Airtel 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Airtel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

Bharti Airtel Annual Report 2010-11

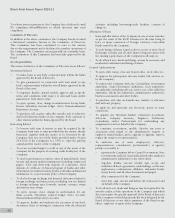

(c) According to the records of the Company, the dues outstanding of income-tax, sales-tax, wealth-tax, service tax, customs duty and

cess on account of any dispute, are as follows:

Name of the Statutes Nature of

the Dues

Amount Disputed

(in ` Mn)

Period to Which

it Relates

Forum where the dispute is

pending

Andhra Pradesh VAT Act Sales Tax 4,661.28 2000-02; 2005-08;

2009-10

High Court of Andhra Pradesh

Gujarat Sales Tax Act Sales Tax 0.93 2006-07 Commissioner (Appeals)

West Bengal Sales Tax Act Sales Tax 0.40 1996-97 DCCT - Appellate Stage

West Bengal Sales Tax Act Sales Tax 0.01 1997-98 DC Appeals

West Bengal Sales Tax Act Sales Tax 0.28 1995-96 The Commercial Tax Officer

West Bengal Sales Tax Act Sales Tax – 2004-05 West Bengal Taxation Tribunal

West Bengal Sales Tax Act Sales Tax 324.85 2005-06 DCCT Appeal

West Bengal Sales Tax Act Sales Tax 1,095.80 2006-08 Appellate Authority

UP VAT Act Sales Tax 2.93 2004-05; 2006-08 Assessing Officer

UP VAT Act Sales Tax 9.18 2002-10 Reviewing authorities

UP VAT Act Sales Tax 0.88 2009-10 Additional Commissioner Appeals

UP VAT Act Sales Tax 0.50 2003-04 Joint Commissioner Appeals

UP VAT Act Sales Tax 22.71 2003-07; 2009-10 Joint Commissioner Appeals

UP VAT Act Sales Tax 9.45 2006-07;

2010

High Court of Judicature at

Allahabad, Lucknow Bench

UP VAT Act Sales Tax – 2008-09 Assistant Commissioner of Sales tax

UP VAT Act Sales Tax 4.36 2006-07; 2008-09 Commercial Taxes Tribunal

UP VAT Act Sales Tax 0.54 2005-06 Appellate Authority

Haryana Sales Tax Act Sales Tax 2.80 2002-2004 Joint Commissioner

Haryana Sales Tax Act Sales Tax 1.35 2009-10 Assessing Officer

Haryana Sales Tax Act Sales Tax 1.80 2007-09 Finance Commissioner (Appeal)

Punjab Sales Tax Act Sales Tax 0 .61 2001-02 Joint Director (Enforcement)

Madhya Pradesh Commercial Sales Tax Act Sales Tax 22.08

1997-01 & 2003-06

& 2007-08

Deputy Commissioner Appeals

Madhya Pradesh Commercial Sales Tax Act Sales Tax 15.44 2007-08 Appellate Authority

UP VAT Act Sales Tax 1.13 2002-05 Assistant Commissioner

Karnataka Sales Tax Act Sales Tax 3,449.57 2002-09 Tribunal

Kerala Sales Tax Act Sales Tax 0.80 2009-11 Intelligence Officer Squad No. V,

Palakkad

Bihar Value Added Sales Tax Act Sales Tax 11.33 2005-07 Joint Commissioner Appeals

Bihar Value Added Sales Tax Act Sales Tax 19.87 2006-07; 2007-08 Assistant Commissioner

Delhi Value Added Tax Act Sales Tax 12.75 2005-06 Sales Tax Department

J&K General Sales Tax Sales Tax 28.85 2004-07 High Court

Karnataka Sales Tax Act Sales Tax 0.15 2005-06 High Court

Tamil Nadu Sales Tax Act Sales Tax 634.28 1996-2001 Commercial Tax Officer

Sub Total (A) 10,336.88

Finance Act, 1994 (Service tax provisions) Service Tax 1,458.99 1997-2009;

2010-11

Customs, Excise and Service Tax

Appellate Tribunal

Finance Act, 1994 (Service tax provisions) Service Tax 46.81 1999-00, 2002-08 Commissioner (Appeals)

Finance Act, 1994 (Service tax provisions) Service Tax 0.45 2004-06 Deputy Commissioner Appeals

Finance Act, 1994 (Service tax provisions) Service Tax 231.02

2000-01 &

2005-08

Suppdt. of Mohali

Finance Act, 1994 (Service tax provisions) Service Tax 19.77 2004-07 Commissioner of Excise

Finance Act, 1994 (Service tax provisions) Service Tax 334.52 2004-08 Commissioner of Service Tax

Finance Act, 1994 (Service tax provisions) Service Tax – 2006-07 Joint Commissioner of Central Excise

Finance Act, 1994 (Service tax provisions) Service Tax 5.56 2001-02;

2005-06

Deputy Commissioner of Service

Tax (Appeals)

Finance Act, 1994 (Service tax provisions) Service Tax 0.97 1994-95 Additional Commissioner of

Service Tax

Finance Act, 1994 (Service tax provisions) Service Tax 1.17 1994-95;

2003-04

Assistant Commissioner of

Service Tax

Finance Act, 1994 (Service tax provisions) Service Tax 3.66 2006-07 Joint Commissioner of Service Tax

Sub Total (B) 2,102.91