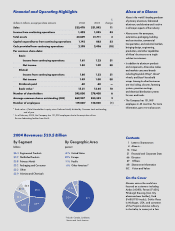

Alcoa 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In addition, we combined

functional groups such as ABS (Alcoa

Business System), Customer and

Marketing Services, EHS, People, and

Quality to accelerate the culture changes

in order to achieve our Vision and

emphasize the ABS philosophy that

“people are the linchpin of ABS.”

As you will see in the pages of

this report, we are expanding across

our markets, using the tenets of ABS, to

help our customers grow their businesses.

We expect the combination of our

global business structure, our functional

resources, and our R&D expertise to

continue to spur profitable organic

growth and share gains across the world.

Upstream – Restarts and

Growth Projects

To take advantage of the strong alu-

minum market, we are restarting several

smelters. When complete, these restarts

will add 220,000 metric tons per year

(mtpy) of production in 2005, leaving

us with idle capacity of 361,000 mtpy.

Restart progress has been made at:

1) the Aluminerie de Bécancour, Inc.

(ABI) facility in Quebec, following the

end of a strike there. This strike resulted

in a significant cost to the Company,

but was necessaryto enable the long-

term flexibility we need to operate

efficiently; 2) the Wenatchee smelter in

Washington, USA, after the successful

resolution of an issue regarding health-

care cost-sharing. The plant had been

idle since 2001, and the resolution

of this issue helped save 400 jobs; and

3) the Massena East and West smelters

in New York, USA, where we are

now running at full capacity.

In addition to restarts, we began

steps to expand our upstream operations

that will benefit the Company for years,

if not decades, to come. For example,

we broke ground in Iceland on Alcoa

Fjar aál,the Company’s first greenfield

smelter in more than 20 years. This

hydropowered smelter, which is sched-

uled to come on line in 2007, will

be among the most environmentally

friendly in the world.

In Norway,we have agreed to build

anew anode plant in Mosjøen, together

with Elkem ASA, that will supply the

Alcoa Fjar aál smelter in Iceland and

the Mosjøen smelter in Norway, which is

50% held by Alcoa and Elkem.

2

Alcoa Aluminio in Brazil also

broke ground on an expansion that will

increase its share of the Alumar smelting

operations in São Luis by 30%, or

63,000 mtpy, bringing Alcoa Aluminio’s

share of smelting capacity there to

262,000 mtpy, and Alcoa’s share of

overall output will grow from 54% to

60%. The expansion was facilitated

by completion of a new, 20-year

hydropower agreement.

We signed a memorandum of

understanding (MOU) under which

Alcoa and the Government of the

Republic of Trinidad and Tobago will

build a state-of-the-art, environmentally

friendly aluminum smelter and related

facilities in Trinidad. The smelter will

utilize power produced by Trinidad and

Tobago’s vast natural gas fields, which

will then be converted into low-cost

electricity for the smelter. We are now

working with the government to finalize

the project plan.

In Ghana, we have signed an

MOU with the Government of the

Republic of Ghana to develop an inte-

grated aluminum industrythat would

include bauxite mining, alumina refin-

ing, aluminum production, and rail

transportation infrastructure upgrades.

We have begun expedited feasibility

studies that are expected to be complet-

ed in 2006, at which time both parties

will negotiate definitive agreements

as well as total investment costs. The

MOU calls for the initial restart of

120,000 mtpy at the jointly owned

200,000 mtpy Valco smelter in Tema,

Ghana, which is currently idled.

Our alumina refining system is

also expanding significantly with an

eye towardsustained, long-termgrowth.

In all, we are working on expansions

that total more than 4 million mtpy. In

Jamaica, for example, following on the

heels of a 250,000 mtpy expansion of

the Jamalco alumina refinery in

Clarendon, we announced plans to fur-

ther expand by at least an additional 1.5

million mtpy. This new expansion would

more than double the refinery’s total

capacity to at least 2.8 million mtpy. In

addition, Alcoa World Alumina and

Chemicals (AWAC) ownership in the

refinery will move from 50% to 70%.

AWAC is also a lead partner in a

project exploring the feasibility for devel-

oping jointly with the Government of the

Republic of Guinea a 1.5 million mtpy

alumina refinery there. A detailed feasi-

bility study for the refinery is expected

to be completed by mid-2005, with final

costs, investment decisions, and con-

struction to begin shortly thereafter.

A600,000 mtpy efficiency upgrade

of the Pinjarra, Australia, alumina

refinery continues to be on-track for

completion by the end of 2005. And

Suralco, owned by AWAC, completed

a250,000 mtpy expansion to its

Paranam alumina refinery in Suriname

well ahead of schedule. This brings that

facility’s total capacity to approximately

2.2 million mtpy.

Portfolio Realignment and

Expanding our Footprint

Wecontinued to review and rebalance

our portfolio to better focus on our core

businesses, while also making progress

on acquisitions that will enhance our

competitive position.

In 2005 and for a few years there-

after, one of our chief challenges will

be the successful and ongoing integration

and investment in two fabricating facili-

ties that we purchased this year in

Samara and Belaya Kalitva in the

Russian Federation. The addition of the

two Russian fabricating facilities – which

feature cast house, flat-rolled products,

extrusions, tubes, and forgings capabili-

ties – will allow the Company to serve

both the growing Russian market and

global customers in Europe, Asia, and

the Americas, giving us substantial com-

petitive and comparative advantages.

Wereached an agreement with

Fujikura Ltd. that paves the way for

Alcoa to obtain full ownership of

the Alcoa Fujikura (AFL) Automotive

business. In return, Fujikura will

obtain complete ownership of the AFL

Telecommunications business. AFL

Automotive is a large part of Alcoa’s

approximately $3 billion automotive

franchise, and this transaction increases

our position in this market.

Bloomberg Methodology calculates

ROC based on the trailing 4 quarters

02 03 04

0

5

10

15

20

Return on Capital

percent

Top Quintile

S&P Industrials

Top Quintile

S&P Industrials

Alcoa ROCAlcoa ROC