internal-use software project terminations.

74