Alcoa 2004 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2004 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

Last year I wrote about how

Alcoa’s Vision of aspiring to be

the best company in the world

is about delivering sustained financial

performance, while building for the

future and delivering on all of Alcoa’s

seven Values. This is the goal that

all 131,000 Alcoans across the globe

are striving for every day.

In 2004 – facing the headwinds

of rising costs and currency challenges –

Alcoans delivered the highest annual

revenue and the second-highest prof-

itability in the Company’s history. Strong

cash flows allowed us to not only reduce

debt by approximately $2 billion over

the last two years, but also to invest in

numerous growth projects around the

world for the Company’s future. And we

did all of this while we continued to live

the Values that are the core

of our Company, achiev-

ing, for example, a Lost

Workday rate of 0.09

for the first time, while

improving our Total

Recordable Rate for the

18th year in a row.

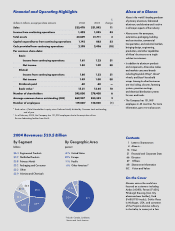

2004 Financial Results

Our 2004 financial results included:

•Income from continuing operations

of $1.4 billion, a 33% increase vs.

2003, and our second straight year of

double-digit earnings growth;

•Revenue of $23.5 billion, an 11%

increase vs. 2003;

• A debt-to-capital ratio decline

to 30.0%, the lowest in five years;

•Disciplined use of capital to fuel

growth projects. 2004 capital spending

was $1.1 billion, or 95% of deprecia-

tion, with approximately one-third

used on growth initiatives. In 2005,

we expect to invest approximately

$2.5 billion on capital projects,

with nearly two-thirds dedicated

to growth projects; and

•Improving the Company’s return on

capital (ROC) to 8.4%, up 140 basis

points from last year.

Fellow Shareowners:

Alain Belda, Chairman and Chief Executive Officer

Afavorable external business

environment contributed to our per-

formance. The global economy grew

at its fastest pace (+4.4%) in the last

two decades. Aluminum consumption

increased by almost 9%, and aluminum

prices were up 21%. Several of our

key markets – notably aerospace and

commercial vehicles – moved to a

cyclical upturn after declining trends

over the past two to three years.

However, these favorable trends

were countered by a weakening

U.S. dollar and significant cost issues,

notably energy and input costs such

as resins, carbon-based materials, and

alloy materials. Currency and energy

alone in 2004 negatively impacted our

earnings by more than $300 million

compared to 2003.

As strong as our 2004 financial

results were, we areconfident we can

do better. The ultimate measure of

success is growth in shareholder value

during the year and over a period. Our

2004 return was –15.7%, obviously a

disappointment. However, the combined

2003/04 return is +44% compared to

+31% for the S&P 500.

Stock performance is a mix of past

performance, future expectations, and

shareholder options. The best answer to

improved shareowner returns is consis-

tent, transparent, and improved perfor-

mance. And this is what our plans areall

about. We remain committed to our key

financial goals:

•Profitable Growth – Continuing the

drive to profitably grow revenues

as well as to join the first quintile of the

S&P Industrials, measured in terms of

ROC; and

•Cost Savings – Achieving $1.2 billion

in cost savings by 2006. In 2005, this

cost-savings initiative – our third three-

year program since 1998 – will be

used to help offset cost increases across

the business and bolster profitability.

On our ROC goal, we again

improved this year, but we have more

work to do. Our 2004 ROC was

8.4%, which improved from 7.0% a

year ago. However, the first quintile

entrypoint is currently 18.5%, so we

will continue to work to profitably

grow and improve our results.

Our cost-savings program, as

previously mentioned, was held back

by rising costs in 2004.

We expect this to contin-

ue to be a challenge in

2005. We project approx-

imately $600 million in

cost increases from ener-

gy, labor, raw materials,

and currencies. Our

cost-savings plans for 2005 indicate

we will be able to offset most, if not all,

of these increases. But this will require

substantial effortin planning, focusing

effort, and execution at all levels of

the organization and across our global

businesses, which is why our structure

and culture are so vital.

Building for the Future

We have taken many steps to position

and align your Company to capture

growth opportunities and expand –

both through new geographies as well

as expanding current assets.

In late 2004, we realigned the

Company along six global platforms to

better serve customers and increase the

ability to capture efficiencies. We also

centralized purchasing on a global basis

to improve our costs and better use our

leverage. As we moved to strengthen the

global business structures, we also creat-

ed strong regional leadership to ensure

that we maintain optimum relationships.

In 2004 – facing the headwinds of rising costs and

currency challenges – Alcoans delivered

the highest annual revenue and the second-highest

profitability in the Company’s history.