Alpine 2008 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2008 Alpine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

Reviewing the world economy in the fiscal year ended March 31, 2008, with concern over the

high oil prices, the US economy slowed down due to the turmoil of the financial and capital

markets arising from the subprime mortgage problem. In Europe, the economy maintained a

slow growth supported by domestic demand, despite sluggish exports due to a strong Euro.

Although the Japanese economy had maintained a stable growth driven by exporting

companies supported by a cheap Yen, the U.S. economic recession brought marked

slowdown to businesses and signs of decrease in personal consumption.

In the automobile industry, the demand shifted to smaller, fuel-efficient cars. Emerging markets

expanded, led by the BRIC countries, with Russia and the Middle East gaining from the high oil

prices and China and India spearheading growth in Asia.

In the car electronics industry, the domestic after-market featured the introduction of navigation

systems equipped for terrestrial digital broadcasting and internet compatibility via mobile phone

and computer connections. Meanwhile, portable navigation devices (PNDs) expanded the size

of the U.S. and Europe market. Automobile manufacturers launched integrated equipment with

new functions compatible with real-time information and communication systems.

In this environment, the Alpine Group prepared the mid-term business plan, “CHALLENGE

30,” aimed for reforming its earnings, cost and development structure.

We also exhibited our products at motor shows in Japan and overseas to showcase our

state-of-the-art technologies to automobile manufacturers and stepped up our drive to create

industry-leading products for the after-market. Moreover, we reinforced our sales network

through such initiatives as establishing sales facilities in China and Thailand in anticipation

of cultivating high-growth emerging markets. However, sales from business with automobile

manufacturers declined during the year, due to the U.S. economic slowdown and model

changes.

Performance by Segment

Audio Products

In this segment, strong sales performers included Alpine’s iPod-LINK automotive CD players

for the after-market and the “IDA-X001” digital media head unit, which got a European

Imaging and Sound Association award. However, sales decreased due to the intensifying price

competition and contraction of the market.

For businesses with automobile manufacturers, the installation in SUVs of the new media “DVD

audio systems” increased in North America, and sales for installed “CD audio systems” in the

BRIC markets were stable, and sales for sound systems designed to overcome severe vehicle

indoor conditions.

The fiscal year was in the midst of model changes and for business with European automobile

manufacturers shifts from single car audio products to integrated products centering on

navigation systems equipments, with trends from single car audio products to integrated

products centering on navigation systems.

As a result, sales of this segment decreased 4.9% compared with the previous fiscal year.

Information and Communication Products

In this segment, we launched the series of next-generation car navigation systems called

“Mobile Media Station X07/X075” which are compatible with terrestrial digital broadcasting

(1-segment + 12-segment) to the Japanese domestic after-market. Despite promotions for

sales expansion, shifts in product demand toward diffusion price zones resulted in sluggish

sales.

On the other hand, “Overhead Monitors” which are high-quality, high-definition rear-seat

entertainment systems with DVD and terrestrial digital broadcasting compatibility achieved

successful sales performance due to responded user needs.

Overseas, sales of the “Blackbird” portable navigation system which was launched in the

European after-market and sales of the “IVA-W205” 2DIN mobile multimedia station featuring

the functions to expand the portable navigation functions were in severe conditions due to the

intensified price competition. Business with automobile manufacturers expanded by effective

promotional activities with growing trends toward factory installation of car navigation systems

and integrated information and communication products. Nevertheless, this factor failed to

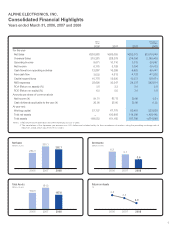

(Millions of yen)

2004

170,984

2005

180,828

2006

215,281

2007

228,379

2008

(Millions of yen)

2004

8,940

2005

10,402

2006

10,778

2007

12,620

2008

(Millions of yen)

2004

181,185

120,908

2005

145,127

80,912

2006

156,507

89,874

2007

169,553

112,377

2008

Total Assets

Net Assets

Net Assets for the years from 2003 to 2006 are recalculated.

Consolidated Financial Review